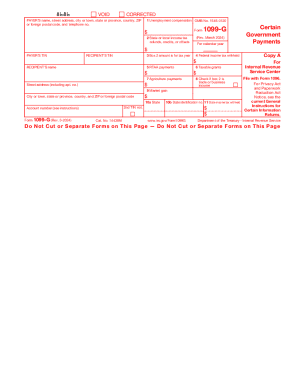

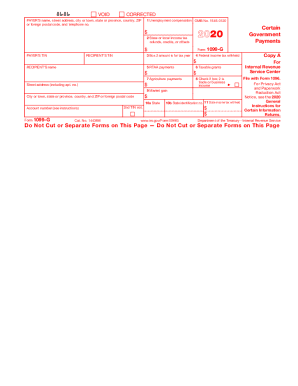

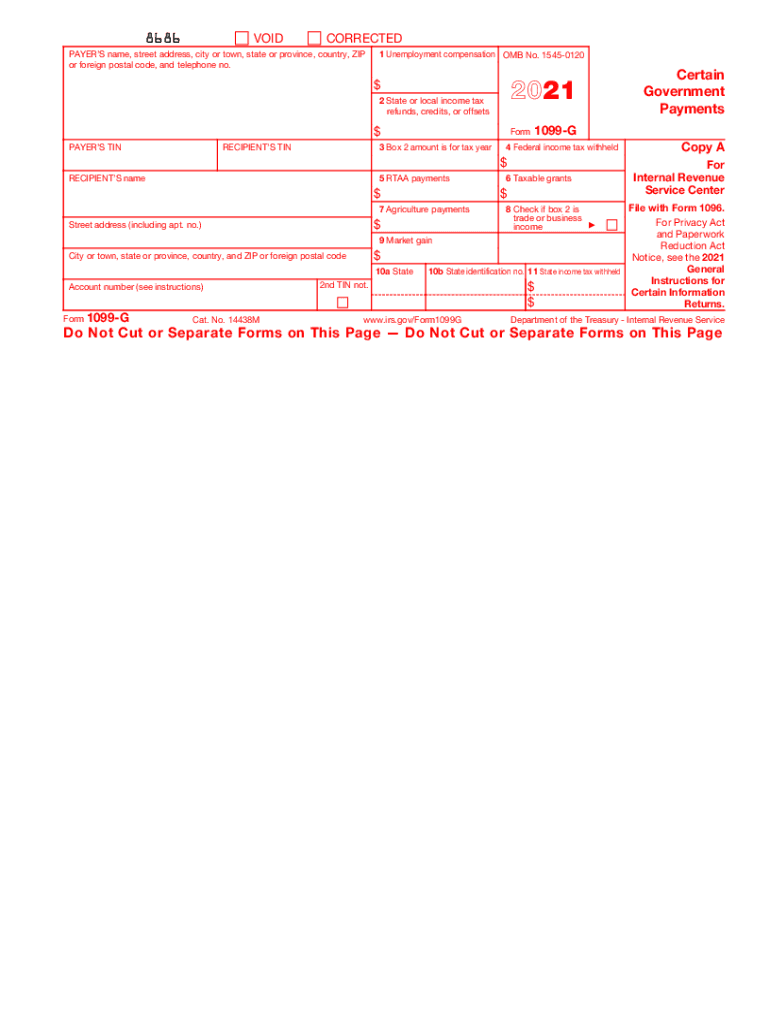

IRS 1099-G 2021 free printable template

Instructions and Help about IRS 1099-G

How to edit IRS 1099-G

How to fill out IRS 1099-G

About IRS 1099-G 2021 previous version

What is IRS 1099-G?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1099-G

What should I do if I discover an error after filing my IRS 1099-G?

If you find an error on your filed IRS 1099-G, you must submit a corrected form to the IRS. Clearly mark the corrected form as 'Corrected' and provide the accurate information. Additionally, you should inform the recipient of the changes made and provide them a copy of the corrected form.

How can I track the status of my IRS 1099-G after submission?

You can track your IRS 1099-G status by using the IRS e-file application or contacting their support. If you submitted electronically, keep an eye out for confirmation emails. Common rejection codes can also help you identify if there are issues with your submission.

Are there any specific legal considerations for filing an IRS 1099-G on behalf of someone else?

When filing an IRS 1099-G on behalf of another individual, ensure you have a valid power of attorney that allows you to act for them. This includes being aware of any state-specific regulations regarding the submission of tax forms for nonresidents or foreign payees.

What common errors should I be aware of when filing an IRS 1099-G?

Common errors when filing an IRS 1099-G include incorrect taxpayer identification numbers, mismatched names, and failing to report all applicable payments. Always double-check all entries against official records to avoid these pitfalls.

See what our users say