Get the free VERIFICATION: UN-TAXED INCOME (2009-2010 Academic Year) - citytech cuny

Show details

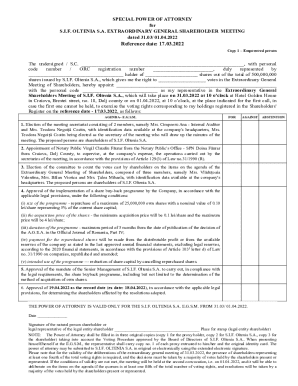

This form is designed to collect information on un-taxed income for a student or family to assess eligibility for financial aid. It requires details regarding the agency issuing payments, the type

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign verification un-taxed income 2009-2010

Edit your verification un-taxed income 2009-2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your verification un-taxed income 2009-2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing verification un-taxed income 2009-2010 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit verification un-taxed income 2009-2010. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out verification un-taxed income 2009-2010

How to fill out VERIFICATION: UN-TAXED INCOME (2009-2010 Academic Year)

01

Obtain the VERIFICATION: UN-TAXED INCOME form for the 2009-2010 academic year.

02

Gather all relevant documents that indicate your un-taxed income for the specified year, such as Social Security benefits, child support, or welfare payments.

03

Carefully read the instructions provided on the form to ensure you understand what information is required.

04

Fill out the form with accurate and honest information based on the gathered documents.

05

Double-check each entry for accuracy before submission.

06

Sign and date the form where indicated.

07

Submit the completed form to the financial aid office or appropriate authority by the specified deadline.

Who needs VERIFICATION: UN-TAXED INCOME (2009-2010 Academic Year)?

01

Students applying for financial aid who have un-taxed income that needs to be verified.

02

Parents or guardians of dependent students who have reported un-taxed income.

Fill

form

: Try Risk Free

People Also Ask about

What comes under other income?

Income from other sources under section 56 is a residuary head of income that contains all incomes that do not fall under the other four heads of income. Examples include rental income, interest on savings, fixed and recurring deposits, lottery winnings, and gifts.

What is other income for IRS?

Other Income includes any taxable income for which there is not a specific line identified on Form 1040. This income is reported on Form 1040, Schedule 1.

What is taxable and non taxable income?

Some common forms of nontaxable income include inheritances, cash gifts of $19,000 or less, scholarships that cover school tuition and fees, alimony, child support, and welfare payments. Taxable income can be “earned” on the job, as with wages, salaries, and commissions.

What is the difference between earned income and other income?

Be sure students understand key vocabulary: ° Earned income: Money made from working for someone who pays you or from running a business or farm. This includes all the income, wages, and tips you get from working. ° Unearned income: Income people receive even if they don't work for pay.

What is included in other income?

Other income is income that does not come from a company's main business, such as interest. Examples of other income include income from interest, rent, and gains resulting from the sale of fixed assets. Companies present other income in a separate section, before income from operations.

What is untaxed income?

Untaxed income is income that is excluded from federal income taxation under the IRS code. Examples include Supplemental Security Income, child support, alimony, and federal or public assistance.

What is recorded in other income?

Other income includes earnings that are not part of your primary business activities. This can include: Interest Income: Earnings from investments in interest-bearing accounts or securities. Dividend Income: Earnings from shares in other companies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VERIFICATION: UN-TAXED INCOME (2009-2010 Academic Year)?

VERIFICATION: UN-TAXED INCOME (2009-2010 Academic Year) is a form used in the financial aid process to verify income that is not subject to federal income tax.

Who is required to file VERIFICATION: UN-TAXED INCOME (2009-2010 Academic Year)?

Students who have been selected for verification and report receiving untaxed income on their FAFSA are required to file VERIFICATION: UN-TAXED INCOME (2009-2010 Academic Year).

How to fill out VERIFICATION: UN-TAXED INCOME (2009-2010 Academic Year)?

To fill out the form, provide accurate information regarding all sources of untaxed income, following the instructions provided on the form carefully.

What is the purpose of VERIFICATION: UN-TAXED INCOME (2009-2010 Academic Year)?

The purpose of this verification form is to ensure that the financial aid office has accurate and complete information regarding the student's financial situation for aid eligibility determination.

What information must be reported on VERIFICATION: UN-TAXED INCOME (2009-2010 Academic Year)?

The form requires reporting of all sources of untaxed income, such as unemployment benefits, child support received, and other non-taxable income sources.

Fill out your verification un-taxed income 2009-2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Verification Un-Taxed Income 2009-2010 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.