Get the free Voluntary Group Life Insurance - calstate

Show details

This document outlines the Voluntary Group Life Insurance plan offered by Standard Insurance Company for employees of The California State University, detailing eligibility, coverage options, application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign voluntary group life insurance

Edit your voluntary group life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary group life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit voluntary group life insurance online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit voluntary group life insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out voluntary group life insurance

How to fill out Voluntary Group Life Insurance

01

Obtain the application form from your employer or insurance provider.

02

Provide your personal information including name, address, and date of birth.

03

Indicate your desired coverage amount based on the options provided.

04

Complete any required health questionnaires honestly.

05

Specify any beneficiaries who will receive the benefits in the event of your passing.

06

Review the terms and conditions of the policy carefully.

07

Sign and date the application form.

08

Submit the completed form to your HR department or the insurance provider.

Who needs Voluntary Group Life Insurance?

01

Employees seeking additional life insurance coverage beyond basic employer-provided options.

02

Individuals who want financial security for their dependents in the event of their death.

03

Those looking to enhance their overall benefits package offered by their employer.

04

Individuals who are in good health and wish to lock in lower premium rates.

Fill

form

: Try Risk Free

People Also Ask about

Should I opt into voluntary life insurance?

You may need voluntary life insurance if your employer's group life insurance isn't enough to cover your beneficiaries' needs and you don't have any other existing policies. For instance, your death benefit may need to be high enough to cover your children's education, mortgage payments and everyday expenses.

Can you take money out of voluntary life insurance?

Second, you can withdraw some of the funds from your cash value, either in a lump sum or in payments. For both of these options, your death benefit will generally be reduced. The last option is to surrender the policy altogether.

How much tax will I pay if I cash out my life insurance?

Do You Have to Pay Taxes When Cashing out a Life Insurance Policy? If you withdraw up to the amount of the total premiums paid into the policy, the transaction is not taxable as it is considered a return of premiums.

What happens to my voluntary life insurance if I quit my job?

If you leave your job (or are terminated) your life insurance may or may not be portable, ie continue to cover you. Even if it is portable, you may need to go through underwriting again, meaning your premium could go up - possibly WAY up - or they could even decline you coverage at all.

Can you cash out voluntary life insurance?

You can typically withdraw up to the amount you've paid into your policy. If you want to withdraw the full amount, you will need to surrender your policy, and you'll no longer have life insurance coverage.

What is voluntary group life insurance?

Voluntary life insurance is a type of employer-provided life insurance that employees can opt into if they choose. 1. In most cases, employees will pay scheduled premiums to keep the plan active. Sometimes, it can come directly from the employee's paycheck.

Can I cancel my voluntary life insurance at any time?

You may cancel life insurance coverage at any time. Be aware that your opportunities to re-enroll are limited.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Voluntary Group Life Insurance?

Voluntary Group Life Insurance is a type of life insurance policy that allows employees to purchase additional life insurance coverage at group rates. It is typically offered by employers as an optional benefit and can be customized according to the needs of the individual.

Who is required to file Voluntary Group Life Insurance?

Generally, it is the responsibility of the employer or the benefits administrator to file and manage the Voluntary Group Life Insurance policy. Employees may need to complete enrollment forms to participate in the program.

How to fill out Voluntary Group Life Insurance?

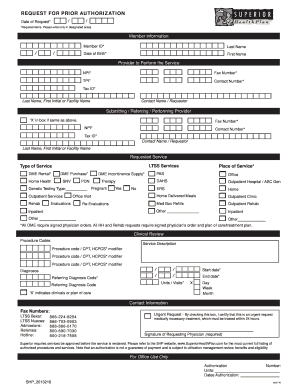

To fill out a Voluntary Group Life Insurance application, employees typically need to provide personal information such as name, address, date of birth, and beneficiary information. They may also need to indicate their desired coverage amount and complete any health questionnaires as required by the insurance provider.

What is the purpose of Voluntary Group Life Insurance?

The purpose of Voluntary Group Life Insurance is to provide employees with an affordable way to obtain additional life insurance coverage, ensuring financial protection for their beneficiaries in the event of their death. It also serves as a valuable employee benefit that can enhance job satisfaction and retention.

What information must be reported on Voluntary Group Life Insurance?

The information that must be reported on Voluntary Group Life Insurance typically includes personal details of the insured employee, such as their name, date of birth, Social Security number, selected coverage amount, and designated beneficiaries, along with any health history if required.

Fill out your voluntary group life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voluntary Group Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.