Get the free Mortgage Protection Insurance

Show details

This document outlines various insurance plans designed to protect mortgage borrowers, including options for life insurance, accidental death coverage, and disability insurance. It provides details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage protection insurance

Edit your mortgage protection insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage protection insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage protection insurance online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage protection insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage protection insurance

How to fill out Mortgage Protection Insurance

01

Gather necessary documents such as your mortgage agreement, identification, and financial statements.

02

Research different Mortgage Protection Insurance (MPI) policies available in the market.

03

Choose the coverage amount that will pay off your mortgage in case of your untimely death.

04

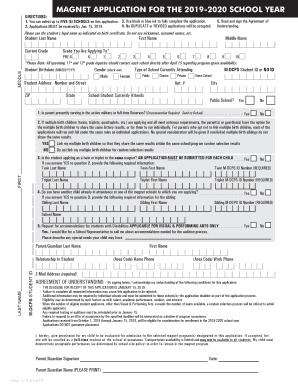

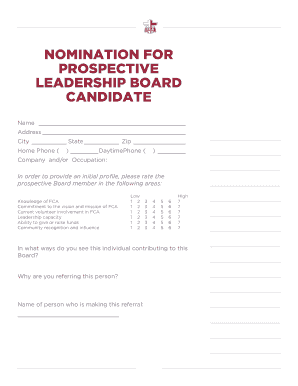

Fill out the application form provided by the insurance company, ensuring all details are accurate.

05

Provide any required medical information or undergo a medical exam if requested.

06

Submit the application along with any required documents and payment for the first premium.

07

Review the policy thoroughly once issued to ensure it meets your needs and keep a copy for your records.

Who needs Mortgage Protection Insurance?

01

Homeowners with a mortgage who want to ensure their family can continue to make mortgage payments in the event of their death.

02

Individuals with dependents who rely on their income to cover housing costs.

03

Those who want peace of mind knowing that their loved ones won't face financial difficulties due to mortgage payments after their passing.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between PMI and MPI?

How much does mortgage protection insurance cost per month? Mortgage protection insurance depends on your mortgage and health conditions, but generally, people pay somewhere between $30-$150 a month.

How much does PMI increase your payment?

Cons of PMI The cost of the PMI payments is added to your monthly mortgage payments. Depending on the size of the down payment, loan term, and buyer's credit score, the cost of PMI can vary. This results in higher monthly costs until the PMI is removed.

What are the cons of mortgage insurance?

Federal law requires mortgage lenders to automatically cancel private mortgage insurance (PMI) when the balance of the mortgage drops to 78 percent of the home's purchase price, or when the loan term is at its halfway point, whichever comes first.

What does mortgage protection insurance cover?

Mortgage insurance protects the mortgage lender against any loss they may occur if a mortgage goes into default for mortgages originated with down payments less than 20%. It allows you to get a mortgage with a smaller down payment. This means you can borrow a larger percentage of your home's value.

What does mortgage insurance protect against?

PMI actually protects the lender if the borrower doesn't pay the loan. On the other hand, depending on the terms of the insurance policy, MPI will make your mortgage payments for a while if you lose your job or become disabled, or it might pay off the mortgage when you die.

What does mortgage insurance cover you for?

Mortgage insurance, also known as private mortgage insurance or PMI, is insurance that some lenders may require to protect their interests should you default on your loan. Mortgage insurance doesn't cover the home or protect you as the homebuyer. Instead, PMI protects the lender in case you are unable to make payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Protection Insurance?

Mortgage Protection Insurance is a type of insurance policy designed to pay off a borrower's mortgage in the event of their death, disability, or certain other circumstances that make it difficult for them to continue making mortgage payments.

Who is required to file Mortgage Protection Insurance?

Mortgage Protection Insurance is not required by law; however, lenders may recommend it to protect their investment. Borrowers can choose to purchase it based on their financial situation and personal preferences.

How to fill out Mortgage Protection Insurance?

To fill out a Mortgage Protection Insurance application, you typically need to provide personal information, details about the mortgage, your financial situation, and health information. It's advised to consult with an insurance agent to ensure accuracy.

What is the purpose of Mortgage Protection Insurance?

The purpose of Mortgage Protection Insurance is to provide financial security for families by ensuring that the mortgage can be paid off in the event of the borrower's death or disability, avoiding foreclosure and allowing beneficiaries to stay in their home.

What information must be reported on Mortgage Protection Insurance?

The information usually required includes the policyholder's personal details, mortgage amount, loan interest rate, term of the mortgage, beneficiary information, and any health-related questions or medical history relevant to underwriting.

Fill out your mortgage protection insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Protection Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.