Get the free Financial Fitness for Youth - clemson

Show details

This document discusses the integration of financial education into school curricula, outlining programs, workshops, and resources aimed at improving financial literacy among young people in South

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial fitness for youth

Edit your financial fitness for youth form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial fitness for youth form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial fitness for youth online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial fitness for youth. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial fitness for youth

How to fill out Financial Fitness for Youth

01

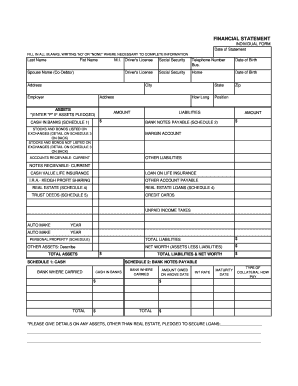

Gather all necessary financial documents, including income statements, bank statements, and expenses.

02

Review the sections of the Financial Fitness for Youth program to understand what information is needed.

03

Fill out the personal information section with accurate details.

04

Input your income and expense data in the designated sections.

05

Assess your financial goals and fill in the relevant parts that relate to your objectives.

06

Double-check your entries for accuracy and completeness.

07

Submit the completed program as per the instructions provided.

Who needs Financial Fitness for Youth?

01

Youth who are looking to understand the basics of personal finance.

02

Teens preparing for financial independence.

03

Parents or guardians wanting to educate their children about financial literacy.

04

Educators aiming to teach financial concepts to students.

Fill

form

: Try Risk Free

People Also Ask about

What are the benefits of financial membership in FCCLA?

FCCLA provides opportunities to: Build a strong foundation in budgeting, saving, and investing. Understand economic principles and financial market trends. Explore ethical decision-making in financial services.

What is financial fitness in FCCLA?

Financial Fitness engages members in teaching one another how to earn, spend, save, and protect money wisely. Through FCCLA's Financial Fitness program, members plan and carry out projects that help them, and their peers learn to become wise financial managers and smart consumers.

What financial fitness looks like?

Here are two of the most important habits for financial fitness: (1) saving money and (2) not spending more money than you have. These habits may sound simple, but they can be more difficult than they appear! Still, with discipline and clear goals, you can achieve financial fitness, one step at a time.

What are the benefits of financial membership in FCCLA?

FCCLA provides opportunities to: Build a strong foundation in budgeting, saving, and investing. Understand economic principles and financial market trends. Explore ethical decision-making in financial services.

What is the definition of financial fitness?

What is financial fitness? Put simply, it is the skills, knowledge, and tools that help you make sound financial decisions. Have you ever put money in a savings account? Or thought about your retirement options? These are the building blocks of a financially fit lifestyle.

What does financial fitness mean in FCCLA?

Financial Fitness is an FCCLA national peer education program that involves youth teaching one. another how to make, save, and spend money wisely. Through FCCLA's Financial Fitness. program, youth plan and carry out projects that help them and their peers learn to become wise financial managers and smart consumers.

What is financial fitness?

Financial fitness, or wellbeing, is about feeling comfortable and in control of your financial position. It means having the knowledge and confidence to make the most of your money – on a daily basis and through planned and unplanned events.

What does the financial fitness program teach?

Financial Fitness engages members in teaching one another how to earn, spend, save, and protect money wisely. Through FCCLA's Financial Fitness program, members plan and carry out projects that help them, and their peers learn to become wise financial managers and smart consumers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Fitness for Youth?

Financial Fitness for Youth is a program designed to educate young individuals about personal finance, budgeting, saving, and investment to help them develop sound financial habits early on.

Who is required to file Financial Fitness for Youth?

Generally, youth participants in financial education programs, as well as students involved in certain financial literacy courses, may be required to complete the Financial Fitness for Youth form as part of their curriculum.

How to fill out Financial Fitness for Youth?

To fill out Financial Fitness for Youth, participants should gather necessary financial information, follow the provided template or guidelines, and ensure all sections are completed accurately, including income sources, expenses, and savings goals.

What is the purpose of Financial Fitness for Youth?

The purpose of Financial Fitness for Youth is to empower young people with the knowledge and skills necessary to manage their finances effectively, make informed financial decisions, and prepare for future financial independence.

What information must be reported on Financial Fitness for Youth?

Participants should report information such as their income, monthly expenses, savings, financial goals, and any debts or liabilities they may have.

Fill out your financial fitness for youth online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Fitness For Youth is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.