Get the free Employee Term Life, Accidental Death and Dismemberment and Dependents Term Life Cove...

Show details

This Booklet outlines the benefits provided under the Employee Term Life, Dependents Term Life, and Accidental Death and Dismemberment insurance coverage for full-time employees at Colby-Sawyer College,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee term life accidental

Edit your employee term life accidental form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee term life accidental form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employee term life accidental online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employee term life accidental. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee term life accidental

How to fill out Employee Term Life, Accidental Death and Dismemberment and Dependents Term Life Coverage for All Full-time Employees

01

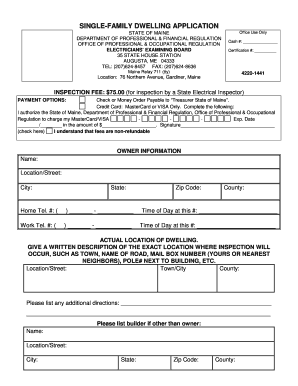

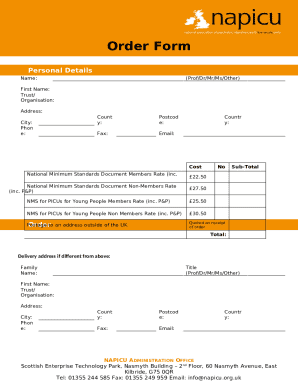

Obtain the Employee Term Life Insurance application form from the HR department or the company’s insurance provider.

02

Fill out the employee's personal information, including name, address, date of birth, and social security number.

03

Provide details about the desired coverage amount for Employee Term Life insurance.

04

Indicate any additional options for Accidental Death and Dismemberment coverage, if applicable.

05

For Dependents Term Life Coverage, list the names and relationships of the dependents to be covered.

06

Specify the coverage amount for each dependent, if required.

07

Review the form for any additional required information, such as health history or beneficiary designation.

08

Sign and date the application form to confirm accuracy and consent.

09

Submit the completed form to the HR department or designated insurance representative.

Who needs Employee Term Life, Accidental Death and Dismemberment and Dependents Term Life Coverage for All Full-time Employees?

01

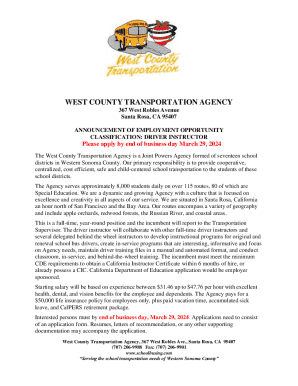

All full-time employees who wish to provide financial protection for themselves and their dependents in the event of death or accidental injuries.

02

Employees with dependents who would benefit from additional life insurance coverage to support their financial needs.

03

Individuals looking for peace of mind regarding life and dismemberment insurance as part of their employee benefits package.

Fill

form

: Try Risk Free

People Also Ask about

What is term life and accidental death & dismemberment AD&D insurance?

Term life insurance usually lasts 10 to 30 years, while permanent life insurance provides coverage until you pass away as long as premiums are paid. AD&D insurance falls within the first category – you pay for coverage for a fixed period of time and can continue to renew the policy once the term ends.

Why was GTL added to my paycheck?

Group term life insurance is an affordable way to make sure your loved ones are financially protected if you die. As shown on your paycheck, group term premiums are usually low or fully covered by your employer.

Is it worth getting accidental death and dismemberment insurance?

To protect your income in case you become ill or injured and can't work, look into disability insurance. If your employer offers AD&D insurance at no charge, it's worth opting into that perk. Otherwise, you may want to buy an AD&D policy only if you have a risky job or hobby and are prone to accidents as a result.

What is $1000 no cost ad&d coverage?

Coverage for accidents TruStage™ Accidental Death & Dismemberment (AD&D) Insurance provides $1000 of no-cost coverage that's fully paid for by Members' Advantage Credit Union. All you have to do is claim it. In the event of a covered accident, TruStage pays a cash benefit to your family at a critical time.

What is employee accidental death and dismemberment insurance?

What is AD&D Coverage? Accidental Death & Dismemberment (AD&D) insurance is a plan that pays a benefit if you lose your life, limbs, eyes, speech, or hearing due to an accident. Full-time regular staff are eligible for AD&D coverage.

Should I get ad&d insurance through work?

To protect your income in case you become ill or injured and can't work, look into disability insurance. If your employer offers AD&D insurance at no charge, it's worth opting into that perk. Otherwise, you may want to buy an AD&D policy only if you have a risky job or hobby and are prone to accidents as a result.

Do I really need accidental death and dismemberment insurance?

Is AD&D insurance worth it? Because AD&D insurance is generally very inexpensive, you might like to have it for peace of mind. However, having life insurance and health insurance will provide far more financial protection due to AD&D's limited coverage and exclusions.

What is employee accidental death & dismemberment insurance?

What is AD&D Coverage? Accidental Death & Dismemberment (AD&D) insurance is a plan that pays a benefit if you lose your life, limbs, eyes, speech, or hearing due to an accident. Full-time regular staff are eligible for AD&D coverage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employee Term Life, Accidental Death and Dismemberment and Dependents Term Life Coverage for All Full-time Employees?

Employee Term Life, Accidental Death and Dismemberment (AD&D), and Dependents Term Life Coverage provides financial protection to full-time employees and their dependents in the event of death or accidental injuries. It offers coverage for employees themselves and, in some cases, their family members, ensuring peace of mind and financial support during difficult times.

Who is required to file Employee Term Life, Accidental Death and Dismemberment and Dependents Term Life Coverage for All Full-time Employees?

All full-time employees who wish to enroll in or maintain their coverage under the Employee Term Life, Accidental Death and Dismemberment, and Dependents Term Life policies are required to file the necessary documentation or enrollment forms as specified by their employer or insurance provider.

How to fill out Employee Term Life, Accidental Death and Dismemberment and Dependents Term Life Coverage for All Full-time Employees?

To fill out the Employee Term Life, AD&D, and Dependents Term Life Coverage forms, employees should provide accurate personal information, including name, social security number, and contact details. Employees must also specify their coverage preferences, including the amount of coverage desired and any dependents to be included. It's important to review the form for completeness and accuracy before submission.

What is the purpose of Employee Term Life, Accidental Death and Dismemberment and Dependents Term Life Coverage for All Full-time Employees?

The purpose of this coverage is to provide financial assistance and security to employees and their families in the event of unforeseen circumstances such as death or dismemberment due to accidents. It aims to help beneficiaries cover expenses such as funeral costs, living expenses, and debts, thereby providing much-needed support during challenging times.

What information must be reported on Employee Term Life, Accidental Death and Dismemberment and Dependents Term Life Coverage for All Full-time Employees?

The information that must be reported includes the employee's personal details (name, social security number, date of birth), coverage selections, details of dependents (if applicable), beneficiary information, and any health-related information required by the insurer. Accurate and thorough reporting is essential for successful coverage enrollment.

Fill out your employee term life accidental online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Term Life Accidental is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.