Get the free APPLICATION FOR SELF-SERVICE BANKING SERVICES (INDIVIDUAL)

Show details

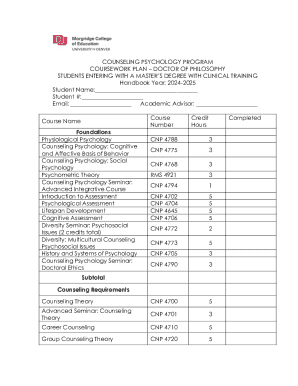

This document is an application form for individuals seeking to apply for ATM, Internet, and Phone Banking services with DBS Bank. It includes options for linking accounts, setting transaction limits,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for self-service banking

Edit your application for self-service banking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for self-service banking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for self-service banking online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for self-service banking. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for self-service banking

How to fill out APPLICATION FOR SELF-SERVICE BANKING SERVICES (INDIVIDUAL)

01

Obtain the APPLICATION FOR SELF-SERVICE BANKING SERVICES (INDIVIDUAL) form from your bank's website or branch.

02

Fill in your personal information at the top of the form, including your full name, address, phone number, and email.

03

Provide your identification details, such as your Social Security Number or other government-issued ID number.

04

Indicate the specific self-service banking services you wish to apply for, such as online banking, mobile banking, and ATM services.

05

Review the terms and conditions associated with the self-service banking services and confirm your understanding and acceptance.

06

Sign and date the application form at the designated section.

07

Submit the completed application form either in person at your bank's branch or through an online submission method if available.

Who needs APPLICATION FOR SELF-SERVICE BANKING SERVICES (INDIVIDUAL)?

01

Individuals who wish to manage their banking transactions conveniently without needing to visit a bank branch.

02

Customers requiring 24/7 access to their bank accounts for activities such as checking balances, transferring funds, and paying bills.

03

People who prefer electronic banking services for efficiency and ease of use.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of self banking?

Self-service banking, often referred to as "digital banking" or "online banking," includes various electronic and online tools. These tools allow you to access your bank account, perform financial transactions, and manage your finances using your computer, smartphone, tablet, or ATMs.

What is self-service banking?

Self-service banking, often referred to as "digital banking" or "online banking," includes various electronic and online tools. These tools allow you to access your bank account, perform financial transactions, and manage your finances using your computer, smartphone, tablet, or ATMs.

What is personal banking service?

Personal Banking comprises products and services offered by banks. It is also known as retail banking. Personal Banking includes essential products like Savings Account, Current Account, and Debit Cards. Financial assistance products like Credit Card and Loans are included under Personal Banking.

Does self help your credit score?

Payment history makes up 35% of your credit score. Self can help. By opening a Credit Builder Account and making your monthly payments on time, you can build positive payment history.

How does self-banking work?

What is Family Banking? At its core, Family Banking (also known as “infinite banking” or “self-banking”) is a strategy where you use the cash value of a whole life insurance policy to finance major purchases, investments, or other needs — without relying on traditional banks or lenders.

What is self banking?

Self-service banking is a service where customers can conduct financial transactions and activities using devices and channels without going into a branch.

How much is self per month?

Self Credit Builder Alternatives CompanyInterest and FeesMonthly Payments Self 15.51% to 15.92% APR $25 to $150 monthly Fizz Debit Card No Fees or Interest N/A CreditStrong $15 setup fee and 15.51% - 15.73% APR $24-$48 monthly MoneyLion $19.99 monthly subscription fee and 5.99% - 29.99% APR $83.33 monthly2 more rows • Jan 27, 2025

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR SELF-SERVICE BANKING SERVICES (INDIVIDUAL)?

It is a formal request submitted by an individual to access and utilize self-service banking facilities offered by a financial institution.

Who is required to file APPLICATION FOR SELF-SERVICE BANKING SERVICES (INDIVIDUAL)?

Any individual who wishes to use self-service banking services, such as ATM access, online banking, or mobile banking, must file this application.

How to fill out APPLICATION FOR SELF-SERVICE BANKING SERVICES (INDIVIDUAL)?

To fill out the application, provide personal identification details, contact information, and any required documentation as specified by the bank. Ensure all information is accurate and complete.

What is the purpose of APPLICATION FOR SELF-SERVICE BANKING SERVICES (INDIVIDUAL)?

The purpose is to enable individuals to request access to convenient banking services that allow them to manage their finances independently.

What information must be reported on APPLICATION FOR SELF-SERVICE BANKING SERVICES (INDIVIDUAL)?

The application typically requires personal details such as name, address, date of birth, identification number, and contact details, along with consent for data processing.

Fill out your application for self-service banking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Self-Service Banking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.