Get the free Morgan Stanley Mortgage Capital Correspondent Approval Application

Show details

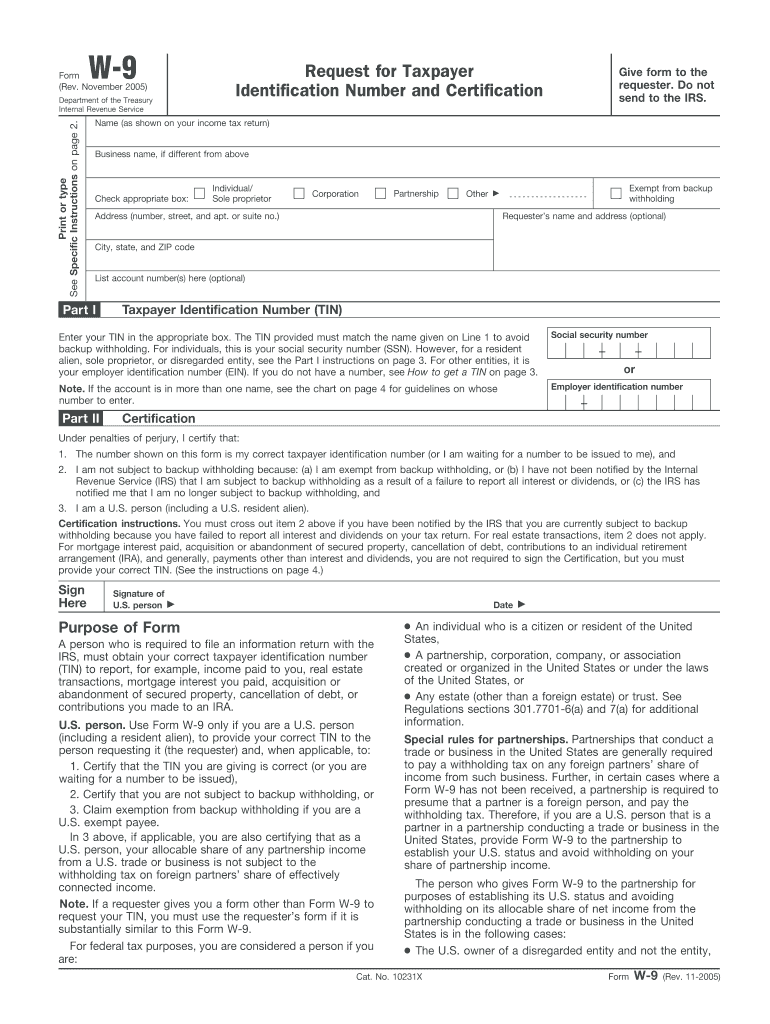

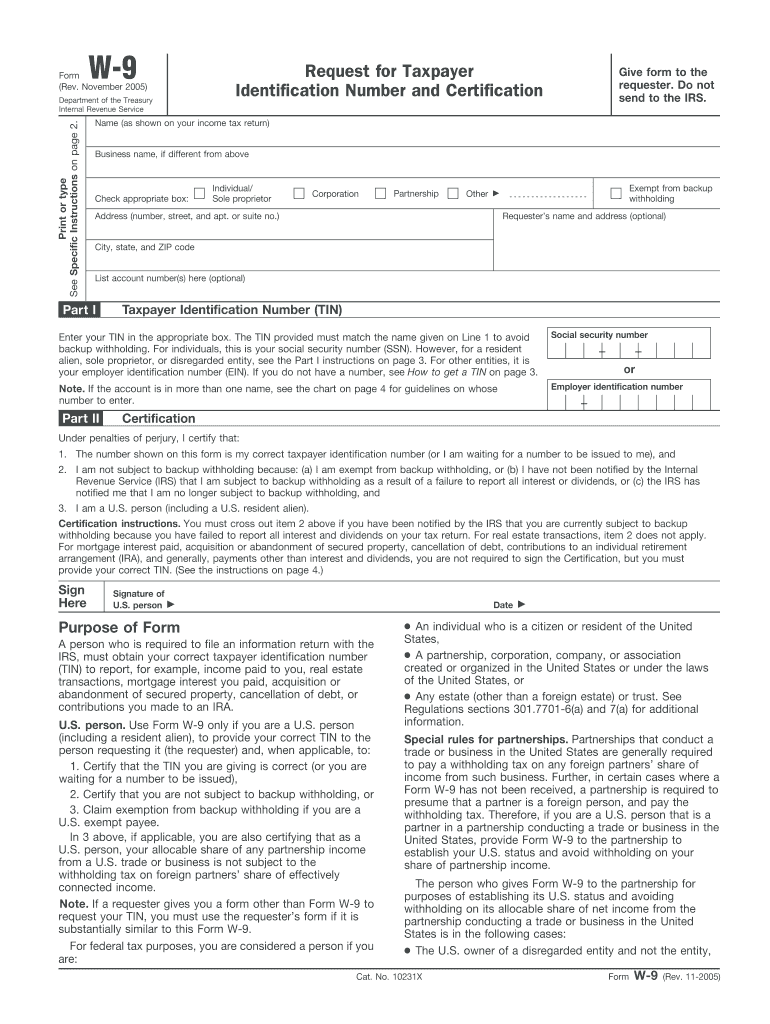

This document is a checklist for correspondent lenders applying to sell mortgage loans to Morgan Stanley Mortgage Capital, outlining the required information and documents needed.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign morgan stanley mortgage capital

Edit your morgan stanley mortgage capital form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your morgan stanley mortgage capital form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit morgan stanley mortgage capital online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit morgan stanley mortgage capital. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out morgan stanley mortgage capital

How to fill out Morgan Stanley Mortgage Capital Correspondent Approval Application

01

Begin by downloading the Morgan Stanley Mortgage Capital Correspondent Approval Application form from the official website or requesting it from your Morgan Stanley representative.

02

Fill out the contact information section with your company's name, address, phone number, and email address.

03

Provide detailed information about your company's ownership structure, including names and percentages of ownership for each principal.

04

Complete the financial information section, listing your company's total assets, net worth, and annual revenue.

05

Include details about your company's experience in mortgage origination and servicing, specifying the types of loans you offer.

06

Attach supporting documentation, such as financial statements, business licenses, and any relevant certifications.

07

Review the application for completeness and accuracy before submission.

08

Submit the application and any required documents through the designated channel specified by Morgan Stanley.

Who needs Morgan Stanley Mortgage Capital Correspondent Approval Application?

01

Mortgage lenders and brokers seeking to partner with Morgan Stanley to access their mortgage capital products and services.

02

Companies looking to expand their lending capabilities or improve their mortgage offerings by working with a reputable financial institution.

Fill

form

: Try Risk Free

People Also Ask about

What is tailored lending Morgan Stanley?

Tailored Lending is a loan/line of credit product offered by Morgan Stanley Private Bank, National Association, an affiliate of Morgan Stanley Smith Barney LLC. A Tailored Lending credit facility may be a committed or demand loan/line of credit.

Can you use Morgan Stanley as a bank?

Whether you're looking to earn a higher rate on your savings or an account for your everyday cash, Morgan Stanley Private Bank offers a variety of high-yield bank accounts.

Can you get a loan through Morgan Stanley?

Whether you want to buy a home, finance a tax obligation, expand your business or have other borrowing needs, your Financial Advisor and team of specialists can work with you to determine appropriate lending strategies to help you achieve your goals.

How to get a mortgage pre-approval?

Mortgage Pre-Approval Requirements To obtain a mortgage pre-approval, you'll typically need to provide the following documentation to your lender: Proof of Income. This may include recent pay stubs, W-2 forms, or tax returns (for self-employed individuals). Asset Documentation.

Can I borrow against my Morgan Stanley brokerage account?

Whether you want to buy a home, pay taxes, expand your business or cover other expenses, a securities based loan1 may offer a convenient way to access funds. Since it uses eligible investments in your Morgan Stanley brokerage account as collateral, you may be able to keep your longer-term investment strategy intact.

Does Morgan Stanley lend money?

Fund real estate needs, expand your business, pay taxes or cover other large expenses through Morgan Stanley lending solutions. Let us help you find an appropriate financing solution to meet your needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Morgan Stanley Mortgage Capital Correspondent Approval Application?

The Morgan Stanley Mortgage Capital Correspondent Approval Application is a document that lenders use to apply for approval to participate in Morgan Stanley's correspondent lending program, allowing them to sell mortgage loans to the firm.

Who is required to file Morgan Stanley Mortgage Capital Correspondent Approval Application?

Mortgage lenders and financial institutions that wish to partner with Morgan Stanley for loan origination and sale services are required to file the application.

How to fill out Morgan Stanley Mortgage Capital Correspondent Approval Application?

To fill out the application, applicants must provide detailed business information, financial statements, and compliance documentation as specified in the application instructions, along with any required signatures.

What is the purpose of Morgan Stanley Mortgage Capital Correspondent Approval Application?

The purpose of the application is to evaluate and approve lending partners for participation in Morgan Stanley's correspondent lending program to ensure compliance and financial reliability.

What information must be reported on Morgan Stanley Mortgage Capital Correspondent Approval Application?

Applicants must report information such as company name, contact details, financial statements, ownership structure, previous mortgage experience, and any regulatory history.

Fill out your morgan stanley mortgage capital online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Morgan Stanley Mortgage Capital is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.