Get the free Report on Net Open Foreign Exchange Position - bank

Show details

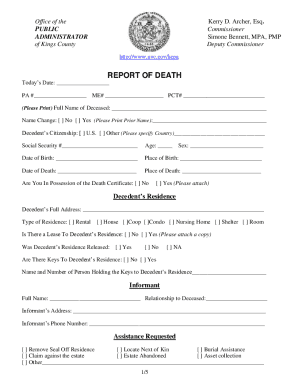

This document is a report that credit institutions must submit to the Bank of Latvia, detailing their net open foreign exchange positions over a specified reporting period.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report on net open

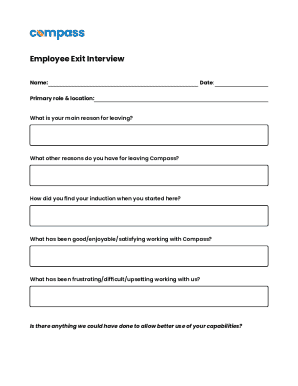

Edit your report on net open form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report on net open form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing report on net open online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit report on net open. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

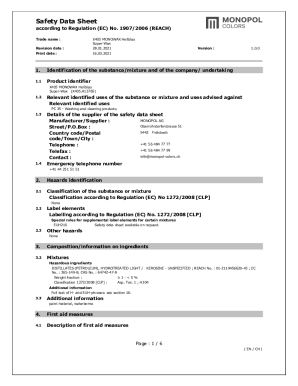

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out report on net open

How to fill out Report on Net Open Foreign Exchange Position

01

Gather all relevant data on your foreign exchange transactions.

02

Calculate your total assets in foreign currencies.

03

Determine your total liabilities in foreign currencies.

04

Compute net open positions by subtracting total liabilities from total assets for each currency.

05

Add up net open positions across all currencies to find the overall net open position.

06

Report the figures in the required format, ensuring accuracy in amounts and currency codes.

07

Review your calculations for completeness and compliance with applicable regulations.

08

Submit the report to the designated authority by the deadline.

Who needs Report on Net Open Foreign Exchange Position?

01

Financial institutions and banks that trade in foreign currencies.

02

Regulatory bodies monitoring currency exposure and risk levels.

03

Companies with international operations or transactions involving foreign currencies.

04

Investors and stakeholders assessing the foreign exchange risk of an entity.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between net position and open position?

Position Limits Currency PairPosition limits USD-INR Gross open position across all contracts shall not exceed 15% of the total open interest or USD 50 million, whichever is higher. EUR-INR Gross open position across all contracts shall not exceed 15% of the total open interest or EUR 25 million, whichever is higher.5 more rows

What is net open position in foreign exchange?

NOP represents the difference between a bank's foreign exchange (FX) assets and liabilities. It reflects the bank's risk exposure to currency movements. Net Open Position (NOP) refers to the difference between a company's foreign currency assets and its foreign currency liabilities.

What is foreign currency open position?

“Open foreign currency position” means an excess of assets (including off-balance sheet forward purchase contracts) over liabilities (including off-balance sheet forward sales contracts) (a “long position”) held by a financial institution denominated a foreign currency, or an excess of liabilities (including off-

What is the FX structural position?

Definition of Structural FX. Positions of a structural nature are investments in a subsidiary with a reporting currency different from that of the parent (also referred to as Type A), or positions that are related to the cross-border nature of the institution that are stable over time (Type B).

What is the net open position of foreign exchange?

NOP represents the difference between a bank's foreign exchange (FX) assets and liabilities. It reflects the bank's risk exposure to currency movements. Net Open Position (NOP) refers to the difference between a company's foreign currency assets and its foreign currency liabilities.

What is an open position in foreign currency?

Net position can either refer to the total value of all open positions, or the balance of long positions and short positions. In trading, this can mean the difference in value of all open trades in profit and all open trades running a loss, resulting in a net positive or net negative position.

How do you calculate net open position in forex?

0:31 5:14 Rate. The net open position is then calculated by adding the sum of the net short positions. Or theMoreRate. The net open position is then calculated by adding the sum of the net short positions. Or the sum of the net long positions whichever is greater plus the absolute value of the gold. Position.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Report on Net Open Foreign Exchange Position?

The Report on Net Open Foreign Exchange Position is a regulatory document that financial institutions prepare to disclose their net exposure to foreign exchange risks. It measures the difference between the assets and liabilities that are denominated in foreign currencies.

Who is required to file Report on Net Open Foreign Exchange Position?

Financial institutions, including banks and other entities involved in foreign exchange trading, are typically required to file the Report on Net Open Foreign Exchange Position as part of their compliance with regulatory requirements set by monetary authorities.

How to fill out Report on Net Open Foreign Exchange Position?

To fill out the Report on Net Open Foreign Exchange Position, institutions must calculate their total open foreign currency assets and liabilities, determine net positions for each currency, and complete the standardized form provided by the regulatory authority, ensuring accuracy in reporting values.

What is the purpose of Report on Net Open Foreign Exchange Position?

The purpose of the Report on Net Open Foreign Exchange Position is to monitor and mitigate risks associated with foreign exchange fluctuations, promote financial stability, and ensure that institutions maintain adequate capital against potential losses from currency exposure.

What information must be reported on Report on Net Open Foreign Exchange Position?

Institutions must report details such as the amount of assets and liabilities in different foreign currencies, the net open position for each currency, and any other relevant metrics required by regulators, often including historical data for analysis.

Fill out your report on net open online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report On Net Open is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.