Get the free Institutional Loan - hope

Show details

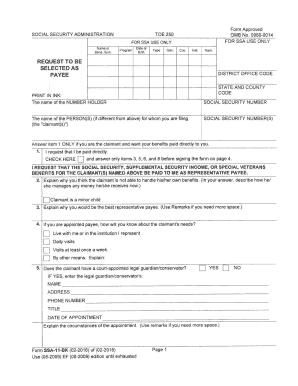

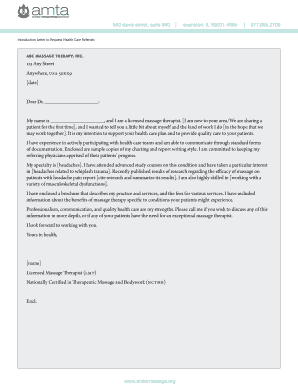

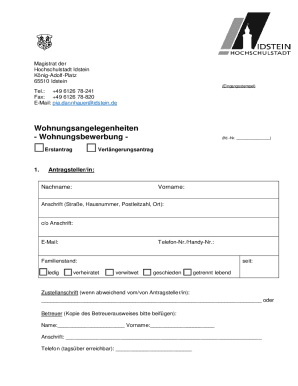

This document is used by students to apply for an institutional loan covering tuition and other related educational expenses for the May, June, and July terms, requiring confirmation of enrollment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign institutional loan - hope

Edit your institutional loan - hope form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your institutional loan - hope form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit institutional loan - hope online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit institutional loan - hope. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out institutional loan - hope

How to fill out Institutional Loan

01

Gather necessary personal and financial information, including income, expenses, and existing debt.

02

Obtain the Institutional Loan application form from the institution or their website.

03

Fill out personal details such as name, address, and contact information.

04

Provide information about your educational institution and the program you are enrolled in.

05

Specify the amount of the loan you are applying for and the purpose of the loan.

06

Attach required documents, such as proof of enrollment, income statements, and financial aid information.

07

Review your application for completeness and accuracy.

08

Submit the application as directed, either online or in person.

Who needs Institutional Loan?

01

Students pursuing higher education who require financial assistance.

02

Individuals who have exhausted other forms of financial aid or funding options.

03

Those seeking to cover tuition fees, living expenses, or educational materials.

Fill

form

: Try Risk Free

People Also Ask about

What is an institutional term loan?

Also referred to as a Term B Loan or an institutional term loan. A term loan made by institutional investors (such as CLOs, debt funds, pension funds, and insurance companies) instead of by banks. One of the primary goals of an institutional investor is maximizing the long-term return on their investment.

What is term loan in English?

A term loan is a monetary loan that is repaid in regular payments over a set period of time. Term loans usually last between one and ten years, but may last as long as 30 years.

What does "institutional loan" mean?

An institutional loan is a type of non-federal financial aid a college or university provides for its students. They don't have the same terms and benefits as federal student loans. An institutional loan may be serviced by the school or a third-party lender and is only offered to enrolled students.

What is the English name for loan?

loan noun (BORROW) an act of borrowing or lending something: Thank you very much for the loan of your bike. This exhibit is on loan (= being borrowed/lent) from/to another museum.

What are institutional term loans?

Also referred to as a Term B Loan or an institutional term loan. A term loan made by institutional investors (such as CLOs, debt funds, pension funds, and insurance companies) instead of by banks. One of the primary goals of an institutional investor is maximizing the long-term return on their investment.

What are the three types of term loans?

Types of Term Loans Short-term Loans. Short-term Loans are usually repaid within a year and are provided to meet urgent business needs. Intermediate-term Loans. These loans have a repayment period of 1 to 5 years. Long-term Loans.

What are the 4 types of student loans?

Federal student loans are issued by the federal government and offer benefits such as fixed interest rates and income-driven and flexible payment plans. There are four types of federal student loans: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans and Direct Consolidation Loans.

What are call loans in English?

A call loan is a loan that the lender can demand to be repaid at any time. A call loan is similar to a callable bond. However, while a callable bond is callable by the borrower, a callable loan is callable by the lender. A call loan is designed to reduce the financial risk of the lender.

What does "institutional loan" mean?

An institutional loan is a type of non-federal financial aid a college or university provides for its students. They don't have the same terms and benefits as federal student loans. An institutional loan may be serviced by the school or a third-party lender and is only offered to enrolled students.

What is the difference between Tla and TLB?

Lenders of TLAs are usually banks but may include the types of institutional investors that are commonly Term B Lenders. TLAs are not subordinated to other indebtedness of the borrower, and are scheduled to be repaid before the Term Loan B (TLB).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Institutional Loan?

An Institutional Loan is a type of financing provided by an institution, often for students to fund their education or for businesses to support operations or growth.

Who is required to file Institutional Loan?

Typically, students applying for educational loans or businesses seeking institutional financing must file for an Institutional Loan.

How to fill out Institutional Loan?

To fill out an Institutional Loan application, gather necessary information such as personal identification, financial details, and the purpose of the loan, and then complete the application form as directed by the lending institution.

What is the purpose of Institutional Loan?

The purpose of an Institutional Loan is to provide financial support for educational expenses, business investments, or other significant financial needs as determined by the lending institution.

What information must be reported on Institutional Loan?

Information that must be reported on an Institutional Loan includes the borrower's personal information, loan amount requested, purpose of the loan, financial history, and any supporting documentation required by the lending institution.

Fill out your institutional loan - hope online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Institutional Loan - Hope is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.