Get the free Application for Group 10/20-Year Level Term Life Insurance

Show details

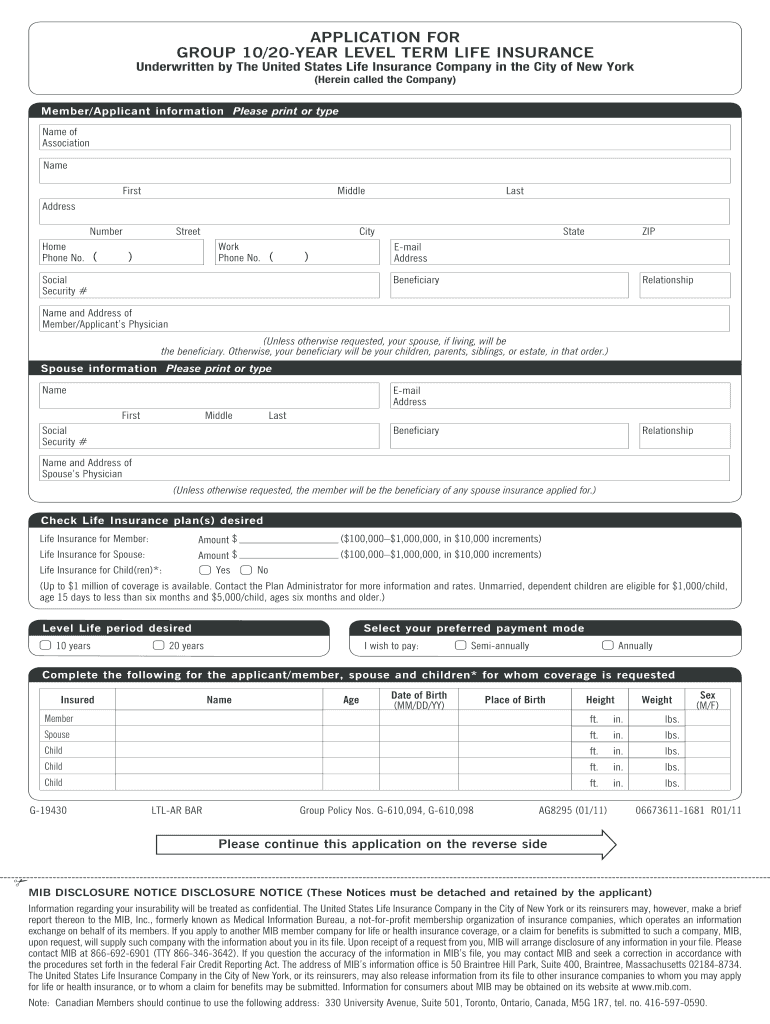

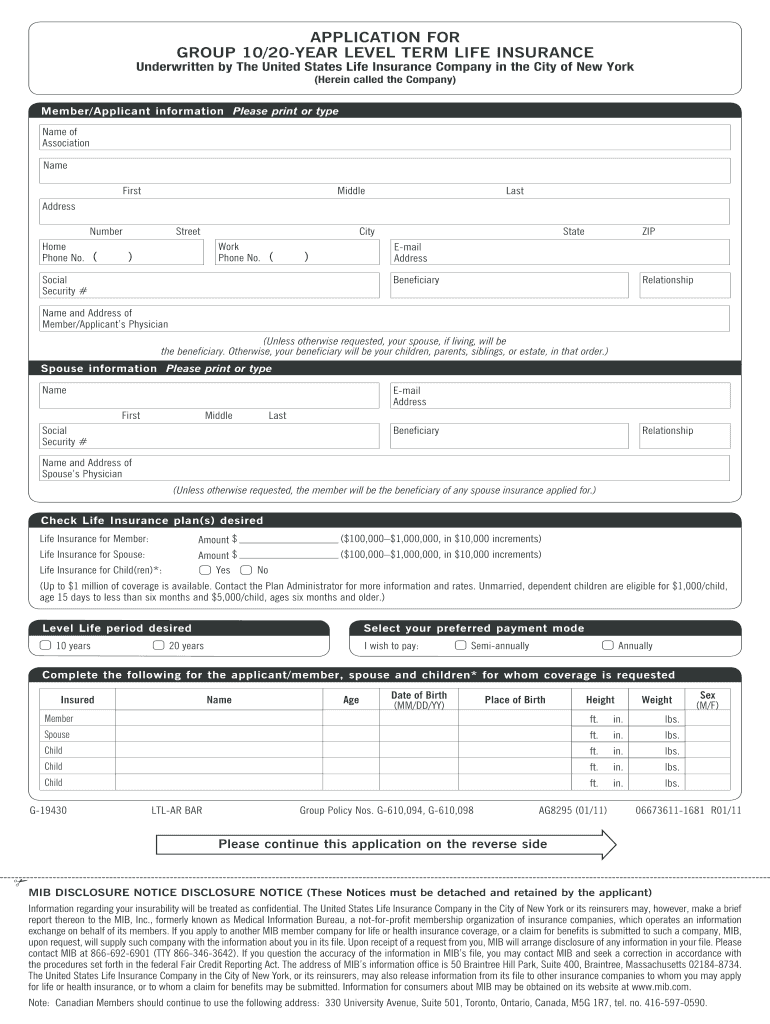

This document is an application form for group 10 and 20 year level term life insurance underwritten by The United States Life Insurance Company. It collects personal and health information from the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for group 1020-year

Edit your application for group 1020-year form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for group 1020-year form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for group 1020-year online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for group 1020-year. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for group 1020-year

How to fill out Application for Group 10/20-Year Level Term Life Insurance

01

Begin by obtaining the Application for Group 10/20-Year Level Term Life Insurance form from your employer or insurance provider.

02

Fill in your personal information in the designated sections, including your name, address, date of birth, and Social Security number.

03

Provide details about your employment, including your job title, employer name, and duration of employment.

04

Indicate the coverage amount you are applying for and any additional riders or options you wish to include.

05

Answer the health questions truthfully to assess your eligibility. This may include questions about pre-existing conditions, medications, and lifestyle habits.

06

Review the application for accuracy and completeness before signing it.

07

Submit the completed application as instructed, either electronically or in person.

Who needs Application for Group 10/20-Year Level Term Life Insurance?

01

Individuals seeking financial protection for their dependents in the event of their death.

02

Employees of organizations offering group term life insurance as part of their benefits package.

03

People who want to ensure their families' financial stability without the high premiums often associated with permanent life insurance.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of level term insurance?

A “10-year” policy may be a policy with a term of 10 years — coverage ends after the tenth year. Or it may be a policy whose coverage lasts to age 90, with premiums that don't increase during the first 10 years. After that tenth year, the policy doesn't end, it just starts increasing in cost.

What does a 10 year level term life insurance policy mean?

This is life insurance with a policy term of 20 years. If the policyholder dies during that time, the life insurance company pays a death benefit to his or her beneficiaries, often dependents or family. After 20 years, there is no more coverage, and no benefit paid.

What happens at the end of a 10-year term life insurance?

Cons of level term insurance Unlike permanent life insurance , level term contracts have an end date, so you won't have coverage or death benefits once the policy has run out. No cash value. Level term insurance contracts don't accumulate cash value.

What not to say when applying for life insurance?

A 10-year term life insurance policy expires after the 10-year term length ends. If you don't pass away during this period, your coverage ends. This means that if you pass away afterward, your beneficiaries won't receive a death benefit.

Is a 10-year term life insurance worth it?

10-year term life insurance can be a good option to help protect your children as they grow. Premiums are typically low, and if you pass away, your partner can use the death benefit to help with loss of income, pay off your debts, and pay for your children's education.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Group 10/20-Year Level Term Life Insurance?

The Application for Group 10/20-Year Level Term Life Insurance is a formal request to obtain a group life insurance policy that provides coverage for a set period of either 10 or 20 years, ensuring financial protection for beneficiaries in the event of the insured's death.

Who is required to file Application for Group 10/20-Year Level Term Life Insurance?

Typically, the employer or an organization offering the insurance benefit to its employees or members is required to file the Application for Group 10/20-Year Level Term Life Insurance.

How to fill out Application for Group 10/20-Year Level Term Life Insurance?

To fill out the application, the responsible entity must provide detailed information about the group, including the number of participants, coverage amounts, and personal information for each individual to be insured, such as names, ages, and health status.

What is the purpose of Application for Group 10/20-Year Level Term Life Insurance?

The purpose of the application is to secure life insurance coverage for a group of individuals, offering a cost-effective way to provide financial protection against unexpected loss of life over a specified term.

What information must be reported on Application for Group 10/20-Year Level Term Life Insurance?

The application must report information such as the group's name, the number of participants, individual personal details (names, dates of birth, and contact information), coverage levels, and any relevant health information that may affect eligibility.

Fill out your application for group 1020-year online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Group 1020-Year is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.