Get the free Macquarie Bank Qantas Frequent Flyer Term Deposit Application Form - macquarie com

Show details

This document serves as an application form for opening a Qantas Frequent Flyer Term Deposit account with Macquarie Bank, requiring identification and compliance with anti-money laundering regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign macquarie bank qantas frequent

Edit your macquarie bank qantas frequent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your macquarie bank qantas frequent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing macquarie bank qantas frequent online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit macquarie bank qantas frequent. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

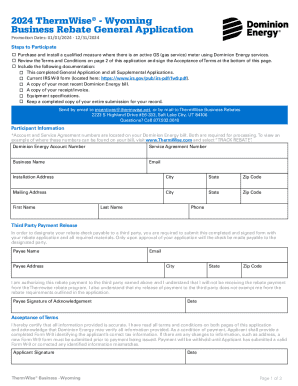

How to fill out macquarie bank qantas frequent

How to fill out Macquarie Bank Qantas Frequent Flyer Term Deposit Application Form

01

Obtain the Macquarie Bank Qantas Frequent Flyer Term Deposit Application Form from the Macquarie Bank website or a local branch.

02

Read the instructions carefully on the form to ensure you understand the requirements.

03

Fill out your personal information including your full name, address, contact number, and email address.

04

Provide your Qantas Frequent Flyer membership number if applicable.

05

Select the term length and amount you wish to deposit in the appropriate sections.

06

Read the terms and conditions of the term deposit and acknowledge your acceptance by signing the form.

07

Submit the completed application form along with any required identification documents to Macquarie Bank either online or in person.

Who needs Macquarie Bank Qantas Frequent Flyer Term Deposit Application Form?

01

Individuals who wish to invest their funds for a fixed term while earning interest.

02

Qantas Frequent Flyer members looking to earn frequent flyer points through their deposit.

03

Anyone seeking a secure investment option with a reputable financial institution.

Fill

form

: Try Risk Free

People Also Ask about

What is the interest rate for Macquarie term deposit 2025?

3.80% p.a. The above interest rates are current as at 13 May 2025 and are subject to change. The interest rate that you'll receive on your Term Deposit may vary depending on when your application is processed and will be confirmed at account opening.

What is the grace period for Macquarie term deposit?

After your Term Deposit has matured, you will have a grace period of 5 business days or 7 calendar days (whichever is longer) to make certain changes to your Term Deposit details or close your account and withdraw funds.

How do I apply for a term deposit at Macquarie Bank?

You can open an individual or joint term deposit online via the Macquarie Mobile Banking app or Macquarie Online Banking. Note: To open an individual or joint term deposit you'll need to have a Macquarie Transaction or Savings Account in the same name(s), prior to opening your Term Deposit.

What is the difference between a fixed deposit and a Term Deposit?

A 'Term Deposit' is simply a deposit that is locked-in for a certain term. By this logic, Fixed Deposits (FDs) and Term Deposits are the same. But that is not all, Term Deposits also cover other products such as Recurring Deposits, Post Office Deposits, Foreign Currency Deposits and Senior Citizen Deposits.

How to do Term Deposits?

You deposit a specific amount of money (usually there's a minimum amount required) for a predetermined term (ranging from a few months to several years). In return, the provider offers you a fixed interest rate. You cannot access your money during the term without incurring early withdrawal penalties.

What is Macquarie current Term Deposit rate?

Featured interest rates 3 months. 4.25% p.a. 4.24% p.a. 6 months. 4.10% p.a. 4.07% p.a. 9 months. 3.90% p.a. 3.85% p.a. 1 year. 3.80% p.a. 3.74% p.a. The above interest rates are current as at 21 May 2025 and are subject to change.

Can I open a Macquarie Bank account from overseas?

You can apply for a Transaction or Savings Account with an overseas passport, but we won't be able to verify your ID electronically. For information on acceptable forms of ID and how to get them certified, visit Verifying your identity via certified documents.

What is the grace period for Term Deposits in Macquarie?

After your Term Deposit has matured, you will have a grace period of 5 business days or 7 calendar days (whichever is longer) to make certain changes to your Term Deposit details or close your account and withdraw funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Macquarie Bank Qantas Frequent Flyer Term Deposit Application Form?

The Macquarie Bank Qantas Frequent Flyer Term Deposit Application Form is a document used to apply for a term deposit with Macquarie Bank while allowing customers to earn Qantas Frequent Flyer points on their deposit.

Who is required to file Macquarie Bank Qantas Frequent Flyer Term Deposit Application Form?

Individuals or entities looking to open a term deposit with Macquarie Bank and wishing to accumulate Qantas Frequent Flyer points are required to file this application form.

How to fill out Macquarie Bank Qantas Frequent Flyer Term Deposit Application Form?

To fill out the application form, applicants need to provide personal information, select the term deposit amount and term length, agree to the terms and conditions, and include their Qantas Frequent Flyer number.

What is the purpose of Macquarie Bank Qantas Frequent Flyer Term Deposit Application Form?

The purpose of the form is to facilitate the process of opening a term deposit account while enabling customers to earn Qantas Frequent Flyer points as a reward for their investment.

What information must be reported on Macquarie Bank Qantas Frequent Flyer Term Deposit Application Form?

Information that must be reported includes the applicant's full name, contact details, financial details regarding the deposit amount, term length, and the Qantas Frequent Flyer membership number.

Fill out your macquarie bank qantas frequent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Macquarie Bank Qantas Frequent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.