Get the free LOW INCOME STATEMENT – INDEPENDENT STUDENT - bpc

Show details

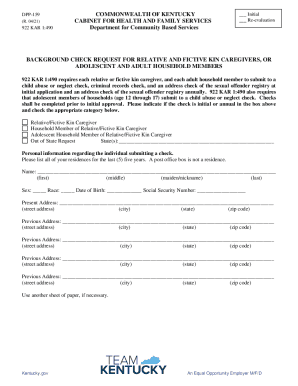

This document is required for independent students applying for federal financial aid to provide additional income information due to unusually low income in the prior year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign low income statement independent

Edit your low income statement independent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your low income statement independent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing low income statement independent online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit low income statement independent. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out low income statement independent

How to fill out LOW INCOME STATEMENT – INDEPENDENT STUDENT

01

Begin by downloading the LOW INCOME STATEMENT form from the appropriate educational institution's website.

02

Fill in your personal information, including your name, student ID, and contact details at the top of the form.

03

Provide details about your household income, including sources of income such as part-time jobs, financial aid, or support from family.

04

Indicate any other financial resources you may have, such as savings or assets.

05

Complete the section regarding any expenses, which may include rent, utilities, and educational costs.

06

Sign and date the form to certify that the information provided is accurate and truthful.

07

Submit the completed form to the designated office at your educational institution, following any specific submission guidelines they may have.

Who needs LOW INCOME STATEMENT – INDEPENDENT STUDENT?

01

Independent students who have limited income or financial resources and need to demonstrate their financial situation for financial aid or scholarship applications.

02

Students who may be pursuing higher education without financial support from parents or guardians and require assistance based on their current financial status.

Fill

form

: Try Risk Free

People Also Ask about

Can I claim an independent student on my taxes?

Independent Students. Independent students file income taxes separately from their parents and do not count as dependents on their parents' tax returns. In general, the designation depends on your age and financial status.

Why is FAFSA saying I'm an independent student?

To be considered independent on the FAFSA without meeting the age requirement, an associate or bachelor's degree student must be at least one of the following: married; a U.S. veteran; in active duty military service other than training purposes; an emancipated minor; a recently homeless youth or self-supporting and at

How to change independent status on FAFSA?

Comments Section If you're categorized as an independent student ing to the FAFSA, your siblings and parents do not influence that question as they are not in your household for the FAFSA. So you'll answer no if you, your spouse, or dependent children do not have these benefits.

Why did FAFSA file me as independent?

To be considered independent on the FAFSA without meeting the age requirement, an associate or bachelor's degree student must be at least one of the following: married; a U.S. veteran; in active duty military service other than training purposes; an emancipated minor; a recently homeless youth or self-supporting and at

What qualifies as a low income student?

"Low income" is a term often used to describe students from families with annual incomes typically at or below 200% of the Federal Poverty Level. However, the specific income thresholds that qualify as "low-income" can vary across different programs, states, and institutions.

What qualifies you as an independent student for FAFSA?

Additionally, if your personal circumstances change and impact your dependency status after you submit your FAFSA form, contact your school's financial aid office to ask if they have a policy that allows you to update your answers to the personal circumstance questions.

How much income is too much for a FAFSA independent student?

Unless you plan on paying for your entire college education out-of-pocket, everyone should submit the FAFSA. There are no FAFSA income limits, meaning there's nothing stopping even the richest college students from submitting a FAFSA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LOW INCOME STATEMENT – INDEPENDENT STUDENT?

The Low Income Statement for Independent Students is a financial document that helps assess an independent student's financial situation, typically used for financial aid applications and eligibility verification.

Who is required to file LOW INCOME STATEMENT – INDEPENDENT STUDENT?

Independent students who are applying for financial aid and have a low income that impacts their ability to pay for their education are required to file the Low Income Statement.

How to fill out LOW INCOME STATEMENT – INDEPENDENT STUDENT?

To fill out the Low Income Statement, independent students must provide detailed information regarding their financial situation, including income, employment status, and any applicable deductions or expenses. It's essential to follow the specific guidelines provided by the educational institution.

What is the purpose of LOW INCOME STATEMENT – INDEPENDENT STUDENT?

The purpose of the Low Income Statement is to document the financial circumstances of independent students, which may qualify them for grant funding, scholarships, or additional financial aid to help cover educational costs.

What information must be reported on LOW INCOME STATEMENT – INDEPENDENT STUDENT?

The information that must be reported includes the student's income, source of income, any dependents, living expenses, and any other relevant financial details that demonstrate their economic need.

Fill out your low income statement independent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Low Income Statement Independent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.