Get the free IRA Checking Application

Show details

This document outlines the application process for obtaining IRA Checking services, allowing account holders aged 59½ and older to take distributions from their Individual Retirement Accounts (IRAs)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira checking application

Edit your ira checking application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira checking application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ira checking application online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ira checking application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

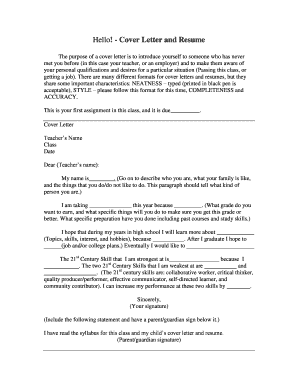

How to fill out ira checking application

How to fill out IRA Checking Application

01

Obtain the IRA Checking Application form from your bank or financial institution.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide the required identification details as instructed on the form.

04

Indicate the type of IRA you wish to open (Traditional or Roth).

05

Specify initial deposit amount and method of funding.

06

Carefully read and agree to the terms and conditions provided.

07

Sign and date the application form.

08

Submit the completed application, along with any required identification documents, to your bank.

Who needs IRA Checking Application?

01

Individuals looking to open an IRA account for retirement savings.

02

People who want to manage their retirement funds with checking account features.

03

Those looking to take advantage of tax benefits associated with IRAs.

04

Individuals planning for long-term financial security.

Fill

form

: Try Risk Free

People Also Ask about

How do I set up a checkbook for my IRA?

FOUR STEPS TO SET UP A CHECKBOOK IRA Open and fund a self-directed IRA. Form a single-member LLC with your IRA as the sole member. Appoint yourself as the manager of the LLC, and open a bank account in the LLC's name. Fund the new LLC with cash from your IRA.

How to write a check to Charles Schwab's IRA?

Ask your employer to deposit your funds directly into your Schwab IRA. To prevent funds from being taxed, the check should be made payable to "Charles Schwab & Co., Inc., FBO (Your Name)." Give your employer your Schwab IRA account number and ask them to include it on the check, to avoid potential hold time.

How do I check my IRA account?

Endorse the back of the check with "For Deposit Only." • Write the JPMS Account Number on the face of the check. If the deposit is for a retirement account, write the type of deposit in the memo field: "Contribution for 20YY," "Rollover" or "Transfer."

How do I write a check for an IRA contribution?

IRAs sometimes have early withdrawal penalties But if your early withdrawal exceeds your contributions and you take out earnings, or if you had previously completed a Roth conversion, you may be subject to taxes and a 10% penalty when you file your taxes with the IRS.

How do I pay into an IRA?

Once you open an IRA, you can fund the account with cash, a check or a direct transfer from your bank.

What is the disadvantage of an IRA account?

Vanguard, Fidelity, and Charles Schwab are all excellent providers, all with very good (and very similar) choices. For any of the three there should be no extra fees to open or trade the funds you will likely be buying. The difference in net return from the funds you buy in any of them will be negligible.

How do I look up my IRA account?

How to Find a Lost IRA Check your federal tax returns. If you received any tax deductions related to an IRA, this would be reflected on previous tax returns, including the name of the financial institution where the IRA was kept. Review old bank statements. Reach out to former employers. Contact financial institutions.

How do I show IRA contributions on my taxes?

IRA contributions will be reported on Form 5498: IRA contribution information is reported for each person for whom any IRA was maintained, including SEP or SIMPLE IRAs. An IRA includes all investments under one IRA plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRA Checking Application?

IRA Checking Application is a form used to open a checking account associated with an Individual Retirement Account (IRA), allowing for easier management and access to funds within the IRA.

Who is required to file IRA Checking Application?

Individuals who wish to open a checking account under their IRA plan are required to file the IRA Checking Application.

How to fill out IRA Checking Application?

To fill out the IRA Checking Application, you need to provide personal information such as your name, address, Social Security number, and details about the IRA, including the type of IRA and any beneficiaries.

What is the purpose of IRA Checking Application?

The purpose of the IRA Checking Application is to facilitate the establishment of a checking account linked to an IRA, enabling account holders to manage transactions and access funds more conveniently.

What information must be reported on IRA Checking Application?

The information that must be reported on the IRA Checking Application includes personal identification details, account type, contribution sources, and any designated beneficiaries.

Fill out your ira checking application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Checking Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.