Get the free Anti-Money Laundering Compliance Certification

Show details

This document certifies that the named money service business has adopted an Anti-Money Laundering Program in compliance with relevant laws, including the USA PATRIOT Act and the Bank Secrecy Act.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anti-money laundering compliance certification

Edit your anti-money laundering compliance certification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti-money laundering compliance certification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

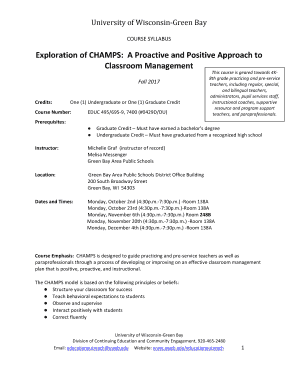

Editing anti-money laundering compliance certification online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit anti-money laundering compliance certification. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti-money laundering compliance certification

How to fill out Anti-Money Laundering Compliance Certification

01

Begin with your organization's name and contact information.

02

Specify the relevant regulatory body or authority.

03

Provide details on your Anti-Money Laundering (AML) policies and procedures.

04

Include information about staff training programs related to AML compliance.

05

Document the identification and verification processes for customers.

06

Describe your ongoing monitoring systems for suspicious activities.

07

Detail the reporting procedures for suspicious transactions to relevant authorities.

08

Sign and date the certification to verify the accuracy of the information provided.

Who needs Anti-Money Laundering Compliance Certification?

01

Financial institutions such as banks and credit unions.

02

Real estate agencies involved in property transactions.

03

Investment firms and broker-dealers.

04

Money services businesses including currency exchanges.

05

Insurance companies offering certain products.

06

Other entities that engage in services that may be vulnerable to money laundering.

Fill

form

: Try Risk Free

People Also Ask about

Which certification is best for AML?

Four-week, online anti-money laundering training course. Available on desktop or mobile (and most other devices) Complete the four hours of coursework at your own pace. Pass a short, 20-question final assessment to receive your AML certificate.

How do I start a career in AML compliance?

Here are the steps to obtain an AML certification: Earn a degree. Typically, AML specialists have at least a bachelor's degree in finance, economics, financial management or a similar discipline. Earn AML or banking experience. Prepare for your ACAMS exam. Pass the ACAMS or equivalent exam. Apply for AML positions.

How do I become AML compliant?

Keep accurate and detailed records. Record-keeping is a cornerstone of AML compliance. As a compliance manager, you need to ensure that your company maintains accurate, up-to-date records of customer information, risk assessment, and any suspicious activities.

How much does AML certification cost?

Offered by the FCA (Financial Crime Academy), this certification demonstrates expertise in the detection and prevention of money laundering activities. The cost of the CAMP certification is $420 annual. Check the updated pricing here. This fee covers the exam and study materials provided by FCA.

How do I get my anti-money laundering certificate?

Pass the ACAMS or equivalent exam CAFP stands for certified AML and fraud professional. Prospective AML specialists choose one of these exams and need a passing score to earn their certification. Applicants who don't pass the exam the first time have the option to pay the fee again and retake the exam.

How do I become AML compliant?

Keep accurate and detailed records. Record-keeping is a cornerstone of AML compliance. As a compliance manager, you need to ensure that your company maintains accurate, up-to-date records of customer information, risk assessment, and any suspicious activities.

How to get certified in AML?

Review Eligibility Requirements. Check your eligibility and learn about experience and training requirements. View Requirements. Prepare for the Exam. Review the ways to help you prepare to take the exam. Prepare. Schedule Your Exam. View upcoming exam dates and locations, and submit your application. Apply.

Is AML certification worth it?

CAMS (Certified Anti-Money Laundering Specialist) is the global gold standard in AML certifications, with more than 57,000 CAMS graduates worldwide. We offer self-study and enhanced learning packages to get you qualified in as little as four months. CAMS is currently available in 14 languages.

How long does it take to get an AML certification?

Entry-degree AML solutions: Start at round $500/month, suitable for small organizations or fintech startups. Mid-tier systems: Range from $1,500 to $3,000/month, offering greater robust functions like real-time screening and automated reporting.

What is the best certification for anti-money laundering?

CAMS is a professional credential, considered a global benchmark for professionals working in the anti-money laundering field. To earn the CAMS Certification, professionals must pass a proctored exam.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Anti-Money Laundering Compliance Certification?

Anti-Money Laundering Compliance Certification is a formal recognition that an organization or individual has met the requirements for preventing money laundering activities as outlined by regulatory authorities.

Who is required to file Anti-Money Laundering Compliance Certification?

Businesses and financial institutions that are subject to Anti-Money Laundering (AML) regulations, including banks, credit unions, insurance companies, and certain other designated non-financial businesses and professions, are required to file this certification.

How to fill out Anti-Money Laundering Compliance Certification?

To fill out the Anti-Money Laundering Compliance Certification, one must provide the required information regarding the organization's AML policies and procedures, list the designated AML compliance officer, and affirm the effectiveness of compliance measures in place.

What is the purpose of Anti-Money Laundering Compliance Certification?

The purpose of Anti-Money Laundering Compliance Certification is to ensure that organizations comply with AML laws and regulations, thereby preventing illicit financial activities such as money laundering and terrorist financing.

What information must be reported on Anti-Money Laundering Compliance Certification?

The information that must be reported includes the organizational structure, identification of the compliance officer, summary of AML policies and procedures, training programs in place, and any incidents of non-compliance or violations.

Fill out your anti-money laundering compliance certification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anti-Money Laundering Compliance Certification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.