Get the free HSA Application & Salary Reduction Agreement - portal arbenefits

Show details

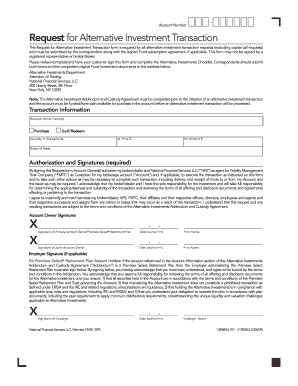

This Salary Reduction Agreement (SRA) allows the employer to reduce an employee's salary for contributions to a Health Savings Account (HSA) as part of a Cafeteria Plan. The document requires the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hsa application salary reduction

Edit your hsa application salary reduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hsa application salary reduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hsa application salary reduction online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit hsa application salary reduction. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

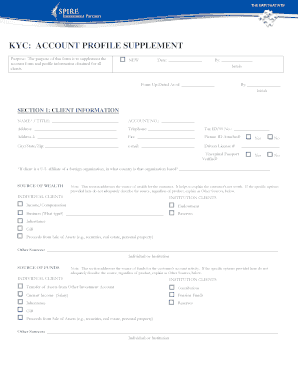

How to fill out hsa application salary reduction

How to fill out HSA Application & Salary Reduction Agreement

01

Obtain the HSA Application & Salary Reduction Agreement form from your employer or HSA provider.

02

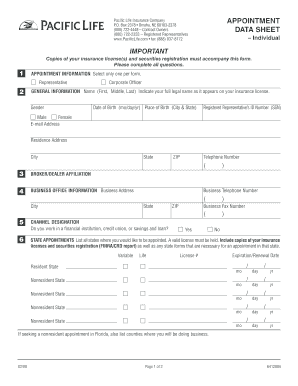

Fill in your personal information, including your full name, address, and Social Security number.

03

Indicate your desired contribution amount to your Health Savings Account (HSA) on the form.

04

Complete the salary reduction section by specifying the amount to be deducted from your paycheck.

05

Review the terms and conditions provided on the form regarding contributions and withdrawals.

06

Sign and date the application to certify that all information provided is accurate.

07

Submit the completed form to your employer's HR department or designated administrator.

Who needs HSA Application & Salary Reduction Agreement?

01

Employees who are enrolled in a high-deductible health plan (HDHP).

02

Individuals looking to save for medical expenses in a tax-advantaged account.

03

People who want to take advantage of potential tax benefits associated with HSA contributions.

04

Anyone interested in reducing their taxable income through salary deductions for HSA contributions.

Fill

form

: Try Risk Free

People Also Ask about

Is it legal for an employer to reduce your salary?

However, employees must be paid their original rate for all the hours they already completed. can an employer lower your pay in california? Yes, it is legal for employers to issue pay cuts.

Is HSA pre-tax salary reduction?

You can claim a tax deduction for contributions you, or someone other than your employer, make to your HSA even if you don't itemize your deductions on Schedule A (Form 1040). Contributions to your HSA made by your employer (including contributions made through a cafeteria plan) may be excluded from your gross income.

What is a salary deduction agreement?

A wage deduction authorization agreement is an agreement between an employer and their employee where the employee authorizes the employer to deduct wages from their paycheck.

What does it mean when a salary is reduced?

A salary cut is what happens when your employer reduces your pay. The amount of a salary cut can vary depending on your job position and the situation responsible for the pay decrease. Salary cuts can mean a reduction in pay without a change in your work responsibilities.

What is the HSA salary reduction agreement?

This Salary Reduction Agreement (SRA) authorizes your employer to reduce your salary by the indicated amount shown below for the exclusive purpose of facilitating a contribution to your Health Savings Account.

What is a salary reduction arrangement?

General Definition. Under salary reduction agreements, an employee can take advantage of tax deferral. through 401(k) or 403(b) plans or by receiving tax-free benefits through a cafeteria plan. Under 401(k) and 403(b) plans, amounts reducing salary are invested in selected. investments or annuities for future

What is a salary reduction agreement?

All contributions to your HSA are tax-deducible, or if made through payroll deductions, are pre-tax which lowers your overall taxable income. Your contributions may be 100 percent tax-deductible, meaning contributions can be deducted from your gross income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

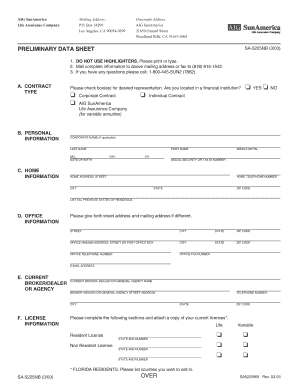

What is HSA Application & Salary Reduction Agreement?

HSA Application & Salary Reduction Agreement is a document that allows employees to set up a Health Savings Account (HSA) and elect to have a portion of their salary deducted on a pre-tax basis to contribute to that account.

Who is required to file HSA Application & Salary Reduction Agreement?

Employees who wish to contribute to a Health Savings Account (HSA) through salary reductions are required to file the HSA Application & Salary Reduction Agreement with their employer.

How to fill out HSA Application & Salary Reduction Agreement?

To fill out the HSA Application & Salary Reduction Agreement, employees should provide personal information, specify the amount of salary to be deducted, and sign the agreement to authorize the deductions.

What is the purpose of HSA Application & Salary Reduction Agreement?

The purpose of the HSA Application & Salary Reduction Agreement is to facilitate tax-advantaged contributions to an HSA, allowing employees to save for qualified medical expenses and reduce their taxable income.

What information must be reported on HSA Application & Salary Reduction Agreement?

The information that must be reported on the HSA Application & Salary Reduction Agreement includes the employee's name, identification details, the amount of salary reduction elected, and the employee's signature to authorize the deductions.

Fill out your hsa application salary reduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hsa Application Salary Reduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.