Get the free Unsubsidized Loan for Dependent Students - csustan

Show details

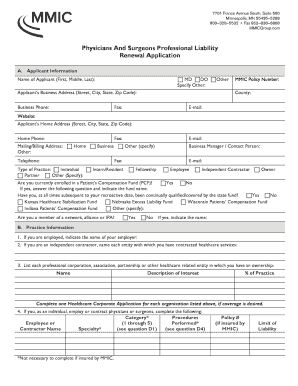

This document is a loan application for dependent students who are eligible for an Unsubsidized Stafford loan based on parental information refusal. It includes sections for student and parent details,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unsubsidized loan for dependent

Edit your unsubsidized loan for dependent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unsubsidized loan for dependent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unsubsidized loan for dependent online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit unsubsidized loan for dependent. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unsubsidized loan for dependent

How to fill out Unsubsidized Loan for Dependent Students

01

Gather necessary information: Collect personal, financial, and academic information required for the loan application.

02

Visit the Federal Student Aid website: Go to studentaid.gov and find the Unsubsidized Loan section for Dependent Students.

03

Complete the FAFSA: Fill out the Free Application for Federal Student Aid (FAFSA) to determine eligibility.

04

Submit the FAFSA: Ensure that you submit your FAFSA by the required deadline to be considered for the Unsubsidized Loan.

05

Review the loan offer: Once processed, review the financial aid offer from your school to see the amount of Unsubsidized Loan you qualify for.

06

Accept the loan: Follow your school’s instructions to formally accept the Unsubsidized Loan offered to you.

07

Complete entrance counseling: If required, complete the online entrance counseling to understand your rights and responsibilities.

08

Sign the Master Promissory Note (MPN): Sign the MPN to agree to the terms of the loan, either electronically or on paper.

Who needs Unsubsidized Loan for Dependent Students?

01

Students who have financial needs not met by other forms of aid.

02

Students attended enroll in college or university on a full-time or part-time basis.

03

Dependent students whose families are unable to contribute towards their educational expenses.

Fill

form

: Try Risk Free

People Also Ask about

Can a parent claim student loan interest for a dependent?

You can't deduct qualified student loan interest payments you paid on a loan in your dependent's name. Neither of you can deduct the loan interest if both of these are true: You claim the student as a dependent. You pay the student's loan interest.

How much is a monthly payment for $40,000 in student loans?

Which loan should I accept? Given the option, you should accept a Direct Subsidized Loan first. Then, if you still need additional financial aid to pay for college or career school, accept the Direct Unsubsidized Loan.

Can a dependent student get a student loan?

If you are a dependent student whose parents are not eligible for a Direct PLUS Loan, you may be able to receive additional Direct Unsubsidized Loan funds. The following chart shows the annual and aggregate limits for subsidized and unsubsidized loans.

Is it better to take subsidized or unsubsidized loans?

A subsidized loan is your best option. With these loans, the federal government pays the interest charges for you while you're in college. Here are the types of student loans. (Keep in mind that not all students are eligible for every loan.)

Who qualifies for an unsubsidized student loan?

Direct Unsubsidized Loans are available to undergraduate, graduate, or professional degree students enrolled at least half-time at a school that participates in the Direct Loan Program. Financial need is not required to qualify.

What are the disadvantages of an unsubsidized student loan?

Drawbacks of Unsubsidized Student Loans You're responsible for paying the interest on that loan from day one. Unsubsidized loans are not the worst loans you can borrow in terms of pure cost and the interest rate that you'll receive. However, the interest accumulates even before you enter repayment.

What are the disadvantages of unsubsidized loans?

The big drawback with unsubsidized student loans is that they're more expensive than subsidized student loans. You're responsible for paying the interest on that loan from day one. Unsubsidized loans are not the worst loans you can borrow in terms of pure cost and the interest rate that you'll receive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Unsubsidized Loan for Dependent Students?

An Unsubsidized Loan for Dependent Students is a federal student loan that is not based on financial need. Interest accrues on the loan while the student is in school, during grace periods, and during any periods of deferment.

Who is required to file Unsubsidized Loan for Dependent Students?

Dependent students who have completed the Free Application for Federal Student Aid (FAFSA) and require additional funding for their education may apply for an Unsubsidized Loan.

How to fill out Unsubsidized Loan for Dependent Students?

To fill out the application for an Unsubsidized Loan, students must complete the FAFSA and specify that they wish to borrow a Direct Unsubsidized Loan. They may also need to provide information about their educational expenses.

What is the purpose of Unsubsidized Loan for Dependent Students?

The purpose of the Unsubsidized Loan for Dependent Students is to provide financial assistance to cover tuition and other educational expenses for students who may not qualify for need-based aid.

What information must be reported on Unsubsidized Loan for Dependent Students?

Students must report their personal information, educational expenses, income, and assets when completing the FAFSA to apply for the Unsubsidized Loan for Dependent Students.

Fill out your unsubsidized loan for dependent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unsubsidized Loan For Dependent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.