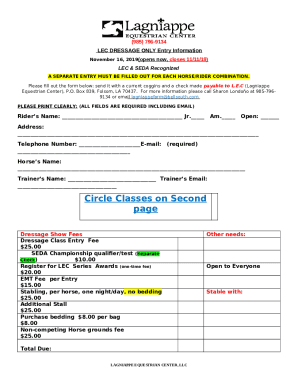

Get the free 2012-2013 Minimal Income Statement - Independent Student with Dependent(s) - cn

Show details

This document is used by independent students with dependents to report low income status for the purpose of determining eligibility for federal student aid.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012-2013 minimal income statement

Edit your 2012-2013 minimal income statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012-2013 minimal income statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012-2013 minimal income statement online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2012-2013 minimal income statement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012-2013 minimal income statement

How to fill out 2012-2013 Minimal Income Statement - Independent Student with Dependent(s)

01

Begin with your personal information at the top of the form, including your name and Social Security number.

02

State your filing status as an independent student and include any dependents you have.

03

Fill in your income information for the year, including wages, salaries, and any other monetary sources.

04

Report any taxable income received, but ensure you do not include non-taxable income amounts.

05

Complete sections related to your expense information if required, detailing necessary expenses that are applicable.

06

Review the statement for accuracy, ensuring all numbers are correct and properly categorized.

07

Sign and date the form to certify that the information provided is true and accurate.

Who needs 2012-2013 Minimal Income Statement - Independent Student with Dependent(s)?

01

Independent students who have dependents and are applying for financial aid or scholarships.

02

Individuals who need to verify their minimal income level for assistance programs.

03

Students seeking to demonstrate financial need for educational funding.

Fill

form

: Try Risk Free

People Also Ask about

How much money can my parents make and still get FAFSA?

There is no income limit to qualify for federal student loans.

Is $100,000 too much for FAFSA?

A common myth is that students from high-income families won't qualify for FAFSA funding. In reality, there's no maximum income cap that determines your eligibility for aid. Although your earnings are a factor on the FAFSA, only some programs are based on need.

Why is FAFSA saying I'm an independent student?

To be considered independent on the FAFSA without meeting the age requirement, an associate or bachelor's degree student must be at least one of the following: married; a U.S. veteran; in active duty military service other than training purposes; an emancipated minor; a recently homeless youth or self-supporting and at

Do parents who make $120000 still qualify for FAFSA?

There is no set income limit for eligibility to qualify for financial aid through. You'll need to fill out the FAFSA every year to see what you qualify for at your college. It's important to make sure you fill out the FAFSA as quickly as possible once it opens for the following school year.

At what point does FAFSA stop using parents' income?

You can only qualify as an independent student on the FAFSA if you are at least 24 years of age, married, on active duty in the U.S. Armed Forces, financially supporting dependent children, an orphan (both parents deceased), a ward of the court, or an emancipated minor.

How rich is too rich for financial aid?

There is no income that is too high to file a FAFSA. No matter how much you make, you can always submit a FAFSA. Eligibility for need-based financial aid increases as the cost of attendance increases, so even a wealthy student might qualify for financial aid at a higher-cost college.

Why is FAFSA saying I'm a dependent?

FAFSA considers you a dependant of your parents, regardless of living condition, unless you meet one of the standards not to be dependent. The easiest one is turning 24. If you've never been declared homeless or joined the military or gotten married, you are a dependent by FAFSA standards until 24.

What is the difference between independent and dependent students on FAFSA?

Your dependency status determines whose information you must report when you fill out the FAFSA form: If you're a dependent student, you'll report your and your parents' information. If you're an independent student, you'll report your own information (and, if you're married, your spouse's).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012-2013 Minimal Income Statement - Independent Student with Dependent(s)?

The 2012-2013 Minimal Income Statement - Independent Student with Dependent(s) is a financial document used by independent students who have dependents to report their minimal income for the academic year.

Who is required to file 2012-2013 Minimal Income Statement - Independent Student with Dependent(s)?

Independent students who have dependents and whose income falls below the minimum threshold set by financial aid programs are required to file the 2012-2013 Minimal Income Statement.

How to fill out 2012-2013 Minimal Income Statement - Independent Student with Dependent(s)?

To fill out the 2012-2013 Minimal Income Statement, independent students should provide personal information, report their income details, and include information about their dependents as required by the form.

What is the purpose of 2012-2013 Minimal Income Statement - Independent Student with Dependent(s)?

The purpose of the 2012-2013 Minimal Income Statement is to determine eligibility for financial aid and to assess the financial situation of independent students with dependents.

What information must be reported on 2012-2013 Minimal Income Statement - Independent Student with Dependent(s)?

The information that must be reported includes the student's total income, any household income, number of dependents, and relevant financial supporting documents as specified in the guidelines.

Fill out your 2012-2013 minimal income statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012-2013 Minimal Income Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.