Get the free HSA Distribution Form

Show details

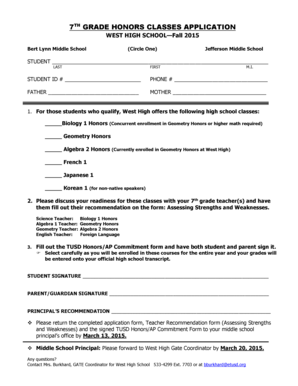

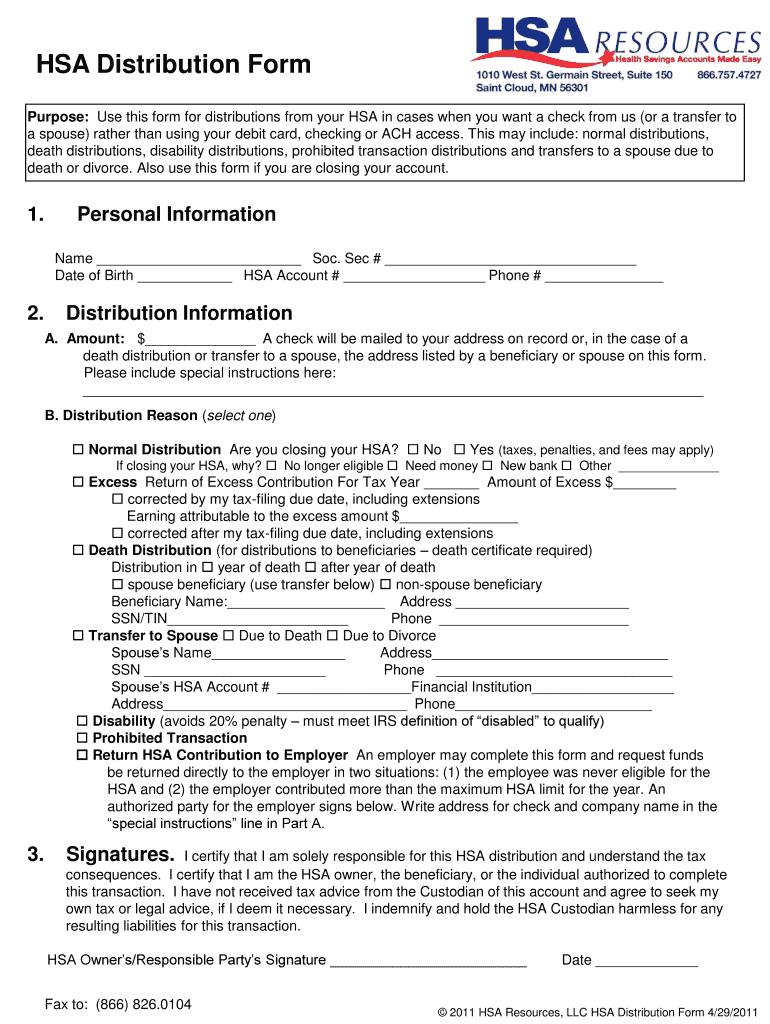

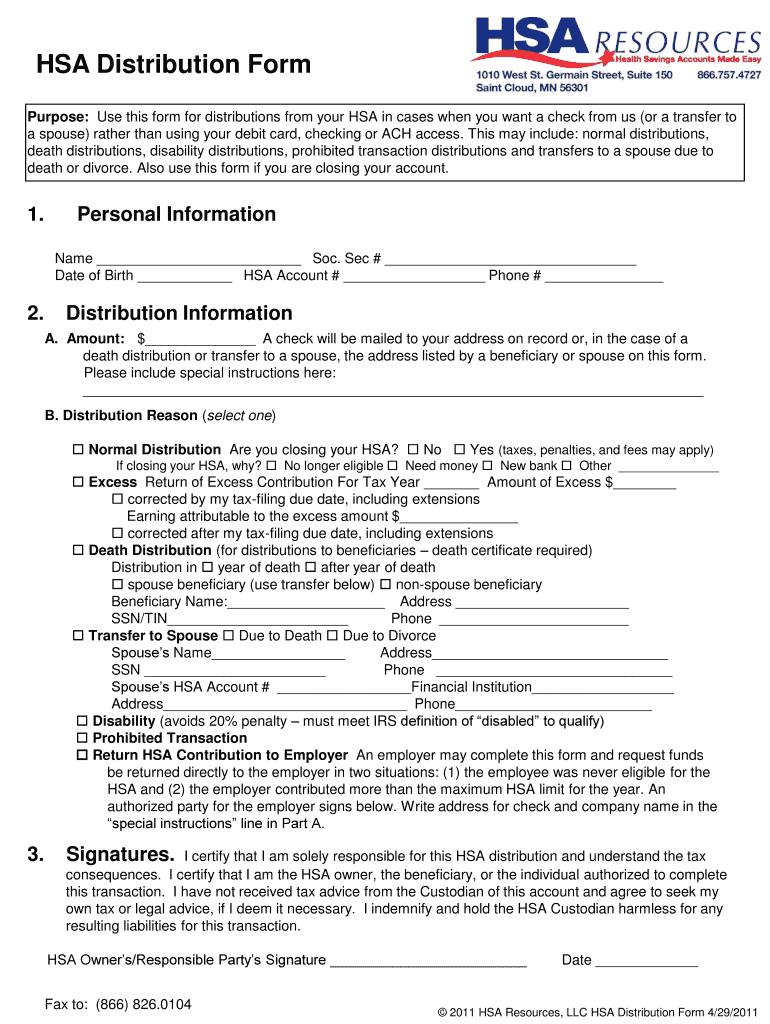

Use this form for distributions from your HSA when requesting a check or transfer to a spouse instead of using a debit card or ACH access. Applicable for various distribution reasons including normal,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hsa distribution form

Edit your hsa distribution form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hsa distribution form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hsa distribution form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit hsa distribution form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hsa distribution form

How to fill out HSA Distribution Form

01

Obtain the HSA Distribution Form from your HSA provider's website or office.

02

Fill in your personal information, including your name, address, and HSA account number.

03

Indicate the type of distribution you are requesting (e.g., medical expense reimbursement, withdrawal).

04

Provide details of the expenses being claimed, including date, amount, and nature of the expense.

05

Attach necessary documentation, such as receipts or invoices that substantiate the claims.

06

Sign and date the form to certify that the information is accurate and complete.

07

Submit the completed form to your HSA provider, either by mail or electronically, as per their instructions.

Who needs HSA Distribution Form?

01

Individuals who have incurred medical expenses and wish to withdraw funds from their HSA for reimbursement.

02

Anyone who needs to report a distribution from their HSA for tax purposes.

03

Participants in an employer-sponsored HSA plan who need to access their funds.

Fill

form

: Try Risk Free

People Also Ask about

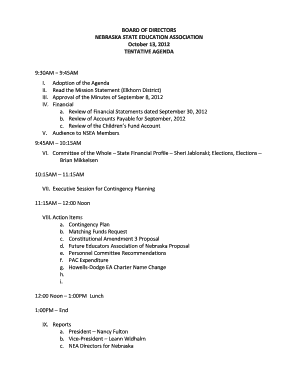

Do I need to enter 5498-SA in TurboTax?

You don't need to enter information from your Form 5498 (IRA Contribution Information) into TurboTax like you do with a W-2 or 1099s. In most cases, you'll find the info needed for your return on other paperwork, such as a year-end summary statement or a Form 1099-R.

Do I need to enter information from form 5498 on my tax return?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only.

Where can I get an HSA form?

How do I find my HSA tax forms? Log in to your account and select Manage My Reimbursement Account. Click the red menu on the top left, click My Accounts, then select Benefit Account Summary. Select the Tax Forms link in the Account Resources section. You may be prompted to complete a PDF verification step.

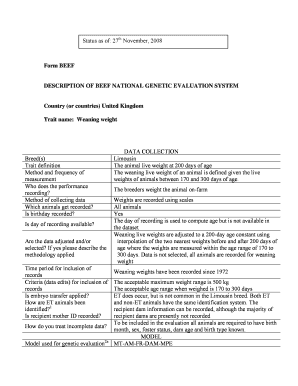

How do I document an HSA withdrawal?

You must report distributions from your HSA on IRS Form 8889. You will receive a separate 1099-SA for each type of distribution made during the tax year. The five distribution types are 1) normal; 2) excess contribution removal; 3) death; 4) disability; and 5) prohibited transaction.

Do I need a 5498-SA to file my taxes?

You won't get a 5498-SA form if you didn't have contributions and your balance was zero dollars at the end of the year. Please note this form is informational only and doesn't need to be filed with your income tax return. If I don't have a 5498-SA, how can I get my contributions by tax year?

Do I have to report 5498-SA on my tax return?

The trustee of your HSA, Archer MSA, or MA MSA may provide other information about your account on this form. Note: Don't attach Form 5498-SA to your income tax return. Instead, keep it for your records.

What's the difference between a 1099-SA and 5498-SA?

Form 1099-SA tells you the total distributions or payments that were made from your HSA. Form 5498-SA summarizes the contributions or deposits you made to your HSA in a particular tax year. You can also find your contribution information on your December HSA statement.

What form do you get for HSA distributions?

File Form 1099-SA to report distributions made from a: Health savings account (HSA).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

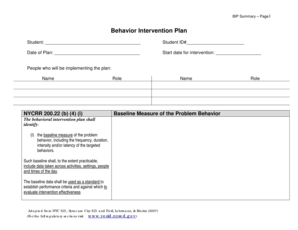

What is HSA Distribution Form?

The HSA Distribution Form is a document used to report distributions from a Health Savings Account (HSA) to the Internal Revenue Service (IRS) and inform account holders about withdrawals made from the account.

Who is required to file HSA Distribution Form?

Taxpayers who have made withdrawals from their Health Savings Account during the tax year are required to file the HSA Distribution Form.

How to fill out HSA Distribution Form?

To fill out the HSA Distribution Form, individuals must provide personal information such as name and Social Security number, details of the HSA account, the amount of the distribution, and the purpose of the withdrawal (qualified medical expenses or otherwise).

What is the purpose of HSA Distribution Form?

The purpose of the HSA Distribution Form is to track and report the distributions from an HSA to ensure that taxpayers comply with tax regulations and to maintain proper documentation for tax reporting purposes.

What information must be reported on HSA Distribution Form?

The information that must be reported on the HSA Distribution Form includes the account holder's name, Social Security number, the total amount distributed, the date of the distribution, and whether the distribution was for qualified medical expenses.

Fill out your hsa distribution form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hsa Distribution Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.