NY MT-203 2002 free printable template

Show details

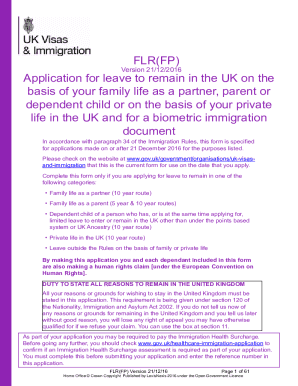

Use this form to report only transactions for the period .... Schedule 2 Transfer of product- Enter the name and address of each of your out-of-state.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY MT-203

Edit your NY MT-203 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY MT-203 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY MT-203 online

Follow the guidelines below to use a professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY MT-203. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY MT-203 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY MT-203

How to fill out NY MT-203

01

Begin by downloading the NY MT-203 form from the New York State Department of Taxation and Finance website.

02

Fill in the taxpayer's identification information, including name, address, and federal Employer Identification Number (EIN) or Social Security Number (SSN).

03

Indicate the tax period for which the form is being completed.

04

Provide details of the transactions being reported, including dates and amounts.

05

Accurately categorize each transaction according to the appropriate codes provided in the form's instructions.

06

Review all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed NY MT-203 form to the appropriate state department as directed.

Who needs NY MT-203?

01

Businesses and individuals who have conducted certain transactions subject to New York State taxes.

02

Taxpayers who need to report specific financial activities related to withholding tax.

03

Employers who need to report withheld wages for employees.

Fill

form

: Try Risk Free

People Also Ask about

Which state has the highest tobacco tax?

The highest combined state-local tax rate is $7.16 in Chicago, IL, with Evanston, IL second at $6.48 per pack. Other high state-local rates include New York City at $5.85 and Juneau, AK at $5.00 per pack.

What is the OTP tax in NY?

New York State and New York City impose an excise tax on all cigarettes possessed in the state for sale. The state excise tax rate is $4.35 per package of 20 cigarettes.

What is the tobacco product tax in NY?

“We have a 75% tax from New York state that we have on our cigar tax. It affects, obviously, the buyer the most. Once again it's just a trickle-down effect where it just affects the customer,” she said. The New York Association of Convenience Stores is also opposed to the tax increase and proposed ban.

What do governments spend cigarette tax revenues on?

Federal Level: On the federal level, revenue from cigarette and tobacco taxes helps fund programs that support children and adults across the country, including the Children's Health Insurance Program (CHIP). CHIP provides health insurance to many children in the U.S. who would otherwise be uninsured.

How much is tobacco products in New York?

Most Expensive Cigarettes by State The states that have the most expensive cigarette prices are New York, Connecticut, Rhode Island, Massachusetts, Alaska, Hawaii, Minnesota, Illinois, Vermont, and Washington. New York has the most expensive cigarettes in the country, at $10.53 per pack.

Are NYS tax forms available?

If you are trying to locate, download, or print state of New York state tax forms, you can do so on the New York Department of Taxation website.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY MT-203 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including NY MT-203, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute NY MT-203 online?

Completing and signing NY MT-203 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit NY MT-203 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute NY MT-203 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is NY MT-203?

NY MT-203 is a tax form used in New York State for the reporting of certain transactions involving the sale of motor fuel and related products.

Who is required to file NY MT-203?

Businesses that sell or distribute motor fuel in New York State are required to file NY MT-203 if they meet the criteria set forth by the New York State Taxation and Finance department.

How to fill out NY MT-203?

To fill out NY MT-203, obtain the form from the New York State Taxation and Finance website, provide information such as the business name and address, transaction details, and report the taxable sales or purchases as required.

What is the purpose of NY MT-203?

The purpose of NY MT-203 is to ensure proper reporting and taxation of motor fuel sales in New York State, contributing to state revenue and regulatory compliance.

What information must be reported on NY MT-203?

NY MT-203 requires reporting information such as the seller's and buyer's details, transaction date, description of the fuel sold, quantity, and the tax amount collected.

Fill out your NY MT-203 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY MT-203 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.