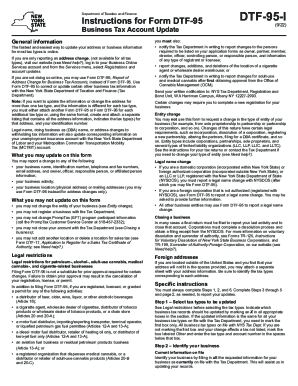

NY DTF DTF-95-I 2011 free printable template

Show details

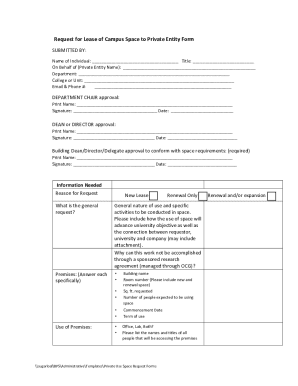

Visit our Web site see Need help and select the option to change your address. an aviation fuel business or residual petroleum products business Use Form DTF-95 to correct or update certain business tax records with the New York State Department of Taxation and Finance Tax Department. New York State Department of Taxation and Finance Instructions for Form DTF-95 DTF-95-I Business Tax Account Update 2/11 General information a diesel motor fuel distributor retailer of heating oil only or If you...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF DTF-95-I

Edit your NY DTF DTF-95-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF DTF-95-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF DTF-95-I online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY DTF DTF-95-I. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF DTF-95-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF DTF-95-I

How to fill out NY DTF DTF-95-I

01

Obtain the NY DTF DTF-95-I form from the New York State Department of Taxation and Finance website or local office.

02

Read the form instructions carefully to understand the requirements.

03

Fill in your personal information, including your name, address, and taxpayer identification number.

04

Provide details about your tax type and the specific tax period for which you are filing.

05

Enter the relevant financial information as requested, ensuring to double-check for accuracy.

06

Review all entries for completeness and correctness before submission.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate NY tax authority as instructed.

Who needs NY DTF DTF-95-I?

01

Individuals or businesses whose tax records must be reported to the New York State Department of Taxation and Finance.

02

Taxpayers who have received a notice or request to complete the DTF-95-I from the NY tax department.

03

Those who need to report certain transactions or tax obligations that require this specific form.

Instructions and Help about NY DTF DTF-95-I

Fill

form

: Try Risk Free

People Also Ask about

Where can tax forms be obtained?

Get federal tax forms Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

What form do I need to file NY state tax return?

Form IT-201, Resident Income Tax Return.

Where can I fax DTF 95?

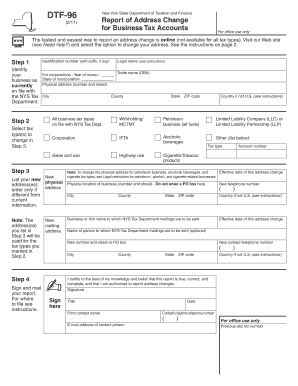

Send your written notification to: NYS Tax Department, Registration and Bond Unit, W A Harriman Campus, Albany NY 12227-2993.

What is a DTF 978 form?

Form DTF-978 — This is a notice to a judgment debtor or obligor, and it means the state intends to levy your assets.

Where can I get NYS tax forms?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY DTF DTF-95-I for eSignature?

When you're ready to share your NY DTF DTF-95-I, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find NY DTF DTF-95-I?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific NY DTF DTF-95-I and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my NY DTF DTF-95-I in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your NY DTF DTF-95-I and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is NY DTF DTF-95-I?

NY DTF DTF-95-I is a form used by the New York State Department of Taxation and Finance to report and reconcile certain tax information.

Who is required to file NY DTF DTF-95-I?

Individuals and entities that have received income that require reporting under New York State tax regulations are required to file NY DTF DTF-95-I.

How to fill out NY DTF DTF-95-I?

To fill out NY DTF DTF-95-I, you should provide accurate income details, relevant tax identification numbers, and any other required information as specified in the form instructions.

What is the purpose of NY DTF DTF-95-I?

The purpose of NY DTF DTF-95-I is to ensure accurate reporting of income and to assist in the reconciliation of tax obligations for individuals and businesses in New York.

What information must be reported on NY DTF DTF-95-I?

The information that must be reported includes the taxpayer's identification, income details, tax withheld, and any other pertinent financial information relevant to the tax year.

Fill out your NY DTF DTF-95-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF DTF-95-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.