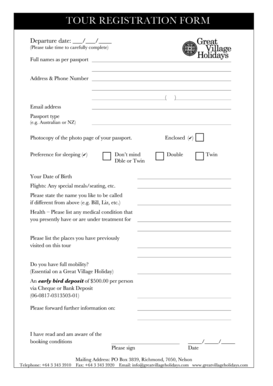

Get the free Salary Reduction Agreement Change and Revocation Form - bridgewater

Show details

This form is used by employees to request changes to their salary reduction agreements regarding benefits under their employer's cafeteria plan, such as healthcare and dependent care flexible spending

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salary reduction agreement change

Edit your salary reduction agreement change form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary reduction agreement change form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing salary reduction agreement change online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit salary reduction agreement change. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out salary reduction agreement change

How to fill out Salary Reduction Agreement Change and Revocation Form

01

Obtain the Salary Reduction Agreement Change and Revocation Form from your employer or HR website.

02

Fill in your personal information at the top of the form, including your name, employee ID, and department.

03

Indicate whether you are making a change or revocation of your salary reduction by checking the appropriate box.

04

If changing your salary reduction, specify the new amount or percentage to be deducted from your salary.

05

If revoking your salary reduction, state clearly that you wish to cancel the previous agreement.

06

Review the form for accuracy and ensure that all required sections are filled out.

07

Sign and date the form to validate your request.

08

Submit the completed form to your HR department or follow the specific submission guidelines provided by your employer.

Who needs Salary Reduction Agreement Change and Revocation Form?

01

Employees who wish to adjust their salary reduction agreements for benefits such as retirement plans, flexible spending accounts, or other pre-tax options.

Fill

form

: Try Risk Free

People Also Ask about

What is a salary deduction agreement?

A wage deduction authorization agreement is an agreement between an employer and their employee where the employee authorizes the employer to deduct wages from their paycheck.

What is a salary reduction agreement form?

The Salary Reduction Agreement (SRA) is to be used to establish, change, or cancel salary reductions withheld from your paycheck and contributed to the 403(b) and/or 457(b) Plan on your behalf. The SRA is also used to change the investment providers that receive your contributions.

How does a salary reduction agreement work?

These voluntary agreements allow a company, at the discretion of the employee, to reduce the employee's compensation so the company can contribute that reduced amount to their selected retirement accounts.

Can my employer reduce my salary without my agreement?

can an employer legally reduce employee pay? Typically, employers can reduce the compensation of their employees' for any reason, as long as it's not illegal and the new pay does not violate California's wage and hour laws.

What is the meaning of salary reduction?

A salary cut is what happens when your employer reduces your pay. The amount of a salary cut can vary depending on your job position and the situation responsible for the pay decrease. Salary cuts can mean a reduction in pay without a change in your work responsibilities.

What is a 403 B salary reduction agreement?

A 403(b) plan may allow: Elective deferrals - employee contributions made under a salary reduction agreement. The agreement allows an employer to withhold money from an employee's salary and deposit it into a 403(b) account.

What is a 457b salary reduction agreement?

An eligible deferred compensation plan under IRC Section 457(b) is an agreement or arrangement (which may be an individual employment agreement) under which the payment of compensation is deferred (whether by salary reduction or by nonelective employer contribution).

What is a Section 125 salary reduction agreement?

A salary-reduction agreement is a document in which the employee agrees to accept a lower salary in exchange for contributing pre-tax money — also called “salary reduction contributions” or “elections” toward their Section 125 plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Salary Reduction Agreement Change and Revocation Form?

The Salary Reduction Agreement Change and Revocation Form is a document used to modify or terminate an existing salary reduction agreement between an employee and employer, allowing changes to the deductions from the employee's salary for benefits or retirement accounts.

Who is required to file Salary Reduction Agreement Change and Revocation Form?

Employees who wish to change or revoke their current salary reduction agreements are required to file the Salary Reduction Agreement Change and Revocation Form with their employer or benefits administrator.

How to fill out Salary Reduction Agreement Change and Revocation Form?

To fill out the form, an employee should provide their personal details, specify the changes or revocation of the agreement, sign and date the form, and submit it to the appropriate department or supervisor.

What is the purpose of Salary Reduction Agreement Change and Revocation Form?

The purpose of the Salary Reduction Agreement Change and Revocation Form is to officially document and process any changes or cancellations to salary reductions, ensuring that both the employee and employer have a record of the agreement modifications.

What information must be reported on Salary Reduction Agreement Change and Revocation Form?

The form must typically report the employee's name, employee ID, job title, details of the current salary reduction agreement, the changes being requested or the intention to revoke, and the signature of the employee.

Fill out your salary reduction agreement change online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salary Reduction Agreement Change is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.