Get the free Fidelity Investments Distribution Form - accantors

Show details

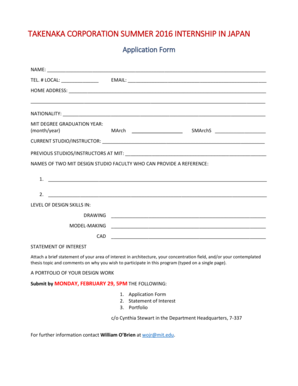

Use this form to request a distribution from your employer’s retirement plan. It includes steps for participant information, reasons for distribution, payout requests, income tax withholding, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity investments distribution form

Edit your fidelity investments distribution form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity investments distribution form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fidelity investments distribution form online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fidelity investments distribution form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fidelity investments distribution form

How to fill out Fidelity Investments Distribution Form

01

Obtain the Fidelity Investments Distribution Form from their website or customer service.

02

Fill in your personal information, including your name, address, and account number.

03

Specify the type of distribution you are requesting (e.g., withdrawal, transfer, rollover).

04

Indicate the amount you wish to withdraw or transfer.

05

Provide any required documentation or identification.

06

Review your completed form for accuracy.

07

Sign and date the form at the designated areas.

08

Submit the form via mail or electronically, as instructed.

Who needs Fidelity Investments Distribution Form?

01

Individuals looking to withdraw funds from their Fidelity account.

02

Investors transferring their investments to another account or institution.

03

Retirees planning to take distributions from their retirement accounts.

04

Beneficiaries of an estate needing to claim distributions from a deceased account holder's Fidelity account.

Fill

form

: Try Risk Free

People Also Ask about

What is the 4% rule for Fidelity?

History of the 4% rule Based on a deep dive into the half century of market data, Bergen concluded that essentially any conceivable economic scenario (even the more tumultuous ones) would allow for a 4% withdrawal during the year they retire and then they'd adjust for inflation each subsequent year for 30 years.

What are the distribution options for Fidelity?

In most cases, you can choose how to receive these distributions. The most common methods include reinvesting the money to buy more shares of the mutual fund or stock, moving the money into your cash account, and/or sending the money to another Fidelity mutual fund.

Does Fidelity automatically distribute RMD?

For your RPB 403(b) account, Fidelity will automatically process your annual RMD payment in early November—minus the amount of any withdrawals you've taken before their processing date. Withdrawals paid to you throughout the year count towards satisfying your RMD.

What is the 55 rule for withdrawal from Fidelity?

If you no longer work for the company that provided the 401(k) plan and you left that employer at age 55 or later—but still maintain a 401(k) account—the 55 Rule is an IRS provision that allows you to take early withdrawals beginning at age 55 without a penalty.

What options does Fidelity offer?

Make the most of your investing opportunities with a host of powerful products and features. Stocks by the Slice℠ Fractional shares. Trade shares of publicly traded companies in both domestic and international markets. Fidelity® Basket Portfolios. Custom basket portfolios. Borrow to buy. Margin.

Does Fidelity automatically distribute RMD?

For your RPB 403(b) account, Fidelity will automatically process your annual RMD payment in early November—minus the amount of any withdrawals you've taken before their processing date. Withdrawals paid to you throughout the year count towards satisfying your RMD.

What is a distribution form for a 401k?

Form 1099-R - 401(k) Distributions. You'll receive a Form 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. from the payer of your 401(k) distribution. A copy of that form is also sent to the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fidelity Investments Distribution Form?

The Fidelity Investments Distribution Form is a document used to request the distribution of funds from various types of investment accounts held with Fidelity Investments, such as retirement plans or brokerage accounts.

Who is required to file Fidelity Investments Distribution Form?

Investors or account holders who wish to withdraw or distribute funds from their Fidelity accounts, including retirees, beneficiaries, or individuals rolling over their investments, are required to file this form.

How to fill out Fidelity Investments Distribution Form?

To fill out the Fidelity Investments Distribution Form, account holders must provide personal information, account details, the amount and type of distribution requested, and sign the form to authorize the transaction.

What is the purpose of Fidelity Investments Distribution Form?

The purpose of the Fidelity Investments Distribution Form is to formally document and process requests for the distribution of funds from an investor's account, ensuring compliance with regulations and account policies.

What information must be reported on Fidelity Investments Distribution Form?

The information that must be reported on the Fidelity Investments Distribution Form includes the account holder's name, account number, type of distribution, amount requested, reason for the distribution, and the date of the request.

Fill out your fidelity investments distribution form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Investments Distribution Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.