Get the free Untaxed Income Statement - hope

Show details

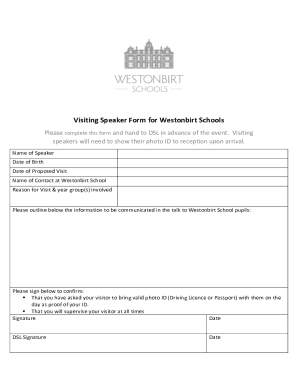

This document is used to verify untaxed income received by a student's family during the previous year for the purpose of determining financial aid eligibility.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign untaxed income statement

Edit your untaxed income statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your untaxed income statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit untaxed income statement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit untaxed income statement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out untaxed income statement

How to fill out Untaxed Income Statement

01

Begin by gathering all relevant financial documents that might contain information about untaxed income.

02

Clearly label the form as 'Untaxed Income Statement'.

03

Fill in the applicant's personal information, including name, address, and date of birth.

04

List each source of untaxed income individually, such as child support, veteran's benefits, or workers' compensation.

05

For each source, enter the total amount received for the specified reporting period.

06

Provide any necessary explanations for your entries if required by the form.

07

Review the completed statement for accuracy and completeness.

08

Sign and date the statement before submission.

Who needs Untaxed Income Statement?

01

Individuals applying for financial aid or assistance programs that require documentation of income.

02

Applicants for federal student aid (FAFSA) who need to report untaxed income.

03

Anyone who has received untaxed income and needs to report it for tax purposes or loan applications.

Fill

form

: Try Risk Free

People Also Ask about

What do I put for untaxed income?

Untaxed income is income that is excluded from federal income taxation under the IRS code. Examples include Supplemental Security Income, child support, alimony, and federal or public assistance.

Do I have to report untaxed income on FAFSA?

The FAFSA requires you to report the total amount of untaxed income you received in the base year, which is two years prior to the academic year you're applying for.

Does FAFSA count untaxed income?

Income found on your federal tax return: The FAFSA will ask for taxable and non-taxable income found on your federal tax return.

Is it bad to have no taxable income?

Any year you have minimal or no income, you may be able to skip filing your tax return and the related paperwork. However, it's perfectly legal to file a tax return showing zero income, and this might be a good idea for a number of reasons.

Should I report untaxed income?

In most cases, nontaxable income does not need to be reported on your tax return, which can simplify your financial reporting.

What is the #1 most common FAFSA mistake?

Some of the most common FAFSA errors are: Forgetting to sign and date: If you're filling out the paper FAFSA, be sure to sign it. Sending in a copy of your income tax returns: You do not need to include a copy of your tax returns with your FAFSA.

Do I need to file a tax return if I have no taxable income?

Typically, if you do not have any taxable income, you do not need to file a tax return. However, the stimulus payments in recent years have shown us how important it is to have your information updated with the IRS, so filing returns without any taxable income has become very normal.

Do I have to report untaxed income?

Income that is taxable must be reported on your return and is subject to tax. Income that is nontaxable may have to be shown on your tax return but is not taxable.

Should I report untaxed income?

In most cases, nontaxable income does not need to be reported on your tax return, which can simplify your financial reporting.

How does untaxed income affect FAFSA?

Although this income is not subject to federal income tax, it is included as part of the parents' or student's adjusted gross income (AGI) when completing the Free Application for Federal Student Aid (FAFSA).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Untaxed Income Statement?

The Untaxed Income Statement is a document that outlines income sources that are not subject to income tax. This includes certain types of income, benefits, and allowances that individuals receive but do not report as taxable income.

Who is required to file Untaxed Income Statement?

Individuals who receive untaxed income, such as certain benefits, housing allowances, or specific types of federal and state assistance, may be required to file an Untaxed Income Statement when applying for financial aid or other financial assistance programs.

How to fill out Untaxed Income Statement?

To fill out the Untaxed Income Statement, gather documentation that details your untaxed income sources, complete all required fields on the form, and provide accurate information about the amounts received. Make sure to include any necessary signatures and submit it to the appropriate agency or institution.

What is the purpose of Untaxed Income Statement?

The purpose of the Untaxed Income Statement is to provide a clear picture of an individual’s financial situation, specifically regarding income that is not subject to taxation. This information helps financial aid administrators assess eligibility for financial assistance.

What information must be reported on Untaxed Income Statement?

The Untaxed Income Statement must report all sources of untaxed income, including but not limited to, social security benefits, child support, veteran's benefits, workers' compensation, and any other non-taxable income. Individuals must also provide their identification details and any relevant documentation.

Fill out your untaxed income statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Untaxed Income Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.