Get the free Certificate of Non Income Tax Filing

Show details

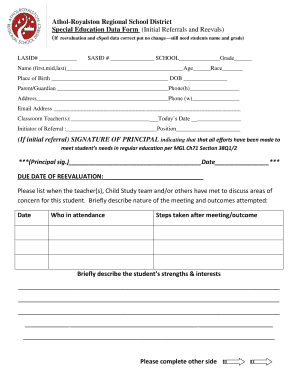

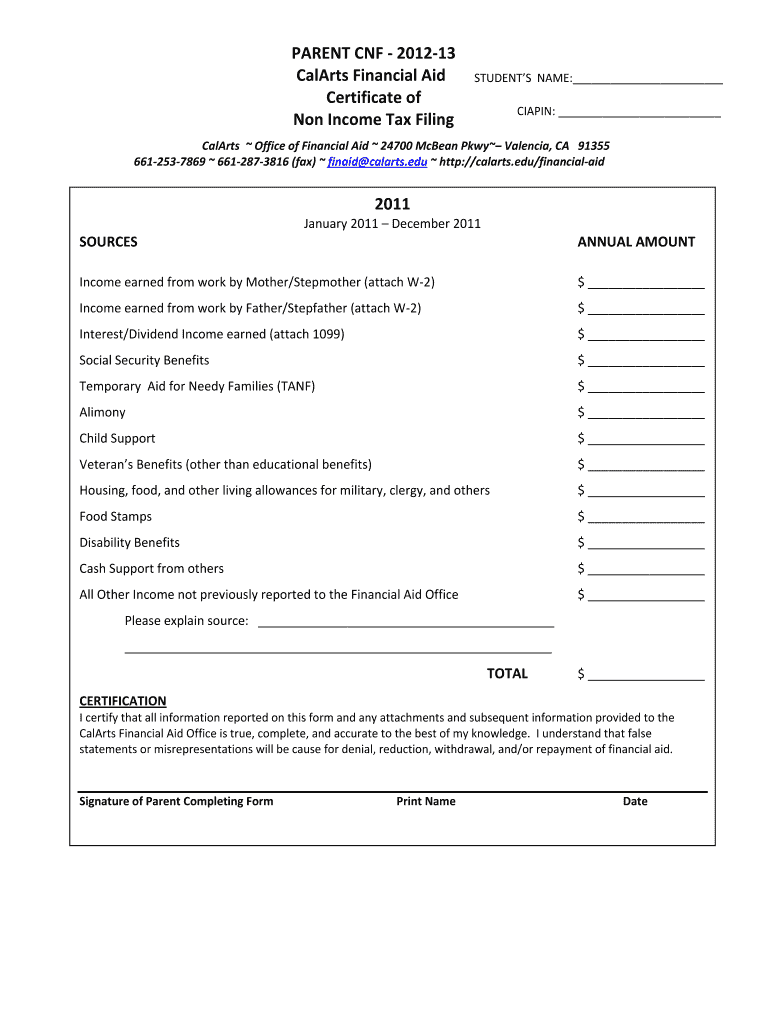

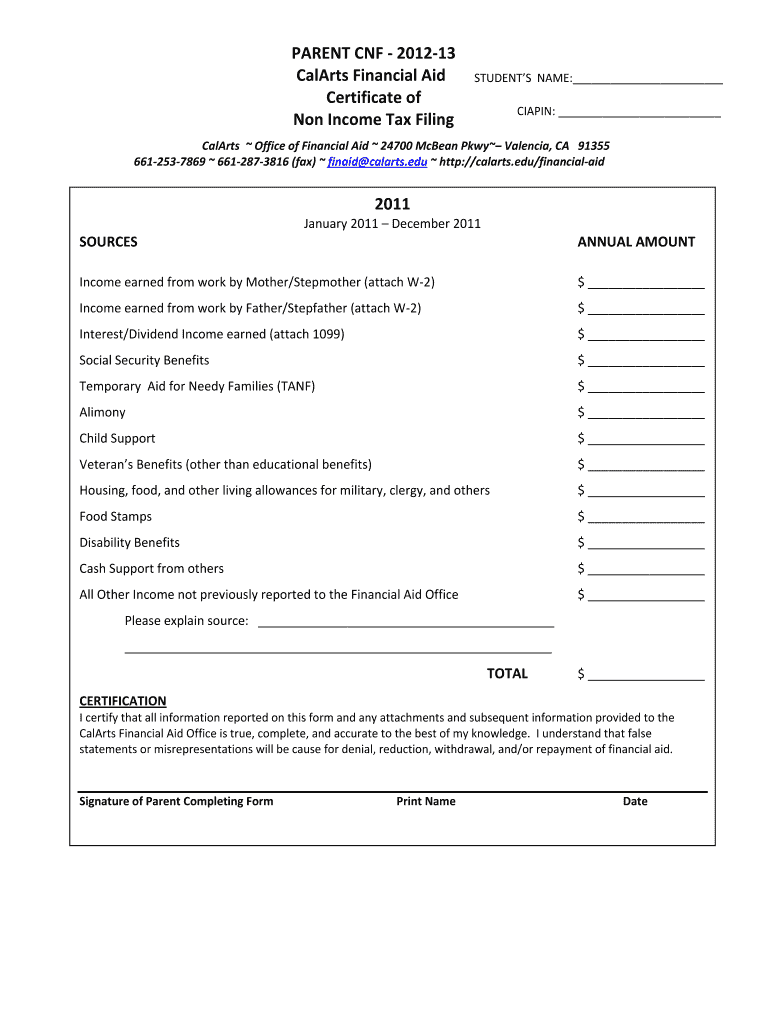

This document is used by parents to certify their non-filing status for income tax, required by the CalArts Financial Aid Office to assess financial aid eligibility.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of non income

Edit your certificate of non income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of non income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of non income online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit certificate of non income. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of non income

How to fill out Certificate of Non Income Tax Filing

01

Obtain a copy of the Certificate of Non Income Tax Filing form from the appropriate tax authority's website or office.

02

Fill out your personal information including your full name, address, and taxpayer identification number.

03

Indicate the tax year for which you are requesting the certificate.

04

Confirm that you have not had any income during the specified tax year.

05

Review all information for accuracy.

06

Sign and date the form.

07

Submit the completed form to the relevant tax authority either online, by mail, or in person as instructed.

Who needs Certificate of Non Income Tax Filing?

01

Individuals who need to prove they did not earn income for a specific tax year.

02

People applying for certain government programs that require proof of income status.

03

Residents applying for loans or financial assistance that may require income verification.

04

Non-profit organizations for grant applications requiring income documentation.

Fill

form

: Try Risk Free

People Also Ask about

Does the IRS issue tax clearance certificates?

If you're a resident or a nonresident alien departing the United States, you usually have to show that you have complied with the U.S. income tax laws before you can depart. You do this by obtaining from the IRS a tax clearance document, commonly called a departure permit or sailing permit.

How do I get a non-filing tax letter?

Telephone Request Available from the IRS by calling 1-800-908-9946. Non-filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided in their telephone request within 5 to 10 days from the time of the request.

What is an IRS clearance?

The IRS MBI clearance, also known as the Moderate Risk Background Investigation, is a critical assessment used to determine individuals' suitability for positions that require access to sensitive information, particularly regarding Federal Tax Information (FTI).

What is a non tax filing statement?

An IRS Verification of Non-filing Letter - provides proof that the IRS has no record of a filed Form 1040, for the year requested. Non-Tax filers can request an IRS Verification of Non-filing of their tax return status, free of charge, from. the IRS in one of three ways: • Online. • By Telephone.

Can 1040 NR be filed electronically?

You can file Form 1040NR, U.S. Nonresident Alien Income Tax Return, or extensions electronically with UltraTax CS in the same way as 1040 returns or extensions. The IRS doesn't let you e-file Form 1040NR-EZ or Dual status returns. You'll need to file these returns on paper.

How do I get an IRS tax clearance certificate?

0:40 3:13 Website when filling out the form make sure you include all the necessary. Information such as yourMoreWebsite when filling out the form make sure you include all the necessary. Information such as your tax identification number and attach any required documents like your passport. And national ID.

How to get a tax clearance certificate in the USA?

In most states, the department of revenue will issue a tax clearance certificate; but in others, it might be the department of taxation, department of finance, secretary of state, or another agency. Many states provide forms for requesting a tax clearance online. Others require you to submit a written request.

How long does it take to get an IRS transfer certificate?

The time frame for the IRS to process the affidavit and supporting documents is six to nine months from the time the IRS receives all necessary documentation. If Part B applies, do not file Form 706-NA. Unnecessary use of the Form 706-NA will delay the issuance of a Transfer Certificate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certificate of Non Income Tax Filing?

A Certificate of Non Income Tax Filing is an official document that verifies an individual or entity has not filed income tax returns for a specific period.

Who is required to file Certificate of Non Income Tax Filing?

Individuals or businesses that have not had any income or are exempt from filing income tax returns may be required to file a Certificate of Non Income Tax Filing.

How to fill out Certificate of Non Income Tax Filing?

To fill out the Certificate of Non Income Tax Filing, provide accurate information about personal or business details, including identification numbers, the period of non-filing, and any other required documentation as specified by the tax authorities.

What is the purpose of Certificate of Non Income Tax Filing?

The purpose of the Certificate of Non Income Tax Filing is to formally declare that a person or business has not filed income tax returns, often required for legal, financial, or regulatory processes.

What information must be reported on Certificate of Non Income Tax Filing?

The information that must be reported typically includes the individual's or entity's name, identification number, period of non-filing, and possibly a declaration or signature affirming the accuracy of the information.

Fill out your certificate of non income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Non Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.