Get the free FTB Publication 737

Show details

This publication assists registered domestic partners (RDPs) in filing their California income tax returns, covering RDP adjustments, relevant filing statuses, and legislative history. It clarifies

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ftb publication 737

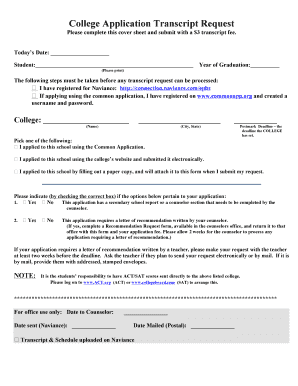

Edit your ftb publication 737 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ftb publication 737 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ftb publication 737 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ftb publication 737. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ftb publication 737

How to fill out FTB Publication 737

01

Download FTB Publication 737 from the California Franchise Tax Board website.

02

Read the introduction to understand the purpose of the publication.

03

Gather your income documents, including W-2s and 1099 forms.

04

Review the sections relevant to your tax situation, such as income adjustments, deductions, and credits.

05

Fill out the necessary sections based on your financial data.

06

Double-check your entries for accuracy and completeness.

07

Submit the form by the due date, either electronically or via mail.

Who needs FTB Publication 737?

01

California residents who have questions about their California state tax returns.

02

Individuals seeking clarification on tax credits and deductions.

03

Tax professionals assisting clients with California tax issues.

04

Anyone needing guidance for specific tax situations addressed in the publication.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to file jointly in domestic partnership?

Can registered domestic partners file federal tax returns using a married filing jointly or married filing separately status? A1. No. Registered domestic partners may not file a federal return using a married filing separately or jointly filing status.

Does IRS recognize RDP?

The IRS doesn't recognize registered domestic partnerships (RDPs) as marriages. Because of this, RDPs must file their federal and California tax returns using two separate accounts. If this applies to you, RDP couples must file a federal return as Single or Head of Household.

Can I file married filing jointly if I just got married?

Your marital status on December 31 determines whether you are considered married for that year. Married persons may file their federal income tax return either jointly or separately in any given year. Choosing the right filing status may save you money.

Can you file jointly if you were only married for part of the year?

If you are legally married on December 31 of the year, then you file your return as if you were married for the whole year. You can file jointly as long as you both agree, even if you were separated part of the year.

Can you file married filing jointly if you're not married?

In addition, joint filers are eligible to take a Standard Deduction that's double that of a single taxpayer. However, since the IRS only allows a couple to file a joint tax return if the state they reside in recognizes the relationship as a legal marriage; unmarried couples are never eligible to file joint returns.

Can you file jointly if not married in California after?

You usually must be married to file together. However, if you are non-married but want to file a joint return, it is possible you can use married filing jointly if you're considered married under a common law marriage recognized by either of these: The state where you live. The state where the common-law marriage began.

Can an unmarried couple file a joint tax return in California?

You usually must be married to file together. However, if you are non-married but want to file a joint return, it is possible you can use married filing jointly if you're considered married under a common law marriage recognized by either of these: The state where you live. The state where the common-law marriage began.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FTB Publication 737?

FTB Publication 737 is a document provided by the California Franchise Tax Board that offers information for California residents about the tax treatment of their income and other financial matters.

Who is required to file FTB Publication 737?

Individuals who have specific income types or who meet certain criteria regarding tax situations in California may be required to file FTB Publication 737.

How to fill out FTB Publication 737?

To fill out FTB Publication 737, one must carefully provide the requested financial details and ensure accurate calculations according to the guidelines published by the California Franchise Tax Board.

What is the purpose of FTB Publication 737?

The purpose of FTB Publication 737 is to inform taxpayers about their obligations, assist them in properly reporting their income and deductions, and provide guidance for complying with California tax laws.

What information must be reported on FTB Publication 737?

Information that must be reported on FTB Publication 737 includes types of income, deductions, and any relevant tax credits that affect the taxpayer's liability under California tax laws.

Fill out your ftb publication 737 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ftb Publication 737 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.