Get the free Payroll Hold on Employee's Final Pay Warrant - fresnostate

Show details

This document outlines the process for placing a hold on an employee's final pay warrant due to non-return of State property upon termination. It details the responsibilities of clearing departments,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll hold on employees

Edit your payroll hold on employees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll hold on employees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll hold on employees online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit payroll hold on employees. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll hold on employees

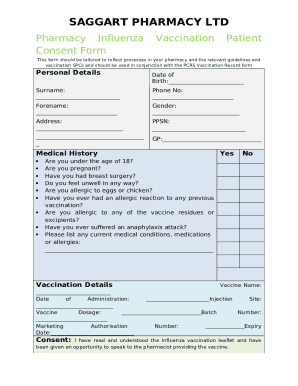

How to fill out Payroll Hold on Employee's Final Pay Warrant

01

Obtain the Employee's Final Pay Warrant form.

02

Fill in the employee's name and identification number.

03

Specify the reason for the payroll hold.

04

Indicate the amount to be held.

05

Include any necessary supporting documents.

06

Sign and date the form.

07

Submit the completed form to the payroll department.

Who needs Payroll Hold on Employee's Final Pay Warrant?

01

Employees with outstanding debts to the company.

02

Employees with pending disciplinary actions.

03

Employees transitioning out of the company with unresolved issues.

Fill

form

: Try Risk Free

People Also Ask about

Is it legal to hold an employee last paycheck?

For example, for employees who quit, California's final paycheck law requires payment of wages within 72 hours or immediately if the employee gave at least 72 hours' notice. If the employee is discharged in California, then the law requires employers to provide any and all compensation due at the time of separation.

Is it illegal to withhold payroll?

No, a company cannot withhold your paycheck if you quit. California law requires employers to issue the final paycheck immediately for employees who get terminated or resign with at least 72 hours' notice. If you do not provide notice before your resignation, the employer must issue the final paycheck within 72 hours.

Can an employer legally withhold your last paycheck?

If the employee is discharged in California, then the law requires employers to provide any and all compensation due at the time of separation. The employee can file a wage claim for every day they don't receive a check after the time of separation.

Can I sue my employer for holding my check?

You can call it wage theft or go with a more gentle term such as withholding income. However you slice it, an employer that illegally takes wages from a worker should be held accountable under state and federal employment laws. In other words, you can sue a company for not paying you.

What happens if your employer can't make payroll?

This is true even if the company is experiencing cash flow problems. Failure to pay employees is considered wage theft. Employees can sue for compensation, and businesses will usually be subjected to fines from civil penalties, as well as court-ordered damages.

What happens if a company keeps paying you after you quit?

it is for income tax, National Insurance contributions or student loan repayments. there is a statutory payment due to a public authority. it is as a result of a court order, for example, an attachment of earnings order where the worker owes someone money following a county court judgment or for unpaid maintenance.

What happens if your boss doesn't give you your paycheck?

Call your state's Department of Labor. If you do not get satisfaction from the state and the company has more than 20 employees, call the US Department of Labor. Failure to pay wages within 15 days is a criminal offense in most states.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Payroll Hold on Employee's Final Pay Warrant?

Payroll Hold on Employee's Final Pay Warrant refers to a temporary suspension of payment, preventing an employee's final paycheck from being issued until certain conditions are met or issues are resolved.

Who is required to file Payroll Hold on Employee's Final Pay Warrant?

Typically, employers or payroll departments are required to file Payroll Hold on Employee's Final Pay Warrant to ensure compliance with legal and regulatory obligations before releasing final payments.

How to fill out Payroll Hold on Employee's Final Pay Warrant?

To fill out Payroll Hold, you need to provide the employee's details, the reason for the hold, the amount of the final pay warrant, and any relevant documentation supporting the hold.

What is the purpose of Payroll Hold on Employee's Final Pay Warrant?

The purpose of Payroll Hold is to ensure that any outstanding obligations, such as unpaid debts, compliance issues, or legal matters, are resolved before issuing the final payment to the employee.

What information must be reported on Payroll Hold on Employee's Final Pay Warrant?

The report must include the employee's name, employee ID, the reason for the hold, the expected amount due, dates of service, and any relevant reference numbers or supporting documentation.

Fill out your payroll hold on employees online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Hold On Employees is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.