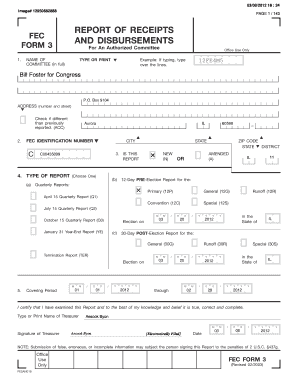

Get the free NYU Supplemental Tax Deferred Annuity Plan - nyu

Show details

El Plan de Anualidad Diferida Suplementaria de Nueva York (STDA) es un plan de ahorro para la jubilación destinado a empleados elegibles. Este folleto resume las disposiciones contenidas en los documentos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nyu supplemental tax deferred

Edit your nyu supplemental tax deferred form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyu supplemental tax deferred form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nyu supplemental tax deferred online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nyu supplemental tax deferred. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nyu supplemental tax deferred

How to fill out NYU Supplemental Tax Deferred Annuity Plan

01

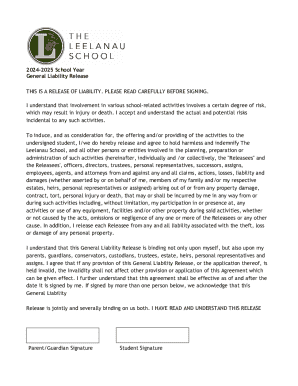

Obtain the NYU Supplemental Tax Deferred Annuity Plan enrollment form from the NYU benefits website or HR department.

02

Read through the plan description and eligibility requirements to ensure you qualify.

03

Fill in your personal details, including name, NYU employee ID, and contact information.

04

Choose your contribution percentage or dollar amount. Consider your budget and retirement goals.

05

Select your investment options from the list provided, based on your risk tolerance and investment strategy.

06

Review your selections for accuracy.

07

Sign and date the form to authorize your contributions.

08

Submit the completed form to your HR department or through the specified submission channel.

Who needs NYU Supplemental Tax Deferred Annuity Plan?

01

Employees of NYU who are looking to save for retirement in a tax-advantaged way.

02

Individuals wishing to supplement their retirement income beyond standard pension plans.

03

Employees who want flexible investment options tailored to their financial goals.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum contribution to a tax-deferred annuity?

Elective deferral limit The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including 457(b) plans) is $23,000 in 2024 ($22,500 in 2023; $20,500 in 2022; $19,500 in 2020 and 2021; $19,000 in 2021).

Is it better to invest in a tax account or a tax-deferred account?

Eventually, when you start withdrawing money (for Traditional IRAs, the qualified age is 59 1/2), you'll have to pay taxes on that money. For investors who need tax deductions now, tax-deferred accounts may be the better option.

Is a tax-deferred annuity a good idea?

A tax deferred annuity is a perfect choice for people who have many years to go before they retire. The large time gap allows your investments to grow to the maximum, thus ensuring a comfortable, happy, peaceful and an independent old age.

Is a tax-deferred annuity plan a 401k?

Although both are financial tools that can help you save for retirement and allow for tax-deferred growth, the two are very different. At the most basic level, a 401(k) is a type of retirement account – a container if you will – that holds different financial products, while an annuity is itself a financial product.

What are the disadvantages of tax-deferred?

But tax-deferred annuities have some drawbacks, too. They are fairly illiquid. That means once you put your money into one, you can incur penalties if you withdraw it before the end of your surrender charge period. Also, depending on the company you buy from and the type of annuity, you may have high fees.

What happens if you have a tax-deferred retirement plan?

Tax-deferred means you don't pay taxes until you withdraw your funds, instead of paying them upfront when you make contributions. With tax-deferred accounts, your contributions are typically deductible now, and you'll only pay applicable taxes on the money you withdraw in retirement.

How much does NYU contribute to retirement?

After a year of service, NYU provides a non-elective contribution of 5% of your base salary. In addition, if you make employee contributions, NYU will make a matching contribution on your behalf with respect to your employee contributions up to 5% of your base salary.

What is the disadvantage of using a tax-deferred retirement plan?

But tax-deferred annuities have some drawbacks, too. They are fairly illiquid. That means once you put your money into one, you can incur penalties if you withdraw it before the end of your surrender charge period. Also, depending on the company you buy from and the type of annuity, you may have high fees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NYU Supplemental Tax Deferred Annuity Plan?

The NYU Supplemental Tax Deferred Annuity Plan is a retirement savings program that allows employees to contribute a portion of their salary on a pre-tax basis to build savings for retirement.

Who is required to file NYU Supplemental Tax Deferred Annuity Plan?

Employees of New York University (NYU) who wish to participate in the plan and make contributions for retirement savings are required to file for the NYU Supplemental Tax Deferred Annuity Plan.

How to fill out NYU Supplemental Tax Deferred Annuity Plan?

To fill out the NYU Supplemental Tax Deferred Annuity Plan, employees typically need to complete a form provided by the university, indicating their desired contribution amount and other personal information required by the plan.

What is the purpose of NYU Supplemental Tax Deferred Annuity Plan?

The purpose of the NYU Supplemental Tax Deferred Annuity Plan is to provide a tax-advantaged way for employees to save for retirement, reducing their taxable income while accumulating savings.

What information must be reported on NYU Supplemental Tax Deferred Annuity Plan?

Information that must be reported on the NYU Supplemental Tax Deferred Annuity Plan includes employee personal details, contribution amounts, and any changes to employment status or salary.

Fill out your nyu supplemental tax deferred online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nyu Supplemental Tax Deferred is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.