Get the free SUPPLEMENTARY PRODUCT DISCLOSURE STATEMENT

Show details

This document supplements the Product Disclosure Statement (PDS) for the ANZ Loan Protection insurance, outlining changes such as an extended cooling-off period and privacy updates.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplementary product disclosure statement

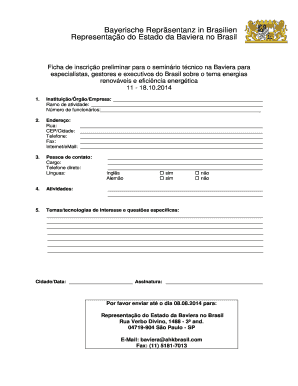

Edit your supplementary product disclosure statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplementary product disclosure statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

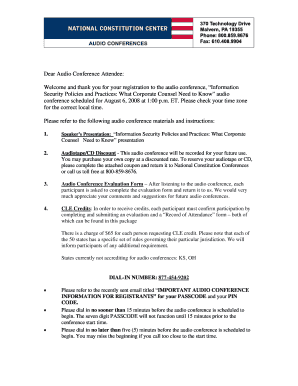

Editing supplementary product disclosure statement online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit supplementary product disclosure statement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

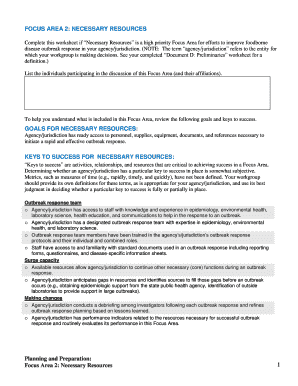

How to fill out supplementary product disclosure statement

How to fill out SUPPLEMENTARY PRODUCT DISCLOSURE STATEMENT

01

Read the guidelines for the SUPPLEMENTARY PRODUCT DISCLOSURE STATEMENT (SPDS).

02

Gather all necessary information related to the primary product disclosure document.

03

Fill out the SPDS with clear and concise descriptions of any additional relevant information.

04

Ensure you include any changes that have occurred since the last product disclosure.

05

Double-check all entries for accuracy and completeness.

06

Submit the SPDS along with the primary product disclosure to the relevant authority or stakeholders.

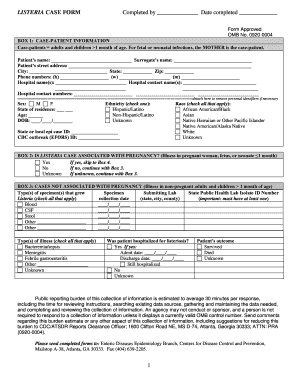

Who needs SUPPLEMENTARY PRODUCT DISCLOSURE STATEMENT?

01

Consumers who are considering purchasing a financial product.

02

Financial advisors who provide guidance on investments.

03

Regulators who oversee compliance and transparency in financial services.

04

Companies that offer financial products and need to inform clients about changes or additional details.

Fill

form

: Try Risk Free

People Also Ask about

What needs to be included in a PDS?

All PDS documents include information about the issuer, benefits, risks, costs, return, dispute resolution and cooling off period for the financial product. The requirement to provide a PDS is contained in Part 7.9 of the Corporations Act 2001 (Cth) (CA 2001).

What are the elements of PDS?

Elements of a PDS should include (but may not be limited to) Performance – Gain, input impedance, S/N ratio – Measurable, Often conflict between different performance specifications. Environment – Temperature, pressure, noise level during mfg, storage, use. Service Life – What is the service life of the product?

What is included in a PDS?

A document that financial service providers must provide to you when they recommend or offer a financial product. It must include information about the product's key features, fees, commissions, benefits, risks and the complaints handling procedure.

How to write a product disclosure statement?

It must include information about the product's key features, fees, commissions, benefits, risks and the complaints handling procedure.

What should be included in a design specification?

A design specification could, for example, include required dimensions, environmental factors, ergonomic factors, aesthetic factors, maintenance requirement, etc. It may also give specific examples of how the design should be executed, helping others work properly (a guideline for what the person should do).

What is a PDS statement?

A Product Disclosure Statement (PDS) is an important legal document that contains all the information regarding your policy. Your PDS includes information regarding your policies key features, covers, exclusions, claims information and our complaints handling procedures.

What is required in a PDS?

All PDS documents include information about the issuer, benefits, risks, costs, return, dispute resolution and cooling off period for the financial product.

What is a supplementary product disclosure statement?

A Supplementary Product Disclosure Statement is a document by which a person who has prepared a Product Disclosure Statement (the PDS ) can: (a) correct a misleading or deceptive statement in the PDS; or. (b) correct an omission from the PDS of information it is required to contain; or.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SUPPLEMENTARY PRODUCT DISCLOSURE STATEMENT?

A Supplementary Product Disclosure Statement (SPDS) is an additional document that provides extra information about a financial product that may not have been included in the primary Product Disclosure Statement (PDS). It is intended to ensure that consumers have access to important information that can affect their decision-making.

Who is required to file SUPPLEMENTARY PRODUCT DISCLOSURE STATEMENT?

Organizations that offer financial products, such as managed investment schemes, insurance products, or other investment opportunities, are required to file a Supplementary Product Disclosure Statement if there are significant changes to the product or the information previously provided that could affect investors.

How to fill out SUPPLEMENTARY PRODUCT DISCLOSURE STATEMENT?

To fill out a Supplementary Product Disclosure Statement, you should include details about the changes or new information regarding the financial product. This includes a clear description of the changes, any associated risks, and how these changes affect the cost or features of the product. It's important to format the document in a way that is consistent with the original PDS.

What is the purpose of SUPPLEMENTARY PRODUCT DISCLOSURE STATEMENT?

The purpose of a Supplementary Product Disclosure Statement is to provide additional, relevant information to consumers regarding their investment choices, ensuring they are fully informed and able to make decisions based on the most current information available.

What information must be reported on SUPPLEMENTARY PRODUCT DISCLOSURE STATEMENT?

The information reported on a Supplementary Product Disclosure Statement must include any significant changes to the product, new fees or charges, updated risks, and alterations to benefits or features of the financial product. Additionally, it should address how these changes impact existing and potential investors.

Fill out your supplementary product disclosure statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplementary Product Disclosure Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.