Get the free Details of Applicants/Guarantors/Directors/Partners for Business Lending

Show details

This document collects personal and financial information from applicants, guarantors, directors, and partners for the purpose of applying for business loans, including asset and liability details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign details of applicantsguarantorsdirectorspartners for

Edit your details of applicantsguarantorsdirectorspartners for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your details of applicantsguarantorsdirectorspartners for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

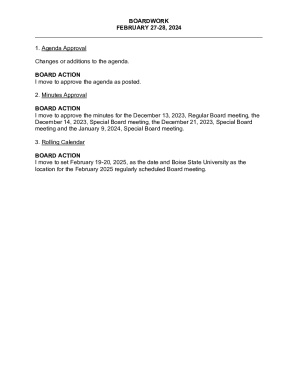

Editing details of applicantsguarantorsdirectorspartners for online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit details of applicantsguarantorsdirectorspartners for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

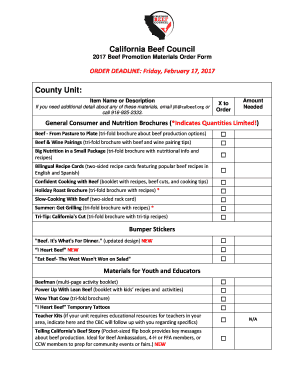

How to fill out details of applicantsguarantorsdirectorspartners for

How to fill out Details of Applicants/Guarantors/Directors/Partners for Business Lending

01

Gather personal identification documents for each applicant, guarantor, director, or partner, such as passports or driver’s licenses.

02

Collect business information, including the legal name, registration number, and address of the company.

03

Provide details on financial history, including current debts, assets, and annual income.

04

List the roles and responsibilities of each individual in the business, clarifying their relationship to the company.

05

Include any relevant credit history or past business dealings to establish trustworthiness.

06

Ensure all information is accurate and up to date before submission.

Who needs Details of Applicants/Guarantors/Directors/Partners for Business Lending?

01

Financial institutions offering business loans or financing.

02

Lenders and investors evaluating the credibility of a business.

03

Compliance and risk management teams assessing potential risks.

04

Business owners seeking to secure funding for growth or operations.

Fill

form

: Try Risk Free

People Also Ask about

Who can be a guarantor on a business loan?

Simply put, a personal guarantee is your promise to repay a business loan if your business is ever unable to do so. Typically, personal guarantors are business owners. However, key employees and non-owners can be required to give personal guarantees if the business wouldn't be functional or operational without them.

Who is eligible for loan guarantor?

Consider the creditworthiness of the borrower. Even if the borrower is your close friend or relative, you may still have to check their creditworthiness before appearing as a guarantor. If the borrower is capable enough to repay the loan, you may go ahead and be the guarantor.

Can you personally guarantee a loan for an LLC?

While forming an LLC protects you legally, it doesn't shield you from needing to personally guarantee a loan, especially as a brand-new business with no operating history or revenue. Most lenders will still evaluate your personal credit, income, and financials for approval.

What type of person can be a guarantor?

However, you should only be a guarantor for someone you trust and are willing and able to cover the repayments for. To be a guarantor you'll need to be over 21 years old, with a good credit history and financial stability. If you're a homeowner, this will add credibility to the application.

Who is the criteria for a guarantor on a loan?

The guarantor must be over the age of 21 and under 75 years old. As a guarantor, you also need to have a reasonably good credit history. You will need to show that you have an income or savings and the ability to repay debt if the borrower can't.

How to fill out a loan application to get approved?

Being a guarantor is not a mere formality to help the borrower, the guarantor is equally responsible for paying off the loan. Requirement of a Loan Guarantor by Bank. Loan Guarantor is not a Co-Borrower. Credit Score is considered for Loan Guarantor. Legal Action if Guarantor Refuses to Pay.

What are the rules for loan guarantors?

If you plan to apply for a loan in the next few months, consider refraining from applying for new credit. Pay attention to debt: Make payments on time every month. Try to pay off your debt before applying for a loan. Prepare your documents: Find out what proofs of income and assets you'll need to apply for a loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Details of Applicants/Guarantors/Directors/Partners for Business Lending?

Details of Applicants/Guarantors/Directors/Partners for Business Lending refers to the comprehensive information required about individuals who are involved with a business seeking a loan. This includes their personal and professional details to assess their suitability and creditworthiness.

Who is required to file Details of Applicants/Guarantors/Directors/Partners for Business Lending?

Businesses applying for a loan must file the details of all applicants, guarantors, directors, and partners who have a significant role in the business. This often includes owners and key decision-makers.

How to fill out Details of Applicants/Guarantors/Directors/Partners for Business Lending?

To fill out the details, provide accurate and complete information for each individual, including their name, position, contact information, financial background, and relevant identification. Use the designated forms provided by the lending institution and follow their specific instructions.

What is the purpose of Details of Applicants/Guarantors/Directors/Partners for Business Lending?

The purpose is to evaluate the creditworthiness and risk associated with the loan application by understanding the background, experience, and financial status of those responsible for the business.

What information must be reported on Details of Applicants/Guarantors/Directors/Partners for Business Lending?

The information that must be reported typically includes full names, dates of birth, addresses, occupation, financial statements, tax identification numbers, and information on any previous bankruptcies or credit issues.

Fill out your details of applicantsguarantorsdirectorspartners for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Details Of Applicantsguarantorsdirectorspartners For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.