Get the free 403(b) TAX SHELTERED ANNUITY MAXIMUM CONTRIBUTION WORKSHEET – 2008 TAX YEAR - calstate

Show details

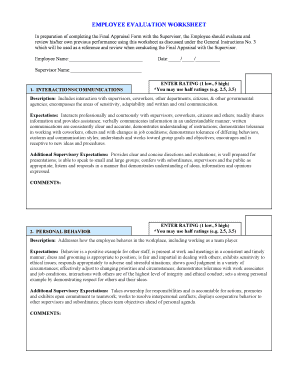

This worksheet is designed to help employees of CSU determine their eligibility and calculate the maximum allowable contributions to their 403(b) retirement accounts, including catch-up provisions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 403b tax sheltered annuity

Edit your 403b tax sheltered annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 403b tax sheltered annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 403b tax sheltered annuity online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 403b tax sheltered annuity. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 403b tax sheltered annuity

How to fill out 403(b) TAX SHELTERED ANNUITY MAXIMUM CONTRIBUTION WORKSHEET – 2008 TAX YEAR

01

Gather your income documents for the tax year 2008.

02

Calculate your total compensation for the 2008 tax year, including all salary, bonuses, and other forms of payment.

03

Identify any prior contributions made to the 403(b) plan in previous years.

04

Refer to the IRS contribution limits for 403(b) plans for the 2008 tax year.

05

Complete Section 1 of the worksheet by entering your total compensation.

06

Complete Section 2 by listing any prior contributions to your 403(b) plan, if applicable.

07

In Section 3, calculate your maximum contribution limit based on your age and employment status.

08

Review the completed worksheet for accuracy and ensure all numbers are entered correctly.

09

Keep a copy of the worksheet for your records and submit it if required by your employer or financial institution.

Who needs 403(b) TAX SHELTERED ANNUITY MAXIMUM CONTRIBUTION WORKSHEET – 2008 TAX YEAR?

01

Employees of public schools and certain nonprofit organizations who participate in a 403(b) retirement plan.

02

Individuals looking to determine their maximum allowable contribution to a 403(b) plan for the 2008 tax year.

03

Financial and tax advisors assisting clients in planning retirement contributions.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum IRA contribution for 2008?

403(b) Plans and Filing Federal Taxes You don't need to report your 403(b) plan contributions separately on your federal tax return. Your employer will report your contributions on your W-2. Because the funds are tax-deferred, your 403(b) plan contributions won't be taxed as part of your federal taxes.

How much can I contribute to my IRA in 2009?

The maximum total annual contribution for all your IRAs (Traditional and Roth) combined is: $7,000 (for tax years 2024 - 2025) if you're under age 50. $8,000 (for tax years 2024 - 2025) if you're age 50 or older.

What is a tax-sheltered annuity 403 B?

A 403(b) plan (tax-sheltered annuity plan or TSA) is a retirement plan similar to a 401(k) plan that lets employees defer some of their salary into individual accounts. You have the flexibility to make traditional before-tax and/or Roth after-tax contributions.

What is the IRS maximum 403b contribution?

Limit on employee elective salary deferrals The limit on elective salary deferrals - the most an employee can contribute to a 403(b) account out of salary - is $23,000 in 2024, ($22,500 in 2023; $20,500 in 2022; $19,500 in 2021 and 2020).

What was the maximum annual contribution amount for an IRA?

You can contribute to a Roth IRA if you have earned income. In 2004 you can contribute up to $3,000 (or the amount of your earned income, whichever is less). In 2005, the amount increases to $4,000.

What was the IRA contribution limit in 2008?

There's still time to make a regular IRA contribution for 2009! You have until your tax return due date (not including extensions) to contribute up to $5,000 for 2009 ($6,000 if you were age 50 by 12/31/09). For most taxpayers, the contribution deadline is April 15.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 403(b) TAX SHELTERED ANNUITY MAXIMUM CONTRIBUTION WORKSHEET – 2008 TAX YEAR?

The 403(b) Tax Sheltered Annuity Maximum Contribution Worksheet for the 2008 tax year is a form used to calculate the maximum amount an individual can contribute to their 403(b) retirement plan. This worksheet helps taxpayers determine their contribution limits based on their salary and other factors.

Who is required to file 403(b) TAX SHELTERED ANNUITY MAXIMUM CONTRIBUTION WORKSHEET – 2008 TAX YEAR?

Individuals who participate in a 403(b) plan and want to determine their maximum allowable contributions for the 2008 tax year are required to file this worksheet. This includes employees of public schools, certain tax-exempt organizations, and ministers.

How to fill out 403(b) TAX SHELTERED ANNUITY MAXIMUM CONTRIBUTION WORKSHEET – 2008 TAX YEAR?

To fill out the 403(b) Tax Sheltered Annuity Maximum Contribution Worksheet, individuals must start by entering their total annual salary, then follow the steps to account for any other eligible contributions, including any catch-up contributions if they meet the criteria. Specific instructions will guide users through calculating the maximum contribution limit.

What is the purpose of 403(b) TAX SHELTERED ANNUITY MAXIMUM CONTRIBUTION WORKSHEET – 2008 TAX YEAR?

The purpose of the 403(b) Tax Sheltered Annuity Maximum Contribution Worksheet is to help taxpayers accurately determine the maximum contribution limits for their 403(b) retirement accounts. This ensures compliance with IRS rules and facilitates retirement savings within legal parameters.

What information must be reported on 403(b) TAX SHELTERED ANNUITY MAXIMUM CONTRIBUTION WORKSHEET – 2008 TAX YEAR?

The information that must be reported on the 403(b) Tax Sheltered Annuity Maximum Contribution Worksheet includes the participant's annual salary, any pre-tax contributions made, catch-up contributions claimed, and other factors that affect contribution limits as per IRS regulations.

Fill out your 403b tax sheltered annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

403b Tax Sheltered Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.