Get the free Endowment and Gift Opportunities - baylor

Show details

This document outlines various donation opportunities available to support Baylor University Libraries, including programs such as Books for Bears, Baylor Book Society, Library Fellows, and Legacy

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign endowment and gift opportunities

Edit your endowment and gift opportunities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your endowment and gift opportunities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit endowment and gift opportunities online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit endowment and gift opportunities. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out endowment and gift opportunities

How to fill out Endowment and Gift Opportunities

01

Visit the institution's website or the specific endowment and gift opportunities page.

02

Download or access the required form for gift opportunities.

03

Fill in the donor's personal information, including name, address, and contact details.

04

Specify the type of gift (e.g., cash, securities, property) in the appropriate section.

05

Indicate the desired endowment purpose or project that the gift will support.

06

Provide any relevant documentation or additional details required for the donation.

07

Review the completed form for accuracy.

08

Submit the form according to the instructions provided (e.g., online submission, mailing, or in-person delivery).

09

Follow up if necessary to confirm receipt and processing of the gift.

Who needs Endowment and Gift Opportunities?

01

Individuals looking to contribute to educational institutions for sustainability.

02

Donors interested in making a long-term impact through endowments.

03

Philanthropists seeking to support specific projects or initiatives.

04

Organizations wanting to enhance their funding through planned giving.

05

Alumni wanting to give back to their alma mater.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean to give an endowment?

But what does it actually mean? In simple terms, an endowment is a fund that is set up by an organization or individual to provide a source of income for a specific charitable purpose.

What is the difference between an endowment and a donation?

An endowed gift is a permanent, self-sustaining source of funding. Endowment assets are invested. Each year, a portion of the value of the fund is paid out to support the fund's purpose, and any earnings in excess of this distribution are used to build the fund's market value.

Can a donor take back an endowment?

No. All gifts to the foundation are irrevocable. This includes the amount contributed by your organization to establish the endowment fund. The foundation requires acknowledgment from your organization that its governing body understands that the gifts are irrevocable.

What is endowment in simple words?

An endowment is a gift. It might be money given to an institution like a college. Or, an endowment might be a natural gift, say of a physical attribute or a talent. If you lack the endowment of musical talent, you could play the tambourine.

What are the disadvantages of an endowment?

While endowment funds can offer financial sustainability, they also can have drawbacks, such as restricted fund use and investment risks. Organizations that establish endowment funds need to be prepared to manage them carefully. But they can be a powerful tool for helping nonprofits achieve their goals.

What is the difference between an endowment and a gift?

An endowed gift is money given by a donor that is to be invested in perpetuity, with the distributions available to spend on activities consistent with donor intent. An expendable gift is money given by a donor that is to be entirely spent on activities consistent with donor intent.

What is the difference between a donation and an endowment?

What's the difference between an endowment and donation? Unlike a donation, the funds of an endowment are carefully invested and only the investment earnings are used. This allows the principal amount to remain and enables us to create a permanent legacy of care in your name.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Endowment and Gift Opportunities?

Endowment and Gift Opportunities refer to financial contributions made to support organizations, typically in the form of donations that are invested to generate income for specific purposes or ongoing needs.

Who is required to file Endowment and Gift Opportunities?

Organizations that receive significant financial contributions or are involved in managing endowment funds are generally required to file Endowment and Gift Opportunities.

How to fill out Endowment and Gift Opportunities?

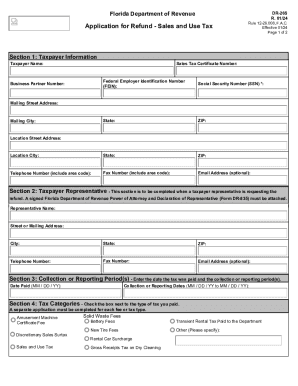

Filling out Endowment and Gift Opportunities typically involves providing specific details about the donor, the amount and type of gift, the intended purpose of the endowment, and relevant organizational information.

What is the purpose of Endowment and Gift Opportunities?

The purpose of Endowment and Gift Opportunities is to secure long-term financial support for an organization, ensuring sustainability and the ability to fund ongoing initiatives.

What information must be reported on Endowment and Gift Opportunities?

Information that must be reported includes donor details, gift amount, the date of the contribution, purpose of the gift, and any restrictions placed on the use of the funds.

Fill out your endowment and gift opportunities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Endowment And Gift Opportunities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.