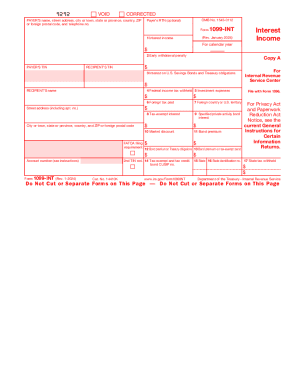

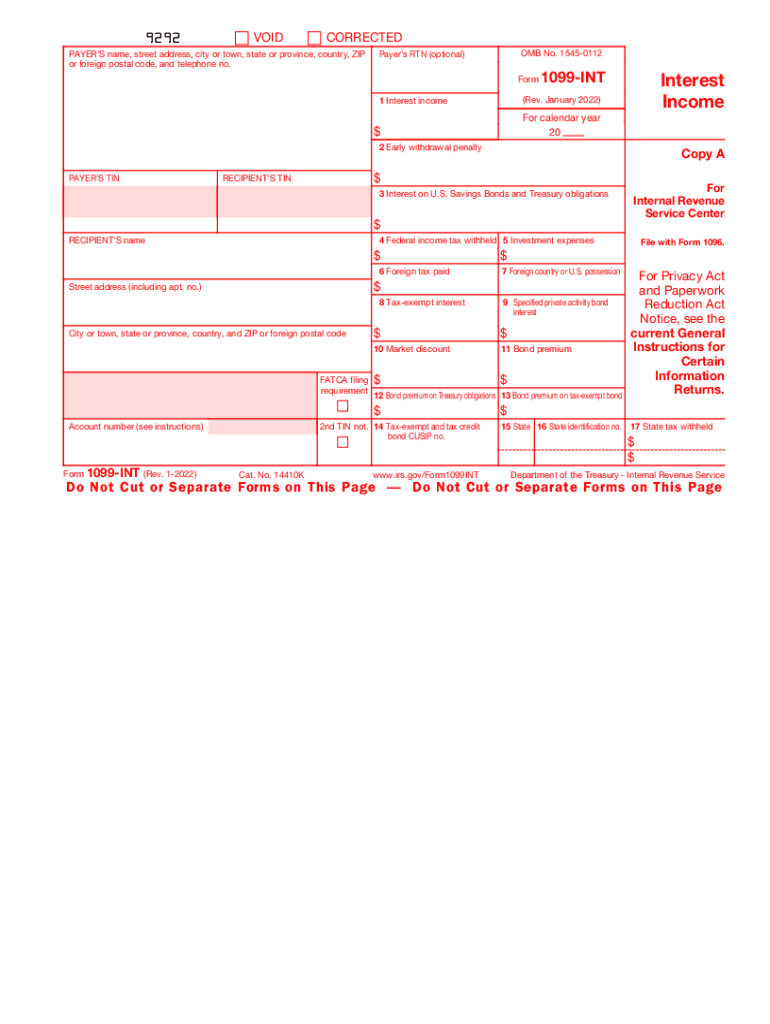

IRS 1099-INT 2022 free printable template

Instructions and Help about IRS 1099-INT

How to edit IRS 1099-INT

How to fill out IRS 1099-INT

About IRS 1099-INT 2022 previous version

What is IRS 1099-INT?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

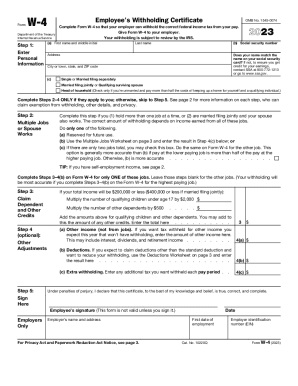

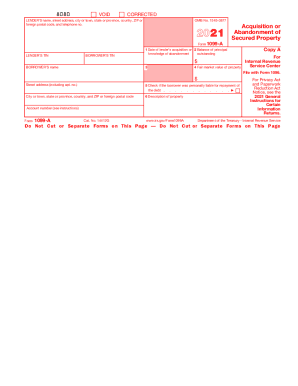

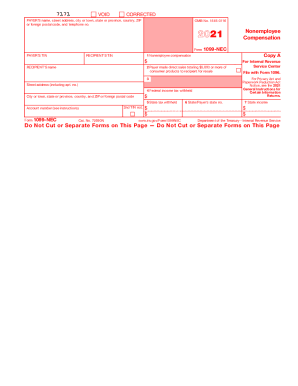

Is the form accompanied by other forms?

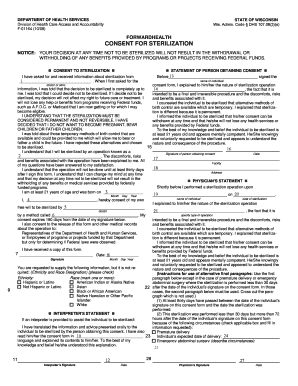

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1099-INT

What should I do if I need to correct an error on my IRS 1099-INT?

If you discover a mistake on your IRS 1099-INT after submission, you should file a corrected form. Ensure you clearly mark it as 'Corrected' at the top. Keep in mind that this process may differ slightly depending on whether you filed electronically or via paper, so consulting IRS guidelines for amendments is advisable.

How can I check the status of my filed IRS 1099-INT?

To check the status of your filed IRS 1099-INT, you can utilize the IRS's e-file confirmation tools. Additionally, if you e-filed, you may receive an acknowledgment from the IRS. If your form is rejected, look out for common rejection codes to identify the issue promptly.

What should I do if I receive a notice regarding my IRS 1099-INT?

If you receive a notice from the IRS concerning your IRS 1099-INT, carefully read the notice to understand the issue at hand. Prepare the necessary documentation to support your case, and respond by the date indicated to avoid penalties. It may also be beneficial to consult with a tax professional for assistance.

Can I use electronic signatures when filing an IRS 1099-INT?

Yes, electronic signatures are generally acceptable when filing an IRS 1099-INT, particularly if you are e-filing. However, ensure that the software you use complies with IRS regulations regarding electronic signatures to maintain the validity of your submission.

What common mistakes should I avoid when preparing my IRS 1099-INT?

To avoid common mistakes when preparing your IRS 1099-INT, double-check the accuracy of taxpayer identification numbers and amounts. Additionally, be mindful of any variations in names or addresses. Ensuring everything is accurate will save you from having to amend your submission later.

See what our users say