Get the free 2012-2013 Parent Tax Worksheet - ndm

Show details

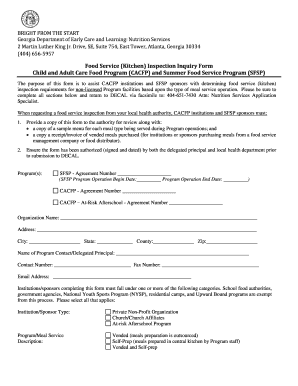

This form is required to process financial aid applications for the 2012-2013 school year, collecting tax information and family details needed for eligibility assessment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012-2013 parent tax worksheet

Edit your 2012-2013 parent tax worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012-2013 parent tax worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

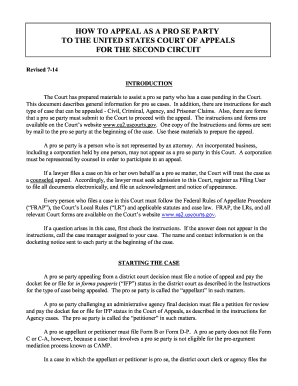

Editing 2012-2013 parent tax worksheet online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2012-2013 parent tax worksheet. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

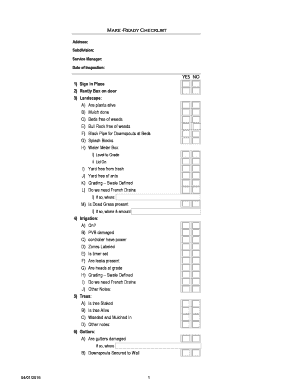

How to fill out 2012-2013 parent tax worksheet

How to fill out 2012-2013 Parent Tax Worksheet

01

Gather necessary documents like your 2012-2013 tax return, W-2 forms, and any other income statements.

02

Start with the first section of the worksheet, which typically asks for information about your filing status.

03

Enter the total number of exemptions you are claiming on your tax return.

04

Fill in your adjusted gross income (AGI) as reported on your tax return.

05

Complete any additional sections regarding tax credits or deductions as specified.

06

Review the worksheet for accuracy and ensure all calculations are correct.

07

Sign and date the worksheet before submitting it as required.

Who needs 2012-2013 Parent Tax Worksheet?

01

Parents who are applying for student financial aid and whose income needs to be reported on the FAFSA.

02

Families who need to document their financial situation for educational institutions or financial assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

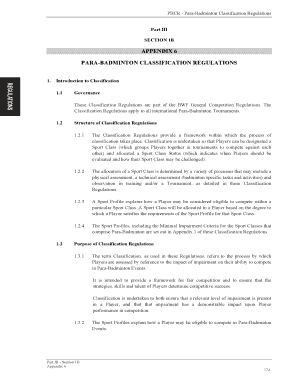

What is a tax calculation worksheet?

A tax calculation worksheet is a helpful tool used to estimate how much tax you owe — or might get refunded — by organizing key financial information such as income, deductions, credits, and payments.

What is the child tax credit for 2012?

The American Taxpayer Relief Act of 2012 increased the value of the federal child tax credit to $1,000 and increased the income threshold to correspond with the earned income tax credit.

How is tax computation calculated?

An individual's federal income tax liability for a tax year is generally determined by multiplying his or her taxable income by the applicable income tax rate, subtracting allowable tax credits, and adding other taxes. Taxable income is determined on an annual basis, ing to the taxpayer's tax year.

What is a computation sheet of income tax?

Computation of Income is the process of calculating an assessee's income and determining the applicable tax for the financial year under consideration. Income Tax Return (ITR) Computation is a summary which presents the taxable and exempt incomes, deductions and tax liabilities and tax payment details of an assessee.

What is the tax computation worksheet?

The Tax Computation Worksheet is an internal TurboTax calculation based on the worksheet that is in the IRS Form 1040 instructions after the tax tables.

Can I file 10 years of back taxes?

You can file back taxes for any past year, but the IRS usually considers you in good standing if you have filed the last six years of tax returns. If you qualified for federal tax credits or refunds in the past but didn't file tax returns, you may be able to collect the money by filing back taxes.

What is a computation worksheet?

The computation worksheet is a tool provided for your convenience in computing the amount of unemployment tax due, and the interest and penalty due if your tax report and/or tax payment is submitted after the due date.

What is the personal tax exemption for 2012?

Exemption amount. It is $3,800 for 2012.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012-2013 Parent Tax Worksheet?

The 2012-2013 Parent Tax Worksheet is a form used by parents to provide financial information for the FAFSA (Free Application for Federal Student Aid) for the academic year 2012-2013.

Who is required to file 2012-2013 Parent Tax Worksheet?

Parents of dependent students applying for federal financial aid must file the 2012-2013 Parent Tax Worksheet if they are reporting their financial information on the FAFSA.

How to fill out 2012-2013 Parent Tax Worksheet?

To fill out the 2012-2013 Parent Tax Worksheet, parents should gather their tax documents, follow the instructions provided on the worksheet, and fill in income, tax information, and any other requested financial details.

What is the purpose of 2012-2013 Parent Tax Worksheet?

The purpose of the 2012-2013 Parent Tax Worksheet is to accurately report parental financial information to determine the student's eligibility for federal financial aid.

What information must be reported on 2012-2013 Parent Tax Worksheet?

The information that must be reported on the 2012-2013 Parent Tax Worksheet includes total income, tax paid, untaxed income, and any other relevant financial details as specified in the worksheet.

Fill out your 2012-2013 parent tax worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012-2013 Parent Tax Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.