NY CHAR014 2010 free printable template

Show details

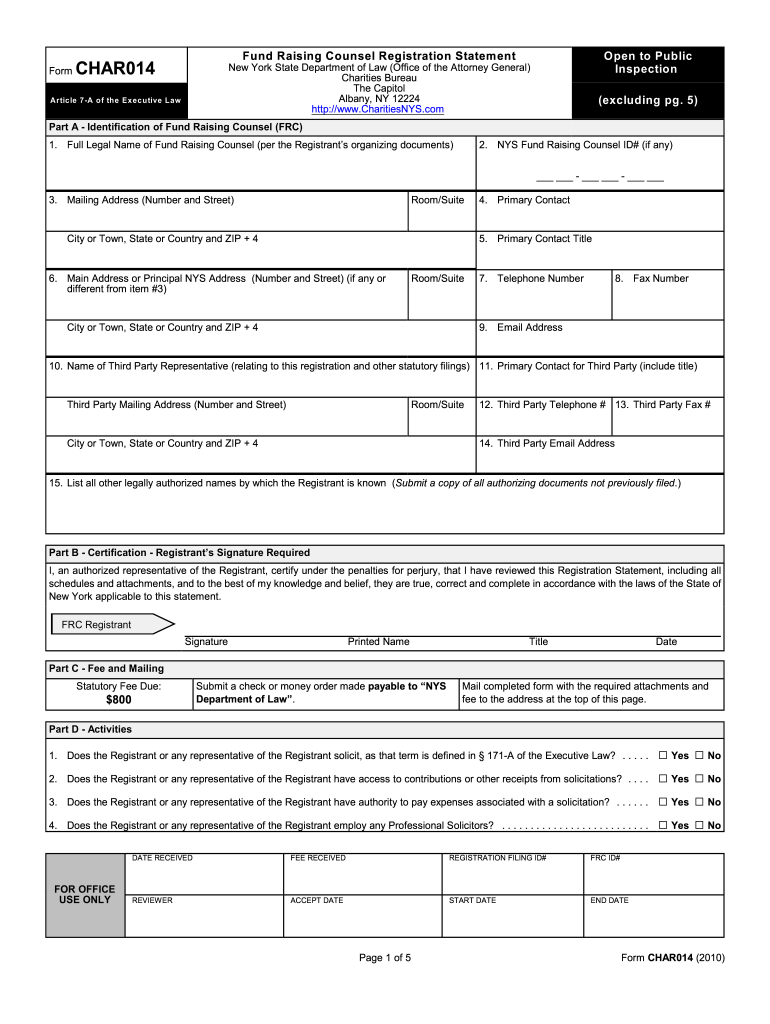

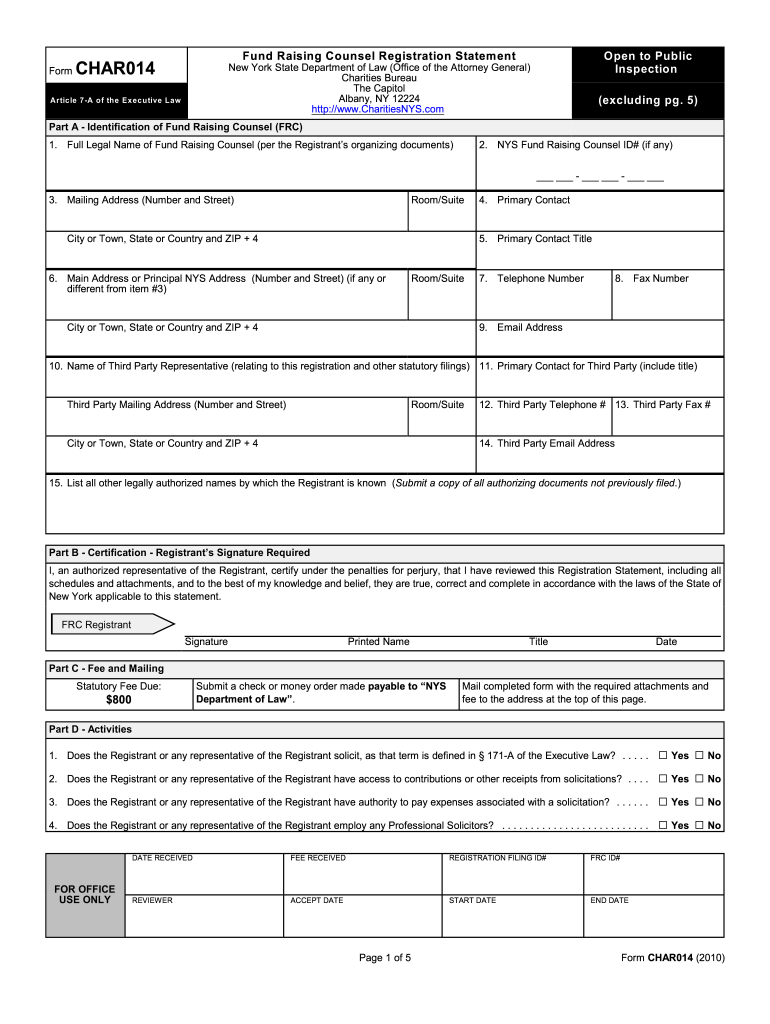

Form Fund Raising Counsel Registration Statement CHAR014 Open to Public Inspection New York State Department of Law Office of the Attorney General Charities Bureau The Capitol Albany NY 12224 http //www. Changes to Registration to the information provided on Form CHAR014. Mailing Instructions All registration documents and payment should be mailed to the following address VIII. Additional Charities Bureau Contact Information Telephone 518 486-9797 E-mail Charities. Fundraising ag. ny. gov -i-...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY CHAR014

Edit your NY CHAR014 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY CHAR014 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY CHAR014 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY CHAR014. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY CHAR014 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY CHAR014

How to fill out NY CHAR014

01

Obtain the NY CHAR014 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Security Number (SSN) or Employer Identification Number (EIN).

03

Specify the tax year for which you are filing.

04

Complete the appropriate sections related to your income, deductions, and credits.

05

Double-check all provided information for accuracy.

06

Sign and date the form at the bottom.

07

Submit the completed form electronically or mail it to the designated address provided in the instructions.

Who needs NY CHAR014?

01

Individuals or businesses in New York State that are required to report their income and taxes.

02

Taxpayers who are claiming certain credits or deductions specific to New York State taxes.

03

Anyone who needs to provide information regarding their tax status to the New York State Department of Taxation and Finance.

Fill

form

: Try Risk Free

People Also Ask about

Are charity and non profit the same?

There are many kinds of nonprofits, and charities are only one type of nonprofit. Generally, if the nonprofit earns a substantial part of its income via public solicitation, it will be defined by the IRS as a public charity.

What is a registered charity?

A charity that is registered with the Charity Commission (Commission).

How many unregistered charities are there in the UK?

UK Charity Numbers - By Type and Country Location/TypeNumberUnregistered charities100,000Scotland45,000Northern Ireland10,000Estimated Total412,3953 more rows

What are the benefits of being a registered charity?

Charities do not generally have to pay income/corporation tax (in the case of some types of income), capital gains tax, or stamp duty. Furthermore, gifts to charities are usually free of inheritance tax.

Do charities have to register in Arizona?

Registration requirements Arizona has no charitable solicitation laws and does not require nonprofits to register with a state agency before soliciting contributions in the state. Out-of-state nonprofit corporations, however, may have to register to do business in the state.

Is there a difference between a non profit and a charity?

While these terms are sometimes used interchangeably, they have different meanings under U.S. tax law. Generally, nonprofit status is a concept of state corporate law, and charity status — or what is charitable — is a concept of federal tax law.

Does a charity have to be registered UK?

Usually, you must register with the Charity Commission if your charity is based in England or Wales and has over £5,000 income per year. The commission will take action to secure compliance if it identifies a charity which isn't registered but should be.

Do you have to register a charity UK?

Usually, you must register with the Charity Commission if your charity is based in England or Wales and has over £5,000 income per year. The commission will take action to secure compliance if it identifies a charity which isn't registered but should be.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY CHAR014 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your NY CHAR014 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit NY CHAR014 in Chrome?

Install the pdfFiller Google Chrome Extension to edit NY CHAR014 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I complete NY CHAR014 on an Android device?

Use the pdfFiller Android app to finish your NY CHAR014 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is NY CHAR014?

NY CHAR014 is a form used by charitable organizations in New York State to report their financial information to the Attorney General's office.

Who is required to file NY CHAR014?

Organizations that are registered as charitable entities in New York State and are subject to the oversight of the New York Attorney General are required to file NY CHAR014.

How to fill out NY CHAR014?

To fill out NY CHAR014, organizations must provide detailed financial information, including income, expenses, and details about their programs and activities for the reporting period.

What is the purpose of NY CHAR014?

The purpose of NY CHAR014 is to promote transparency and accountability among charitable organizations, ensuring they are compliant with state regulations and effectively serving their mission.

What information must be reported on NY CHAR014?

NY CHAR014 requires organizations to report information such as total revenue, expenses, assets, liabilities, and details about fundraising activities and program services.

Fill out your NY CHAR014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY char014 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.