Get the free RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP)

Show details

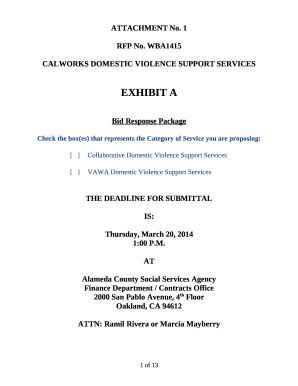

This document serves to withdraw funds from a Registered Education Savings Plan (RESP) for capital withdrawal or as an Education Assistance Payment (EAP) for educational expenses. It requires subscriber

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign resp withdrawal capital withdrawal

Edit your resp withdrawal capital withdrawal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your resp withdrawal capital withdrawal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing resp withdrawal capital withdrawal online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit resp withdrawal capital withdrawal. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out resp withdrawal capital withdrawal

How to fill out RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP)

01

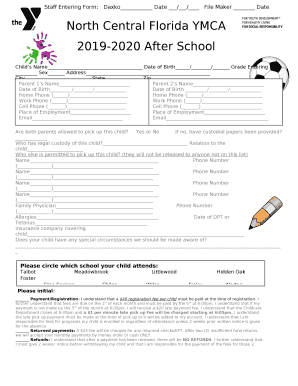

Gather necessary documents including the RESP account details and identification.

02

Determine the amount you wish to withdraw as capital or EAP.

03

Fill out the RESP Withdrawal Request Form, indicating whether the withdrawal is for Capital or EAP.

04

If withdrawing EAP, ensure you have proof of enrollment in a qualifying educational program.

05

Submit the completed withdrawal form and any required documentation to the RESP provider.

06

Wait for the processing of your request, which may take several business days.

07

Receive the funds directly into your bank account or as a cheque, depending on the provider's options.

Who needs RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP)?

01

Beneficiaries of an RESP who are planning to pursue post-secondary education.

02

Students who need financial support for educational expenses.

03

Planholders who want to withdraw capital or EAP for educational purposes.

Fill

form

: Try Risk Free

People Also Ask about

Can RESP be used in the USA?

If you're wondering, “Can I use RESP to study abroad?” or “Can RESP be used for US schools with different start dates?” — the answer is yes, but with planning. The Canadian RESP provider may require proof of enrollment aligned with specific dates to approve Educational Assistance Payments (EAPs).

Where to report RRSP on US tax return?

Form 8938 and RRSP (FATCA) Form 8938 aka FATCA (Foreign Account Tax Compliance Act) is similar to the FBAR and requires US taxpayers who have ownership of foreign pension plans such as an RRSP to report the information to the IRS directly on Form 8938.

What happens to RESP if I move to the USA?

Scenario Three: RESP Beneficiary Moves to the USA The beneficiary must be a Canadian resident to receive RESP grants. If not, while they can still use the RESP for education, the grants must be returned to the government.

What is the maximum EAP withdrawal for RESP?

Understand how much you can withdraw In your child's first 13 weeks of post-secondary school, you can withdraw a maximum of $8,000 in EAP money. After that, there's no restriction on how much you can withdraw. What to do: The EAP is taxable in the hands of the student.

Are RESP withdrawals taxable in the US?

Any income earned within the RESP must be reported on the taxpayer's income tax return. Earnings and grants, such as the Canada Education Savings Grant (CESG), are treated as ordinary income. These are included in gross income and reported on Form 1040, impacting the individual's taxable income for the year.

Does IRS recognize TFSA?

Since the IRS does not recognize the TFSA as tax-exempt, U.S. residents must report and pay taxes on any income generated within the account.

How do I claim RESP withdrawal?

Here's a step-by-step guide to making an RRSP withdrawal: First, determine if your RRSP is locked-in. Decide on how much you need to withdraw. Understand the tax implications. Contact the financial institution holding your RRSP to request the withdrawal. Remember to report the withdrawal as income on your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP)?

The RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP) refers to the process of withdrawing funds from a Registered Education Savings Plan (RESP) to cover educational expenses. Capital Withdrawal allows the subscriber to take out the contributions they made, while an Education Assistance Payment is the portion of funds representing government grants and investment earnings allocated for the beneficiary's education.

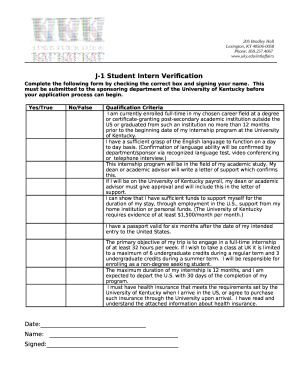

Who is required to file RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP)?

The subscriber of the RESP is responsible for filing the RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP). This is typically the person who opened the RESP, and they must initiate the withdrawal when the beneficiary is ready to pursue post-secondary education.

How to fill out RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP)?

To fill out the RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP), the subscriber must complete the required forms provided by the financial institution managing the RESP. This typically includes providing details about the beneficiary, the amount to be withdrawn, and specifying whether the withdrawal is for capital or as an EAP.

What is the purpose of RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP)?

The purpose of RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP) is to provide financial support to beneficiaries for their education-related expenses. Capital Withdrawal allows the subscriber to reclaim their contributions, while EAPs provide access to government grants and accumulated earnings to help pay for tuition, books, and living costs during the beneficiary's education.

What information must be reported on RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP)?

When reporting an RESP Withdrawal: Capital Withdrawal / Education Assistance Payment (EAP), the following information must be included: the subscriber's name and contact details, the beneficiary's name and Social Insurance Number, the dates of withdrawal, the amounts being withdrawn, and whether the withdrawal is classified as capital or an EAP.

Fill out your resp withdrawal capital withdrawal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Resp Withdrawal Capital Withdrawal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.