Get the free form 203 - dol

Show details

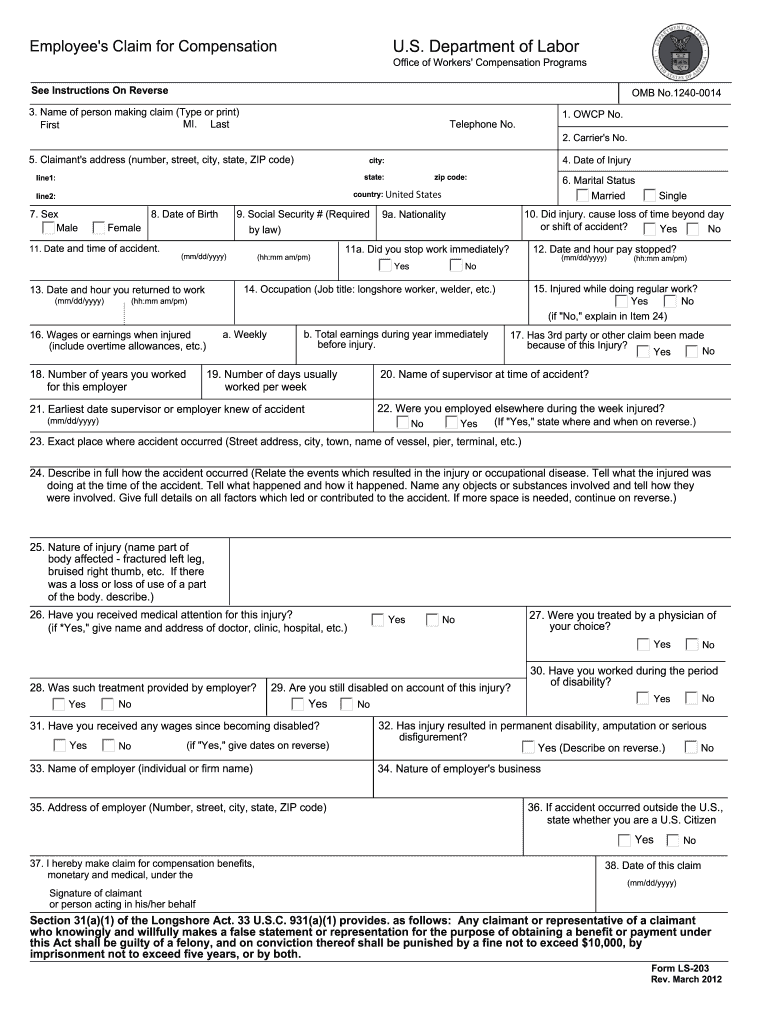

Form LS-203 Rev. March 2012 Use this form to file a claim under any one of the following laws Longshore and Harbor Workers Compensation Act Defense Base Act Outer Continental Shelf Lands Act Nonappropriated Fund Instrumentalities Act - Applicant may leave items 1. U*S* Department of Labor Employee s Claim for Compensation See Instructions On Reverse Print Office of Workers Compensation Programs Reset OMB No*1240-0014 3. Name of person making claim Type or print MI. Last First 1. OWCP No*...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 203 - dol

Edit your form 203 - dol form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 203 - dol form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 203 - dol online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 203 - dol. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 203 - dol

How to fill out DoL LS-203

01

Begin by downloading the DoL LS-203 form from the Department of Labor website.

02

Carefully read the instructions on the first page to understand the requirements.

03

Fill in the 'Employee Information' section with your details, including name, address, and contact information.

04

In the 'Employer Information' section, provide the name and address of your employer.

05

Complete the 'Claim Information' section by detailing the nature of your claim and relevant dates.

06

If applicable, provide information about any witnesses or supporting documents.

07

Review all the information for accuracy and completeness.

08

Sign and date the form at the designated location.

09

Submit the completed form to the appropriate address provided in the instructions.

Who needs DoL LS-203?

01

The DoL LS-203 form is needed by employees who wish to file a wage claim against their employer.

02

It is also required by individuals seeking to report violations of labor laws regarding minimum wage and overtime pay.

Fill

form

: Try Risk Free

People Also Ask about

What is Arizona Form 203?

Purpose of the Form You may apply for protection as an injured spouse if your share of an overpayment shown on your joint return is expected to be applied against your spouse's past-due delinquencies or debts.

What is Form IT-203 on my tax return?

You must file Form IT-203, Nonresident and Part-Year Resident Income Tax Return, if you: were not a resident of New York State and received income during the tax year from New York State sources, or. moved into or out of New York State during the tax year.

Who must file a NY non resident return?

Who must file the 1127 tax return? Any New York City employee who was a nonresident of the City (the five NYC boroughs) during any part of a particular tax year must file an 1127 return. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return.

Do I need to file it-203 B?

If you received a W-2 for a job which you worked some days in New York and some days outside of New York, you must complete NY IT-203B Schedule A - Allocation of wage and salary income to New York State to adjust the State wage amounts.

What Arizona state tax form should I use?

The most common Arizona income tax form is the Arizona form 140. This form is used by residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

What should my Arizona withholding percentage be?

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 203 - dol from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your form 203 - dol into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send form 203 - dol to be eSigned by others?

Once your form 203 - dol is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I fill out form 203 - dol on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your form 203 - dol. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is DoL LS-203?

DoL LS-203 is a form used by employers to report certain labor-related information related to their business operations, primarily for compliance with labor laws.

Who is required to file DoL LS-203?

Employers engaged in specific industries and those who employ workers covered by federal labor laws are required to file DoL LS-203.

How to fill out DoL LS-203?

To fill out DoL LS-203, employers must provide detailed information as requested on the form, including employee data, wages, and hours worked, and submit it to the appropriate department.

What is the purpose of DoL LS-203?

The purpose of DoL LS-203 is to ensure compliance with labor laws, to collect data for statistical purposes, and to protect workers' rights.

What information must be reported on DoL LS-203?

The information that must be reported on DoL LS-203 includes employee names, work hours, wages, job classifications, and information on any labor agreements.

Fill out your form 203 - dol online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 203 - Dol is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.