Get the free MARGIN LOAN PROVISION / REPAYMENT ORDER - rietumu

Show details

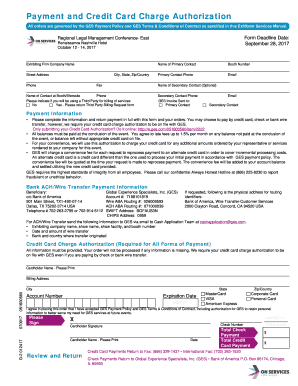

This document is an application form for a margin loan provided by JSC “Rietumu Banka,” detailing the client's request, collateral information, loan amounts, and agreement to terms and conditions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign margin loan provision repayment

Edit your margin loan provision repayment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your margin loan provision repayment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing margin loan provision repayment online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit margin loan provision repayment. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out margin loan provision repayment

How to fill out MARGIN LOAN PROVISION / REPAYMENT ORDER

01

Begin by obtaining the MARGIN LOAN PROVISION / REPAYMENT ORDER form from your broker or financial institution.

02

Fill in your personal details, including your name, account number, and contact information.

03

Specify the amount of margin loan you wish to provision or repay.

04

Indicate the relevant period for which the loan is being requested or repaid.

05

Review the terms and conditions related to margin loans provided in the form.

06

Sign the form to authorize the transaction, ensuring to include the date.

07

Submit the completed form as per your brokerage's guidelines, either online or through physical submission.

Who needs MARGIN LOAN PROVISION / REPAYMENT ORDER?

01

Individuals seeking to invest in stocks or other securities using borrowed funds.

02

Traders and investors who require additional capital to enhance their trading positions.

03

Clients of financial institutions that offer margin lending services.

Fill

form

: Try Risk Free

People Also Ask about

How do I pay off my margin loan?

Unlike fixed-rate mortgages, margin loan rates are typically variable and can fluctuate based on market conditions. As interest rates rise, the cost of borrowing money through a margin loan may increase, making it more expensive to maintain the loan over time.

Is margin the same as loan?

Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of an investment and the loan amount.

What is the difference between a margin loan and a normal loan?

The traditional margin loan market benefits from having an immediate and reliable valuation of the underlying assets securing the financing, while in the typical NAV facility, the value of the collateral can lag the advancing of the loans.

What are the repayment terms for margin loans?

Margin account loans don't have a set repayment schedule, but you must keep a minimum level of assets in the margin account to maintain sufficient collateral. You must also pay interest for as long as the loan is outstanding.

How risky is a margin loan?

While margin loans can be useful and convenient, they are by no means risk free. Margin borrowing comes with all the hazards that accompany any type of debt — including interest payments and reduced flexibility for future income. The primary dangers of trading on margin are leverage risk and margin call risk.

Can I use a margin loan for personal use?

As long as you're comfortable with the margin loan interest rate (which will not always be as low as it is today but should in general remain cheaper than a mortgage), you can borrow against your growing pool of investments for everyday living expenses, house purchases, and even charitable contributions.

Are margin loans better than personal loans?

Borrowing on margin is generally more cost-effective than other lending options, such as credit cards or bank loans. You're less likely to incur trading violations in a margin account because you may have margin cash available to cover trades. You'll also have more buying power in your margin account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MARGIN LOAN PROVISION / REPAYMENT ORDER?

A MARGIN LOAN PROVISION / REPAYMENT ORDER is a financial document issued to manage and facilitate the repayment of borrowed funds secured by margin loans against securities, ensuring that the borrower remains compliant with margin requirements.

Who is required to file MARGIN LOAN PROVISION / REPAYMENT ORDER?

Individuals or entities that have taken out margin loans from a brokerage or financial institution are required to file a MARGIN LOAN PROVISION / REPAYMENT ORDER.

How to fill out MARGIN LOAN PROVISION / REPAYMENT ORDER?

To fill out a MARGIN LOAN PROVISION / REPAYMENT ORDER, one must provide details such as the borrower's information, loan amount, the securities involved, repayment terms, and signatures from both the lender and borrower.

What is the purpose of MARGIN LOAN PROVISION / REPAYMENT ORDER?

The purpose of a MARGIN LOAN PROVISION / REPAYMENT ORDER is to establish the terms under which the borrower must repay the loan, to protect the lender's interests, and to ensure compliance with regulatory requirements related to margin lending.

What information must be reported on MARGIN LOAN PROVISION / REPAYMENT ORDER?

The MARGIN LOAN PROVISION / REPAYMENT ORDER must report information including the parties involved, the loan amount, interest rate, repayment schedule, details of the collateral securities, and any relevant conditions or covenants.

Fill out your margin loan provision repayment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Margin Loan Provision Repayment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.