Get the free SPECIAL TERMS FOR CHECKING ACCOUNTS

Show details

This document outlines the special terms and conditions regarding checking accounts, including handling of dishonored checks, definitions related to transactions, and procedures for account management.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign special terms for checking

Edit your special terms for checking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your special terms for checking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

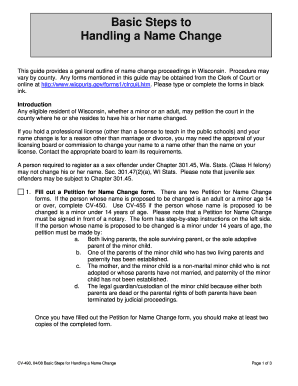

How to edit special terms for checking online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit special terms for checking. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out special terms for checking

How to fill out SPECIAL TERMS FOR CHECKING ACCOUNTS

01

Obtain the SPECIAL TERMS FOR CHECKING ACCOUNTS form from your bank or financial institution.

02

Carefully read the introductory sections that explain the terms and conditions.

03

Fill out your personal information such as name, address, and account number in the designated fields.

04

Review the specific terms regarding fees, transactions, and account management.

05

Sign and date the form to verify your acknowledgment and agreement to the terms.

Who needs SPECIAL TERMS FOR CHECKING ACCOUNTS?

01

Anyone who is opening a new checking account at a bank or credit union.

02

Existing account holders who wish to understand the updated terms and conditions of their checking account.

03

Customers looking for clarity on fees and service charges related to their checking account.

Fill

form

: Try Risk Free

People Also Ask about

What is a synonym for checking account?

Definitions of checking account. noun. a bank account against which the depositor can draw checks that are payable on demand. synonyms: chequing account, current account. bank account.

What is a checking account in British English?

In the US, a bank account that issues a checkbook is a checking account. The equivalent account in the UK is called a current account, and it usually comes with a chequebook. The spelling of check for every other meaning is the same in American English and British English.

What are the 4 types of bank accounts?

The four basic types are checking account, savings account, certificate of deposit and money market account. Each kind of account serves a different purpose. For instance, a checking account is geared toward covering everyday expenses, while a savings account is designed to help achieve short-term financial goals.

What is the other name for checking account?

A transaction account (also called a checking account, cheque account, chequing account, current account, demand deposit account, or share account at credit unions) is a deposit account or bank account held at a bank or other financial institution.

What is a nickname for a checking account?

What Are Account Nicknames? Account nicknames are a way to easily identify and personalize your accounts in Online Banking. Using this feature is especially helpful if you have multiple checking or savings accounts, credit cards, or other types of loans.

What are the terminologies used in banking?

A Account balance. The total amount of all funds in your account. Adjustable rate. A rate of interest that can vary during the term of the loan. Annual percentage rate (APR) Annual percentage yield (APY) Assets. ATM fees. Auto loan. Automated clearing house (ACH)

What are the words associated with banking?

The Most Common Banking Vocabulary Words WordDefinition Credit Making funds available to a beneficiary, without requiring immediate repayment Credit card A payment card that allows its owner to use money from a revolving credit facility Debit All sums withdrawn from a bank account Debt Money owed to a bank17 more rows • Oct 20, 2021

What are checking accounts also called?

With a checking account, also known as a demand deposit account, you can deposit money with your bank that you can later withdraw or use checks or a debit card to pay others. It can give you a secure place to store your cash and other payments made to you, and you can easily access and spend this money when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SPECIAL TERMS FOR CHECKING ACCOUNTS?

SPECIAL TERMS FOR CHECKING ACCOUNTS refers to specific conditions and agreements pertaining to checking account services provided by a financial institution. These may include details about fees, interest rates, account limits, and other terms that govern the use of the account.

Who is required to file SPECIAL TERMS FOR CHECKING ACCOUNTS?

Typically, financial institutions that offer checking account services are required to file the SPECIAL TERMS FOR CHECKING ACCOUNTS to ensure compliance with regulatory requirements and to inform consumers of the terms associated with their accounts.

How to fill out SPECIAL TERMS FOR CHECKING ACCOUNTS?

To fill out the SPECIAL TERMS FOR CHECKING ACCOUNTS, one must provide accurate information regarding the account terms, including fees, interest rates, and account usage limits, as well as any specific conditions that apply. The financial institution usually provides a form or document that must be completed and submitted.

What is the purpose of SPECIAL TERMS FOR CHECKING ACCOUNTS?

The purpose of SPECIAL TERMS FOR CHECKING ACCOUNTS is to provide transparency and clarity to account holders regarding the terms and conditions governing their checking accounts. It helps both the institution and customers understand their rights and responsibilities.

What information must be reported on SPECIAL TERMS FOR CHECKING ACCOUNTS?

The information that must be reported includes details such as monthly maintenance fees, transaction fees, minimum balance requirements, interest rates, overdraft policies, and any promotional offers associated with the checking account.

Fill out your special terms for checking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Special Terms For Checking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.