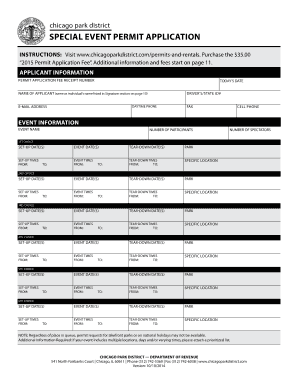

Get the free Current Financing

Show details

This document details current financing terms, including mortgage balance, interest rates, and lender information, and summarizes capital expenditures and loan application specifics.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign current financing

Edit your current financing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your current financing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing current financing online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit current financing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out current financing

How to fill out Current Financing

01

Gather all relevant financial information, including income, expenses, and existing debts.

02

Identify the purpose of current financing (e.g., business expansion, personal loan, etc.).

03

Assess your credit score and history to understand your borrowing capacity.

04

Research different financing options available (e.g., loans, credit lines, etc.).

05

Complete the application form with accurate and complete information.

06

Provide necessary documentation such as tax returns, pay stubs, and bank statements.

07

Review the terms and conditions associated with the financing options.

08

Submit the application and await approval.

Who needs Current Financing?

01

Individuals seeking personal loans for personal projects or emergencies.

02

Business owners looking to expand operations or manage cash flow.

03

Entrepreneurs needing startup capital to launch their business.

04

Students requiring funding for educational expenses.

05

Homebuyers needing mortgages to purchase a home.

Fill

form

: Try Risk Free

People Also Ask about

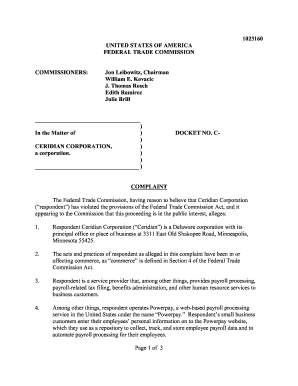

What is financing in English?

Financing means asking any financial institution (bank, credit union, finance company) or another person to lend you money that you promise to repay at some point in the future. In other words, when you buy a car, if you do not have all the cash for it, the dealer will look for a bank that will finance it for you.

What does term financing mean?

What is the meaning of term financing? Also known as Business Term Financing (BTF), it is a type of unsecured financial support offered by lenders to businesses to enhance and grow. This financing product provides a lump sum of money upfront that the borrower needs to repay over a fixed period with regular instalments.

What does it mean when someone is financing?

Financing is the process of receiving funds from a lender to help make a purchase and then paying those funds back over time. For example, someone may want to finance big-ticket items like furniture, a renovation project, a new car, or a new home.

What does it mean when someone is financing?

Financing is the process of receiving funds from a lender to help make a purchase and then paying those funds back over time. For example, someone may want to finance big-ticket items like furniture, a renovation project, a new car, or a new home.

How trustworthy is Current?

Is Current legit? Yes, Current is a legitimate fintech with banking services. Your money is insured for up to $250,000 through Current's issuing bank, Choice Financial Group and Cross River Bank. Current also uses several security protections to keep your information safe.

What is current account information in English?

A Current Account is a type of bank account specifically created to manage daily financial transactions for businesses (MSMEs, start-ups, large corporations) and individuals with business-related needs. Current Accounts are ideal for business owners, traders and service providers.

What is the meaning of financing?

Financing is the process of providing funds for business activities, making purchases, or investing. Financial institutions, such as banks, are in the business of providing capital to businesses, consumers, and investors to help them achieve their goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Current Financing?

Current Financing refers to the methods and instruments used by organizations or individuals to obtain funds for short-term operational needs or projects, typically consisting of loans, credit lines, or other financial arrangements.

Who is required to file Current Financing?

Entities that require short-term financing to support their operational activities, particularly businesses and organizations seeking to maintain liquidity or undertake immediate projects, are typically required to file Current Financing.

How to fill out Current Financing?

To fill out Current Financing, one must gather relevant financial information, specify the amount needed, detail the purpose of the financing, and provide personal or business financial statements as needed. Complete the required forms and submit them to the appropriate financial institution or regulatory body.

What is the purpose of Current Financing?

The purpose of Current Financing is to provide necessary funds to cover immediate operational costs, bridge cash flow gaps, or facilitate short-term projects that require quick access to financial resources.

What information must be reported on Current Financing?

Information that must be reported on Current Financing includes the amount of financing requested, the intended use of the funds, the applicant’s financial statements, existing debts, and any collateral offered.

Fill out your current financing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Current Financing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.