Get the free Routing Form – Tax-Exempt Donations - hpu

Show details

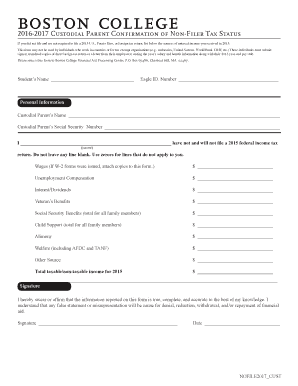

This form is used for routing tax-exempt donations to the Institutional Advancement at Hawai‘i Pacific University, capturing details about the donations and the associated project or proposal.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign routing form tax-exempt donations

Edit your routing form tax-exempt donations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your routing form tax-exempt donations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing routing form tax-exempt donations online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit routing form tax-exempt donations. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out routing form tax-exempt donations

How to fill out Routing Form – Tax-Exempt Donations

01

Obtain the Routing Form from your organization or the relevant tax authority.

02

Fill in the required information at the top of the form, including your name, organization name, and contact information.

03

Provide the donation details, including the amount and purpose of the donation.

04

Verify that the donation meets the qualifications for tax-exempt status.

05

Sign and date the form to certify the information provided is accurate.

06

Submit the completed form to the relevant organization or tax authority as instructed.

Who needs Routing Form – Tax-Exempt Donations?

01

Non-profit organizations seeking to accept tax-exempt donations.

02

Donors who wish to ensure their contributions are tax-exempt.

03

Charitable foundations and trusts managing tax-exempt funds.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax-exempt donation form?

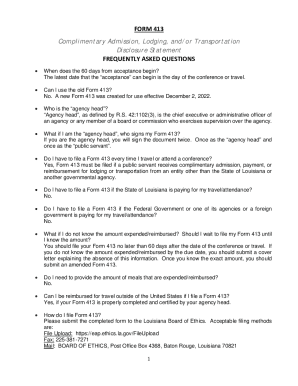

IRS Form 8283, Noncash Charitable Contributions, is required when an individual, partnership, or corporation donates property valued at more than $500 in a single tax year. This form ensures that taxpayers properly document their donations and claim deductions accurately.

What does tax exempt donation mean?

A charitable donation is a gift of money or goods to a tax-exempt organization that can reduce your taxable income. To claim a deduction for charitable donations on your taxes, you must have donated to an IRS-recognized charity and received nothing in return for your gift.

What IRS form do I use for donations over $5000?

Form 8283. For noncash donations over $5,000, the donor must attach Form 8283 to the tax return to support the charitable deduction. The donee must sign Part IV of Section B, Form 8283 unless publicly traded securities are donated.

What is the tax free donation form?

IRS Form 8283, Noncash Charitable Contributions, is required when an individual, partnership, or corporation donates property valued at more than $500 in a single tax year. This form ensures that taxpayers properly document their donations and claim deductions accurately.

Did the $600 charitable deduction go away?

In response to the COVID-19 pandemic, Congress enacted a $300 charitable deduction for non-itemizers in 2020. This temporary deduction was extended and expanded to $600 for joint filers through 2021. However, the provision expired at the end of 2021 and has yet to be restored.

What is an example of a tax-exempt donation letter?

On thank you letters not related to membership dues: “This letter serves as your receipt for your donation of $X, check number, check date. No goods or services were provided in exchange for your donation.” Note: see fair market value note at end of this document if any gifts or benefits are added.

What tax form do I use for charitable donations?

Schedule A reports your itemized deductions, including charitable contributions. Fill out this form carefully to ensure accurate information about your donations. Cash donations are reported on line 11, and non-cash donations are reported on line 12 of Schedule A.

What is the tax form 8283 for donations?

Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Routing Form – Tax-Exempt Donations?

Routing Form – Tax-Exempt Donations is a document used to facilitate the proper management and reporting of donations that are exempt from taxation, ensuring compliance with tax regulations.

Who is required to file Routing Form – Tax-Exempt Donations?

Organizations that receive tax-exempt donations, such as non-profits and charitable institutions, are required to file the Routing Form – Tax-Exempt Donations.

How to fill out Routing Form – Tax-Exempt Donations?

To fill out the Routing Form – Tax-Exempt Donations, organizations must provide information such as donor details, the amount of the donation, the nature of the donation, and relevant tax-exempt status documentation.

What is the purpose of Routing Form – Tax-Exempt Donations?

The purpose of Routing Form – Tax-Exempt Donations is to streamline the documentation process for tax-exempt donations and ensure that both the donor and recipient comply with legal and tax obligations.

What information must be reported on Routing Form – Tax-Exempt Donations?

The information that must be reported includes the donor's name and contact information, the amount donated, the date of the donation, the type of donation, and certification of the recipient's tax-exempt status.

Fill out your routing form tax-exempt donations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Routing Form Tax-Exempt Donations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.