Get the free 2011-12 Private/Alternative Loan Programs - CalArts

Show details

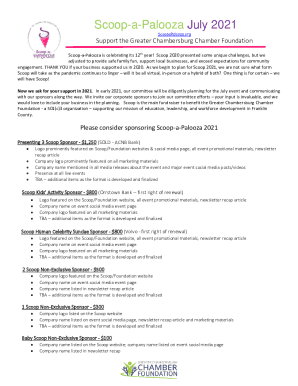

2011-12 Private/Alternative Loan Programs Private/Alternative Loans are private bank loans for students, designed to help meet the gap between the cost of attendance and financial aid. These loans

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011-12 privatealternative loan programs

Edit your 2011-12 privatealternative loan programs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011-12 privatealternative loan programs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011-12 privatealternative loan programs online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2011-12 privatealternative loan programs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011-12 privatealternative loan programs

How to fill out 2011-12 privatealternative loan programs:

01

Start by gathering all the necessary documents and information, such as your identification, income verification, and financial aid award letter.

02

Research and compare different private alternative loan programs to find the best option for your needs. Consider factors such as interest rates, repayment terms, and eligibility requirements.

03

Once you have chosen a lender, visit their website or contact them directly to access the loan application. Follow the instructions provided and complete all the required fields accurately.

04

Provide any supporting documents that may be required, such as bank statements or tax returns. Make sure to submit clear and legible copies.

05

Review the completed application form and supporting documents for any errors or missing information. Double-check all the details before submitting to avoid delays or rejections.

06

Submit your application online or by mail, following the lender's instructions. If submitting online, ensure that you receive a confirmation or reference number to track the progress of your application.

07

Wait for the lender's decision. This may take a few days to a few weeks, depending on the lender and the volume of applications they receive.

08

If approved, carefully review the loan offer, including the terms and conditions, interest rates, and repayment schedule. Make note of any deadlines or requirements.

09

Accept the loan offer by signing any necessary documents and returning them to the lender. Ensure that you fully understand the terms and obligations of the loan before accepting.

10

Receive the loan funds, as per the lender's instructions. They may be disbursed directly to your educational institution or deposited into your bank account.

Who needs 2011-12 privatealternative loan programs:

01

Individuals who are not eligible for federal student loans or need additional financial aid beyond what is offered.

02

Students attending private colleges or universities with high tuition costs that may not be fully covered by other forms of financial aid.

03

Graduates or professionals pursuing further education, such as advanced degrees or specialized training, who require additional financial assistance beyond federal loans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2011-12 privatealternative loan programs in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your 2011-12 privatealternative loan programs, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I fill out 2011-12 privatealternative loan programs on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your 2011-12 privatealternative loan programs from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I complete 2011-12 privatealternative loan programs on an Android device?

Use the pdfFiller mobile app to complete your 2011-12 privatealternative loan programs on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is 12 privatealternative loan programs?

12 private alternative loan programs refer to a set of loan programs offered by private lenders, such as banks and credit unions, that are an alternative to traditional government-backed loans like FHA or VA loans.

Who is required to file 12 privatealternative loan programs?

Private lenders who offer these alternative loan programs are required to file the 12 private alternative loan programs.

How to fill out 12 privatealternative loan programs?

To fill out the 12 private alternative loan programs, private lenders need to provide detailed information about the loan programs they offer, including interest rates, repayment terms, eligibility criteria, and any fees associated with the loans.

What is the purpose of 12 privatealternative loan programs?

The purpose of 12 private alternative loan programs is to provide borrowers with additional options for obtaining financing for various purposes, such as purchasing a home, starting a business, or funding education.

What information must be reported on 12 privatealternative loan programs?

Private lenders must report detailed information about the loan programs they offer, including the number of loans originated, loan amounts, interest rates, borrower demographics, loan performance, and any foreclosures or defaults.

Fill out your 2011-12 privatealternative loan programs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011-12 Privatealternative Loan Programs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.