Get the free Direct Debit Request Service Agreement

Show details

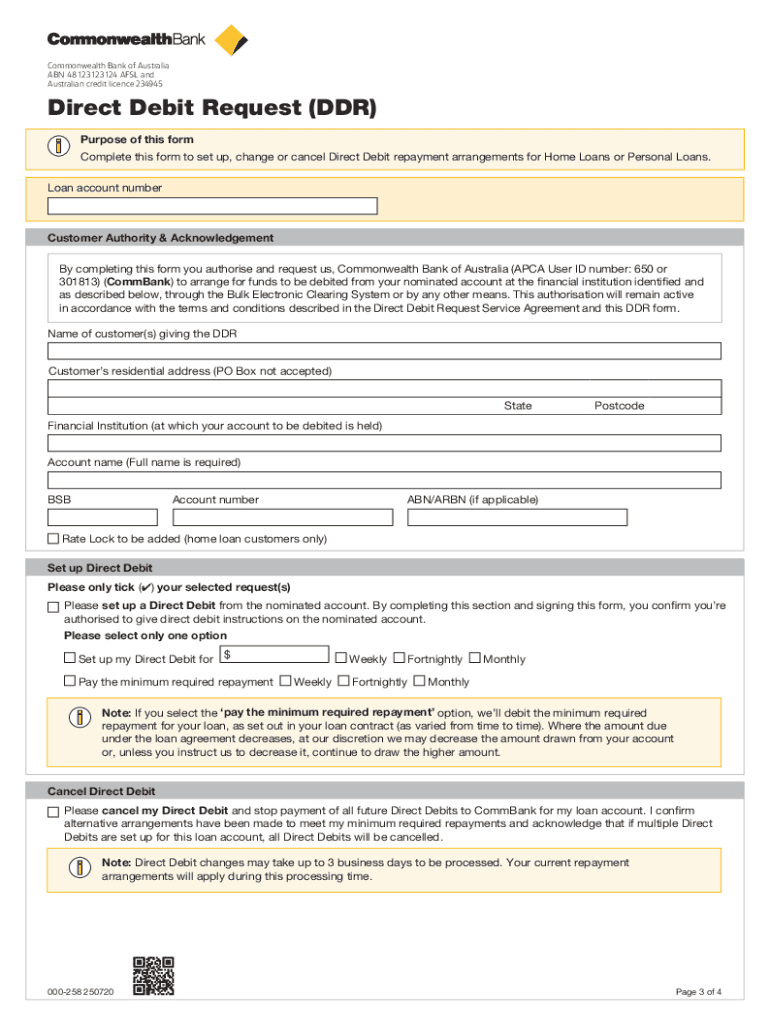

This document outlines the Direct Debit arrangement between Commonwealth Bank of Australia and the user for loan repayments, including details about rights, obligations, and procedures regarding changes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct debit request service

Edit your direct debit request service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct debit request service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing direct debit request service online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit direct debit request service. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct debit request service

How to fill out Direct Debit Request Service Agreement

01

Start by obtaining the Direct Debit Request Service Agreement form from your service provider.

02

Fill in your personal details, such as your name and address.

03

Provide your bank account details, including the account name, BSB number, and account number.

04

Specify the amount to be debited and the frequency of the debits (weekly, monthly, etc.).

05

Review the terms and conditions mentioned in the agreement.

06

Sign and date the form to authorize the direct debit.

07

Submit the completed form to your service provider.

Who needs Direct Debit Request Service Agreement?

01

Individuals or businesses that wish to set up recurring payments for services or bills.

02

Customers of service providers that offer direct debit as a payment option.

03

Anyone looking for a convenient way to manage regular payments.

Fill

form

: Try Risk Free

People Also Ask about

What is a Direct Debit authorization?

eDDA refers to electronic Direct Debit Authorisation. It allows the payee to collect funds directly from the payer. Payers can initiate an eDDA instruction to the designated payee with maximum amount, date range and frequency of the payment. The instruction will be effective immediately after the setup*.

How do I authorize my debit card?

You send an authorization request to the debit or credit card issuer (cardholder's bank). The issuer approves the transaction and puts a hold on the cardholder's account. When you are ready, you submit the transaction for settlement. The issuer replaces the temporary hold with a debit to the cardholder's account.

How do I enable Direct Debit?

You'll need to contact the company you want to pay and they'll arrange for you to complete a Direct Debit instruction. They'll want to know a little about you, such as your name, address and bank details. The company will then let us know and begin to collect your payments on the dates you've agreed.

Do you need to authorise a Direct Debit?

Authorisation Process A fundamental aspect of Direct Debit law is the requirement for clear and detailed customer consent before initiating Direct Debits. This involves obtaining a Direct Debit Instruction (DDI) from the customer, which specifies the frequency, amount, and purpose of the payments.

How do I authorize a Direct Debit?

To do this, you'll need to arrange a direct debit authority and give the merchant or service provider your card number, expiry date, and 3-digit CVV number on the back of your card. This allows the merchant or service provider to charge your debit or credit card.

Does a Direct Debit mandate need to be signed?

Advance notice clause: This requires businesses to provide advance notice (usually 10 working days) before they make any changes to the direct debit amount, frequency, or collection date. Signature: Paper-based mandates require the customer's signature and the date of signing.

How do I request a Direct Debit from a customer?

Invite your customers to make the first payment instantly from their bank - When presenting payment options on your checkout, invite customers to make the first payment instantly with Instant Bank Pay and request they set up a Direct Debit mandate for future payments at the same time.

What are the legal requirements for a Direct Debit?

Before initiating a direct debit, businesses must obtain explicit consent from the account holder. The authorisation process must be clear, unambiguous, and include detailed information about the frequency, amount, and purpose of the payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Direct Debit Request Service Agreement?

A Direct Debit Request Service Agreement is a formal agreement between a customer and a service provider that authorizes the service provider to debit amounts from the customer's bank account for recurring payments.

Who is required to file Direct Debit Request Service Agreement?

Any service provider who intends to collect payments via direct debit from their customers is required to file a Direct Debit Request Service Agreement.

How to fill out Direct Debit Request Service Agreement?

To fill out a Direct Debit Request Service Agreement, provide the customer's bank account details, specify the payment frequency, the amount to be debited, and obtain the customer's signature for authorization.

What is the purpose of Direct Debit Request Service Agreement?

The purpose of a Direct Debit Request Service Agreement is to provide a clear, legal framework for processing direct debit transactions, ensuring both the customer and service provider understand the terms of the payment arrangement.

What information must be reported on Direct Debit Request Service Agreement?

The information that must be reported includes the customer's bank account details, the frequency and amount of payments, terms and conditions of the arrangement, and the customer's authorization.

Fill out your direct debit request service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Debit Request Service is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.