Get the free 501c3 Certification of Employment - concordia

Show details

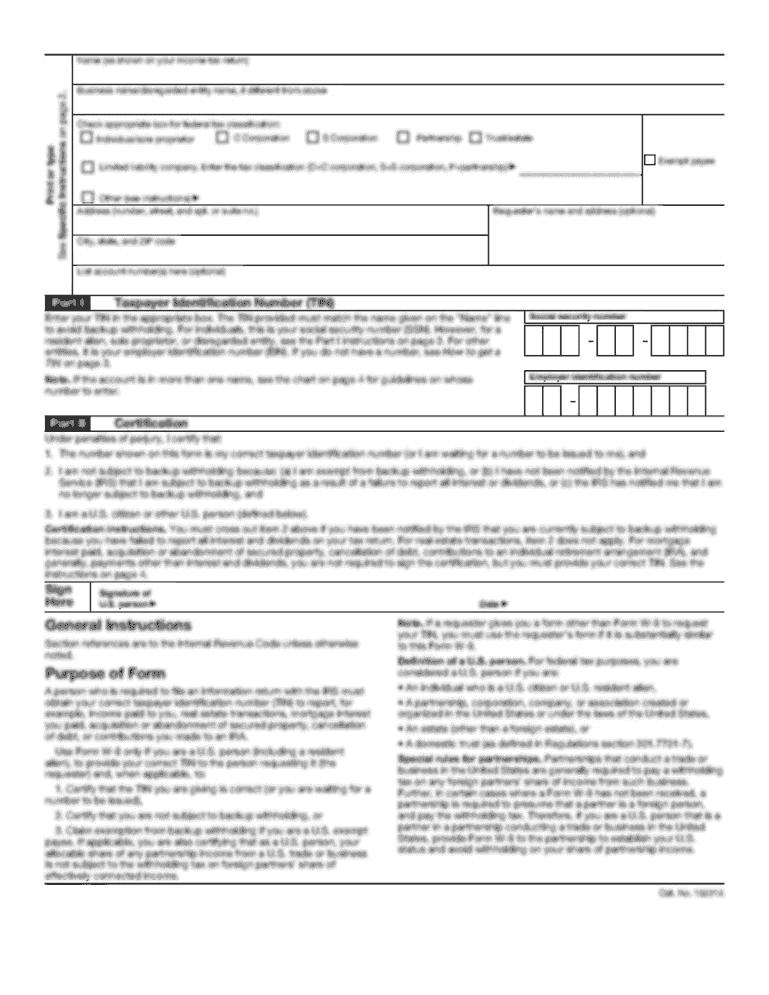

This document certifies that a Concordia student is currently a full-time, paid employee of a registered 501c3 organization, which is a requirement for eligibility for the MBA Non-Profit Grant.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 501c3 certification of employment

Edit your 501c3 certification of employment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 501c3 certification of employment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 501c3 certification of employment online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 501c3 certification of employment. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 501c3 certification of employment

How to fill out 501c3 Certification of Employment

01

Obtain the 501c3 Certification of Employment form from the appropriate agency or organization's website.

02

Read the instructions carefully to understand the requirements for completion.

03

Fill out the organization name and address in the designated fields.

04

Provide the name and contact information of the individual responsible for the certification process.

05

Indicate the purpose of the organization and how it qualifies under 501(c)(3) status.

06

Include details of the employee or volunteers for whom the certification is being requested.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate governing body or department.

Who needs 501c3 Certification of Employment?

01

Nonprofit organizations that have received 501(c)(3) status under the Internal Revenue Code and are looking to certify employment for their workers or volunteers.

02

Organizations seeking to apply for grants or funding that require proof of 501(c)(3) employment certification.

Fill

form

: Try Risk Free

People Also Ask about

Is it difficult to get 501c3 status?

In order to become a tax-exempt nonprofit, one must file for tax-exempt status. This is a difficult process and professional help is often recommended. The most common way to become a tax-exempt nonprofit is by establishing the organization as a section 501(c)(3) entity with the IRS.

How hard is it to get 501c3 status?

Historically, the IRS denies a very small number of 501(c)(3) applications (less than 1%). It is much more likely that they will ask you questions that seem too hard to answer. As many as 10% of applicants simply give up on their applications for this reason.

What is the difference between a nonprofit and a 501c3?

While a nonprofit corporation is a state-level designation, the 501(c)(3) status is a federal, nationwide designation awarded by the IRS. If a group has 501(c)(3) status, then it is exempt from federal income tax, which often also means you don't need to pay state income taxes either.

What documents are needed to prove 501c3 status?

Any of the following is acceptable evidence of nonprofit status: (a) a reference to the applicant organization's listing in the Internal Revenue Service's (IRS) most recent list of tax-exempt organizations described in section 501(c)(3) of the IRS Code; (b) a copy of a currently valid IRS tax exemption certificate; (c)

How hard is it to set up a 501c3?

How long does it take to get a 501(c)(3) approval? 501(c)(3) status applications can take about three to four weeks for approval with Form 1023-EZ and about three to six months with Form 1023.

How long does it take to get approved for a 501c3?

Incorrect or Incomplete Financial Documentation. Financial transparency is important for nonprofits, especially when you're applying for 501(c)(3) status. Accurate financial documentation helps the IRS assess and determine your organization's eligibility for tax-exempt status.

What is a 501c3 verification letter?

The letter is a valuable document that nonprofits can use to demonstrate their eligibility for tax benefits and assure donors and grantmakers that their contributions are tax-deductible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 501c3 Certification of Employment?

The 501c3 Certification of Employment refers to a designation given by the IRS to non-profit organizations that meet specific criteria, allowing them to be recognized as tax-exempt and eligible for public and private grants and donations.

Who is required to file 501c3 Certification of Employment?

Non-profit organizations that wish to receive tax-exempt status under section 501(c)(3) of the Internal Revenue Code are required to file for 501(c)(3) certification.

How to fill out 501c3 Certification of Employment?

To fill out the 501c3 Certification of Employment, an organization must complete IRS Form 1023 or Form 1023-EZ, providing necessary details about its structure, purposes, and programs, along with supporting documentation.

What is the purpose of 501c3 Certification of Employment?

The purpose of 501c3 Certification of Employment is to provide non-profit organizations with tax-exempt status, enabling them to operate without federal income tax liability and to attract donations that are also tax-deductible for the donor.

What information must be reported on 501c3 Certification of Employment?

The information that must be reported includes the organization’s name, address, structure, mission, activities, financial data, and the qualifications of its directors and officers.

Fill out your 501c3 certification of employment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

501C3 Certification Of Employment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.