Get the free Non-Employee Compensation Citizenship / Residency Statement - csun

Show details

This form is required for individuals receiving non-employee compensation, ensuring compliance with tax regulations by collecting citizenship or residency information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-employee compensation citizenship residency

Edit your non-employee compensation citizenship residency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-employee compensation citizenship residency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-employee compensation citizenship residency online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-employee compensation citizenship residency. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

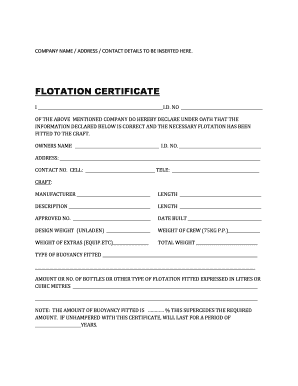

How to fill out non-employee compensation citizenship residency

How to fill out Non-Employee Compensation Citizenship / Residency Statement

01

Start with your personal information: include your name, address, and taxpayer identification number (TIN).

02

Indicate your citizenship or residency status by checking the appropriate box.

03

Provide details on the type of income you are expecting to receive (e.g., consulting fees, contract work).

04

Review the form for accuracy and completeness.

05

Sign and date the statement at the bottom.

Who needs Non-Employee Compensation Citizenship / Residency Statement?

01

Individuals or businesses engaging independent contractors or freelancers.

02

Persons receiving non-employee compensation who need to establish their citizenship or residency status for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What happens if a non-resident file taxes as a resident?

If a nonresident files as a resident they can claim benefits and receive refunds that they're not entitled to. Incorrect filing breaks the terms and conditions of a nonresident visa, this can lead to fines and penalties and you may also jeopardize your future visa or green card applications.

What criteria and tests are used to determine federal tax residency status ing to the IRS?

You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year. In some cases, an individual who is not a U.S. resident within the meaning of IRC section 7701(b)(1)(A) can choose to be treated as a U.S. resident.

Is DACA considered a resident alien?

As we've noted, DACA individuals may have SSNs and file as resident aliens, but they are not subject to the ACA mandate. Conversely, another individual may be lawfully present in the U.S. and hold a work visa, while the individual's spouse and children have ITINs.

Can 1040 NR be filed electronically?

You can file Form 1040NR, U.S. Nonresident Alien Income Tax Return, or extensions electronically with UltraTax CS in the same way as 1040 returns or extensions. The IRS doesn't let you e-file Form 1040NR-EZ or Dual status returns. You'll need to file these returns on paper.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Non-Employee Compensation Citizenship / Residency Statement?

The Non-Employee Compensation Citizenship / Residency Statement is a document used to certify the citizenship or residency status of individuals who receive non-employee compensation, ensuring proper tax reporting and compliance.

Who is required to file Non-Employee Compensation Citizenship / Residency Statement?

Individuals or entities that make payments to non-employees, such as independent contractors or freelancers, for services performed are required to file the Non-Employee Compensation Citizenship / Residency Statement.

How to fill out Non-Employee Compensation Citizenship / Residency Statement?

To fill out the Non-Employee Compensation Citizenship / Residency Statement, one must provide their name, address, tax identification number (TIN), and certify their citizenship or residency status by signing the form.

What is the purpose of Non-Employee Compensation Citizenship / Residency Statement?

The purpose of the Non-Employee Compensation Citizenship / Residency Statement is to ensure that payments made to non-employees are correctly taxed and reported according to the individual's residency or citizenship status.

What information must be reported on Non-Employee Compensation Citizenship / Residency Statement?

The information that must be reported includes the individual's name, address, tax identification number (TIN), citizenship or residency status, and a signature certifying the accuracy of the provided information.

Fill out your non-employee compensation citizenship residency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Employee Compensation Citizenship Residency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.