Get the free 2009-2010 Low Income Statement - Dependent Student - bpc

Show details

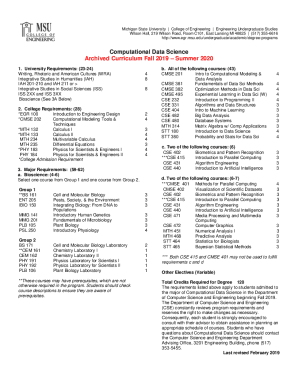

This document is a form necessary for determining eligibility for student financial aid, requiring additional information about the financial situation of a dependent student's family, particularly

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2009-2010 low income statement

Edit your 2009-2010 low income statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009-2010 low income statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2009-2010 low income statement online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2009-2010 low income statement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2009-2010 low income statement

How to fill out 2009-2010 Low Income Statement - Dependent Student

01

Gather your financial documents, including income statements, W-2 forms, and tax returns.

02

Using the Low Income Statement form, enter your name and personal information at the top of the form.

03

List your income sources including wages, benefits, and any other relevant income.

04

If you are not required to file taxes, indicate this on the form and provide an explanation of your income.

05

Complete the section about your family's financial situation, including information about your parent(s) or guardian(s).

06

Review the information for accuracy, ensuring all required fields are filled out.

07

Sign and date the form before submission.

Who needs 2009-2010 Low Income Statement - Dependent Student?

01

Dependent students who come from low-income families and need to report their financial situation for financial aid purposes.

02

Students applying for educational programs that require proof of low-income status.

03

Those seeking financial assistance or scholarships that require a Low Income Statement.

Fill

form

: Try Risk Free

People Also Ask about

How much can a parent make for a child to get financial aid?

There is no income cut-off to qualify for federal student aid. Many factors — such as the size of your family and your year in school — are considered.

How much is dependent student income protection allowance?

For the 24/25 Aid Year as a Dependent Student, your own income has a $11,130 income protection allowance, which will leave that amount of your 2022 income out of the calculation entirely.

Do dependent students get more financial aid?

As a dependent student, your annual and aggregate federal student loan limits are typically lower than those for independent students. However, your parents can apply for a Parent PLUS Loan to help cover your educational costs.

What is the highest sai to get Pell Grant?

A negative SAI indicates you have a higher financial need. For example, if you have an SAI of –1500, you'll qualify for a maximum Pell Grant award assuming you have not exhausted your lifetime amounts and meet all student eligibility requirements. Learn how the SAI is calculated.

What is the income protection allowance for students?

Student Income Most students don't need to worry about their income affecting their FAFSA, since students get an Income Protection Allowance of $11,510 this year. And since the FAFSA only takes income from tax returns, students who do not file taxes do not report any income.

How much do dependent students get from FAFSA?

Your actual award amount will be determined by your institution based on attendance status and unmet financial need: Cal Grant A – annual access award up to $6,000 plus: CA Community College: $0 for Tuition and Fees* California State University (CSU): Up to $5,742 for Tuition and Fees.

Do parents who make $120000 still qualify for FAFSA?

There is no set income limit for eligibility to qualify for financial aid through. You'll need to fill out the FAFSA every year to see what you qualify for at your college. It's important to make sure you fill out the FAFSA as quickly as possible once it opens for the following school year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2009-2010 Low Income Statement - Dependent Student?

The 2009-2010 Low Income Statement for Dependent Students is a form used to report the financial status of dependent students who come from low-income families. It helps institutions assess the financial need of students when applying for financial aid.

Who is required to file 2009-2010 Low Income Statement - Dependent Student?

Dependent students who have a family income that falls below a certain threshold are required to file this statement to ensure they receive the appropriate financial aid.

How to fill out 2009-2010 Low Income Statement - Dependent Student?

To fill out the statement, gather the required financial documents, answer all questions accurately, report total household income, and ensure that both the student and their parent(s) sign the form before submission.

What is the purpose of 2009-2010 Low Income Statement - Dependent Student?

The purpose of the Low Income Statement is to provide a formal declaration of financial need, allowing colleges and financial aid offices to determine eligibility for aid programs aimed at supporting low-income students.

What information must be reported on 2009-2010 Low Income Statement - Dependent Student?

The statement requires information such as total household income, any additional financial resources, family size, and the number of family members attending college, among other relevant financial details.

Fill out your 2009-2010 low income statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009-2010 Low Income Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.