Get the free REPORT OF PETTY CASH EXPENDITURES - case

Show details

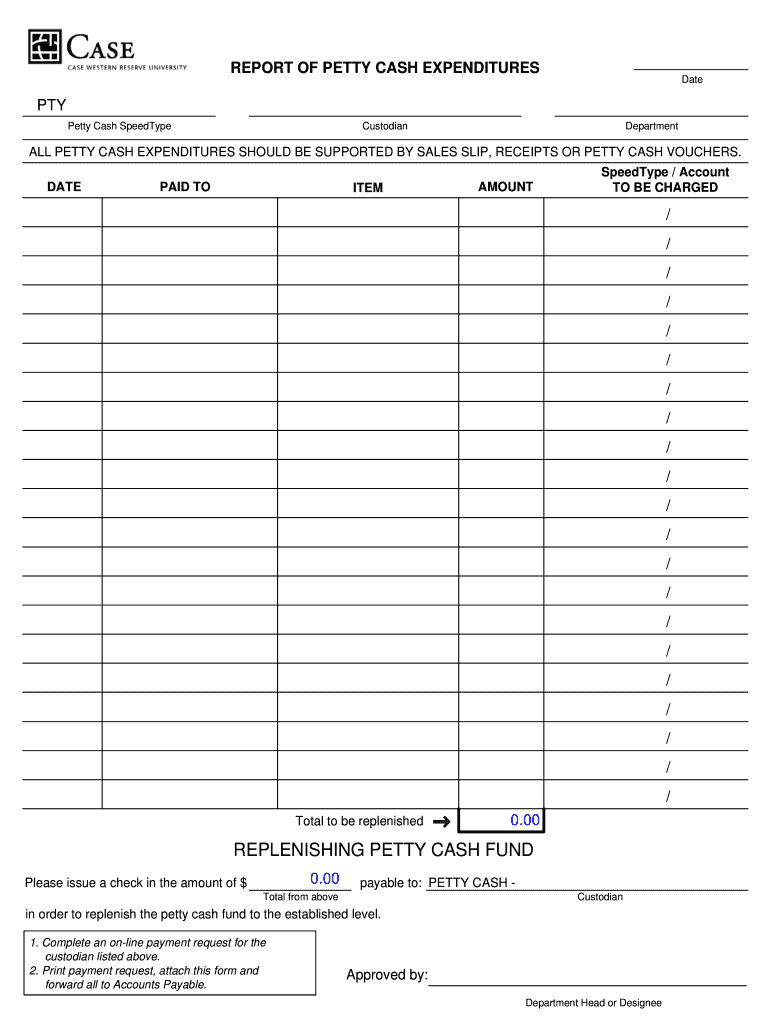

Document detailing petty cash expenditures including dates, amounts, and recipient information, used for replenishing the petty cash fund in a department setting.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report of petty cash

Edit your report of petty cash form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report of petty cash form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit report of petty cash online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit report of petty cash. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out report of petty cash

How to fill out REPORT OF PETTY CASH EXPENDITURES

01

Obtain a blank REPORT OF PETTY CASH EXPENDITURES form.

02

Fill in the date of the report at the top of the form.

03

Enter the name of the department or individual responsible for the petty cash.

04

List each expenditure in the designated columns, including the date, description, amount, and any relevant receipt number.

05

Calculate and fill in the total amount of expenditures at the bottom of the form.

06

Include any remaining petty cash balance if applicable.

07

Sign and date the report to certify its accuracy.

08

Submit the completed report to the finance department for record-keeping.

Who needs REPORT OF PETTY CASH EXPENDITURES?

01

Employees or departments that manage petty cash funds.

02

Finance or accounting departments for financial tracking.

03

Auditors for expense verification during audits.

Fill

form

: Try Risk Free

People Also Ask about

How to write a petty cash report?

Petty Cash Reporting Count the cash balance in the petty cash fund. Compare the cash balance to the log of transactions. Identify any discrepancies and investigate as necessary. Prepare a petty cash journal entry to record all the expenses incurred. Refill the petty cash fund to its original designated amount.

What is a petty cash summary?

What Is Petty Cash and What Is It Used For? Petty cash is the money that a business or company keeps on hand to make small payments, purchases, and reimbursements. Either routine or unexpected, these are transactions for which writing a check or using a credit card is impractical or inconvenient.

What is a cash summary sheet?

The Cash Summary shows the movement of cash into and out of your organisation for a selected period.

What information would you include in a petty cash report?

Petty cash is recorded in accounting by maintaining a petty cash log that includes the date, amount, purpose, and recipient of each transaction. The petty cash account is typically replenished periodically by recording a journal entry that debits the individual expense accounts and credits the petty cash account.

What is a petty cash summary sheet?

Instructions. A petty cash fund is a fixed sum of money for the purpose of making cash payments for small purchases where more formal procurement or payment actions would be uneconomical. The form is to be used to summarize purchases and request replenishment of the fund.

What are examples of typically petty cash expenditures?

Examples of petty cash expenditures include human subject payments, cab fare, and miscellaneous inexpensive purchases of office or lab supplies.

What is petty cash summary book?

A petty cash book is not similar to your computer accounting record. Instead, it is a ledger book used to note down all petty expenses. Whenever there is any payment made for smaller office or business expenses, that expense is recorded along with the amount and date in a petty cash book.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REPORT OF PETTY CASH EXPENDITURES?

A REPORT OF PETTY CASH EXPENDITURES is a financial document that details the small cash transactions made by a business or organization, typically for minor expenses that do not warrant the use of a formal purchase order or invoice.

Who is required to file REPORT OF PETTY CASH EXPENDITURES?

Typically, businesses, organizations, or individuals who maintain a petty cash fund are required to file a REPORT OF PETTY CASH EXPENDITURES to keep track of the disbursements and to maintain accountability.

How to fill out REPORT OF PETTY CASH EXPENDITURES?

To fill out a REPORT OF PETTY CASH EXPENDITURES, one should record the date of the transaction, the amount spent, the purpose of the expenditure, and any relevant receipts or documentation to support the expense.

What is the purpose of REPORT OF PETTY CASH EXPENDITURES?

The purpose of a REPORT OF PETTY CASH EXPENDITURES is to provide transparency and accountability for the use of petty cash, ensuring that funds are used appropriately and that expenditures are properly documented.

What information must be reported on REPORT OF PETTY CASH EXPENDITURES?

The information that must be reported includes the date of each expenditure, the amount, the purpose or description of the expense, the name of the individual responsible for the transaction, and any supporting documentation or receipts.

Fill out your report of petty cash online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report Of Petty Cash is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.