Get the free Leave Share Program Donor Form - wm

Show details

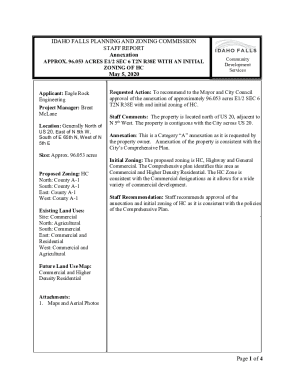

This form is used to document the donation of annual leave hours by an employee to support colleagues in need within the College of William and Mary and Virginia Institute of Marine Science.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign leave share program donor

Edit your leave share program donor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your leave share program donor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing leave share program donor online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit leave share program donor. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out leave share program donor

How to fill out Leave Share Program Donor Form

01

Obtain the Leave Share Program Donor Form from the HR department or the company's intranet.

02

Fill in your personal information including your name, employee ID, and department.

03

Indicate the total number of hours you wish to donate.

04

Review the eligibility criteria to ensure you can donate hours.

05

Sign and date the form to confirm your donation.

06

Submit the completed form to HR for processing.

Who needs Leave Share Program Donor Form?

01

Employees who wish to donate their leave hours to help colleagues in need.

02

Employees in the organization who are facing personal or medical emergencies and require additional leave.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum donation write off for the IRS?

Your deduction for charitable contributions generally can't be more than 60% of your AGI, but in some cases 20%, 30%, or 50% limits may apply.

What is the leave sharing program for the post office?

The annual leave-sharing program provides employees the opportunity to receive and use donated annual leave and to donate their annual leave to another employee under certain conditions.

What is the IRS policy on leave donations?

There is a general tax law concept that the individual who earns paid time off, and has the choice to receive it as income (use the time) or dispose of it (donate it), is still obligated to pay taxes on it. Therefore, any leave earned by one employee and donated to another would be taxable income to both parties.

What is the OPM leave donor program?

Under the Voluntary Leave Transfer Program (VLTP), a covered employee may donate annual leave directly to another employee who has a personal or family medical emergency and who has exhausted his or her available paid leave. Each agency must administer a voluntary leave transfer program for its employees.

What is the IRS leave donation program?

Leave donation allows employees to exchange their paid leave for charitable contributions. for medical emergencies and major disasters. The IRS has approved leave donation for specific events, including Hurricanes Harvey and Irma.

How to create a leave donation program?

How to Create a Leave Donation Program Step 1: Decide Which Type of Leave Donation Program to Implement. Medical emergency leave. Step 2: Consider Budget Implications. Step 3: Review and Set Budget. Step 4: Design the Program. Step 5: Implement and Roll Out the Plan.

What is the IRS rule for donations over $500?

You must fill out one or more Forms 8283, Noncash Charitable Contributions and attach them to your return, if your deduction for each noncash contribution is more than $500.

How does leave donation work?

Under the Voluntary Leave Transfer Program (VLTP), a covered employee may donate annual leave directly to another employee who has a personal or family medical emergency and who has exhausted his or her available paid leave. Each agency must administer a voluntary leave transfer program for its employees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Leave Share Program Donor Form?

The Leave Share Program Donor Form is a document used to facilitate the donation of leave time from one employee to another within an organization, allowing employees to support their colleagues in times of need.

Who is required to file Leave Share Program Donor Form?

Employees who wish to donate their accrued leave to a colleague in need are required to file the Leave Share Program Donor Form.

How to fill out Leave Share Program Donor Form?

To fill out the Leave Share Program Donor Form, employees need to provide their personal information, specify the amount of leave they wish to donate, and ensure their supervisor or HR department is notified of the donation.

What is the purpose of Leave Share Program Donor Form?

The purpose of the Leave Share Program Donor Form is to formalize the process of leave donation, ensuring transparency and fairness while providing support to employees facing personal emergencies or extended illness.

What information must be reported on Leave Share Program Donor Form?

The Leave Share Program Donor Form must report the donor's name, employee identification number, department, the total number of leave hours being donated, and any specific conditions or remarks relevant to the donation.

Fill out your leave share program donor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Leave Share Program Donor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.