Get the free NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S) - hope

Show details

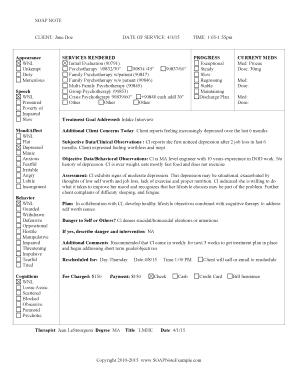

This form is used by custodial parents of students at Hope College to report income if they have not filed a federal tax return for the specified year. It includes sections for listing earned income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-tax filer status and

Edit your non-tax filer status and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-tax filer status and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-tax filer status and online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit non-tax filer status and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-tax filer status and

How to fill out NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S)

01

Begin by downloading the Non-Tax Filer Status and Income Statement form from the appropriate website or institution.

02

Fill in the parent's full name and social security number at the top of the form.

03

Indicate the tax year for which you are submitting the form.

04

Clearly state that the parent is a non-tax filer and explain the reason why they did not file taxes during that year.

05

List all forms of income received by the parent during the tax year, including wages, unemployment benefits, and any other sources.

06

Provide total income amounts for each source in the designated spaces.

07

Include any supporting documentation, such as pay stubs or bank statements, that verifies the reported income.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form before submitting it to the requesting institution.

Who needs NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S)?

01

Parents who did not file a tax return for the relevant tax year but need to provide income information for financial aid or other purposes.

02

Families applying for financial assistance or benefits that require proof of income without tax filings.

Fill

form

: Try Risk Free

People Also Ask about

How to get a non-tax filer statement?

Available from the IRS by calling 1-800-908-9946. Non-filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided in their telephone request within 5 to 10 days from the time of the request.

How do I write a letter of explanation for not filing taxes?

I, (full name), certify that I did not file a tax return in 20YY. I attempted to obtain the IRS Verification of Non Filing Letter but was unable to obtain the required documentation. I earned untaxed income of $(enter amount) in 20YY from (type of work in which you earned income). Attach the W-2 or 1099 forms.

What do I put for parent income from work on FAFSA?

If your parent is single, separated, divorced, or widowed but doesn't use the IRS DRT to transfer their IRS information into your FAFSA form, fill in their total earnings from two years. You can calculate their earning amounts from their tax return, W-2s, or other earning statements.

What is student untaxed income for FAFSA?

The FAFSA requires you to report the total amount of untaxed income you received in the base year, which is two years prior to the academic year you're applying for. You'll report this information on the appropriate section of the FAFSA form, usually labeled “other untaxed income.”

What do I put for untaxed income?

Untaxed income is income that is excluded from federal income taxation under the IRS code. Examples include Supplemental Security Income, child support, alimony, and federal or public assistance.

What is a statement of non filing tax status?

Verification of non-filing letter - states that the IRS has no record of a processed Form 1040-series tax return as of the date of the request. It doesn't indicate whether you are required to file a return for that year.

What does "parents' untaxed income and benefits" mean?

Untaxed Income is income not reported on a tax return, such as: Alimony. Child support. Untaxed portions of pensions. Housing, food, and other allowances paid to military, clergy, and others, including cash and cash value.

What do I put for parents untaxed income and benefits?

Enter the total amount of any other untaxed income or benefits, such as workers compensation, Black Lung Benefits, untaxed portions of Railroad Retirement Benefits, foreign income not earned from work, disability benefits, etc., that your parents received in 2021.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S)?

NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S) is a document used to report the income and financial standing of parents who are not obligated to file a federal income tax return due to low income or other qualifying factors. It outlines the income sources and amounts, helping educational institutions and financial aid offices assess the family's financial situation.

Who is required to file NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S)?

Parents who have income below the threshold required for filing a federal income tax return, or those who are not required to file due to other circumstances (such as non-residency) must file the NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S) when applying for financial aid or certain programs.

How to fill out NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S)?

To fill out the NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S), parents should provide personal information, list any sources of income (if applicable), indicate the reasons for non-filing, and provide any supporting documentation to validate their income status. It may require specific forms or formats as specified by the financial aid office or institution.

What is the purpose of NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S)?

The purpose of the NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S) is to provide clear and accurate financial information for assessment purposes when the standard tax return is not available. It aids institutions in determining eligibility for financial aid, ensuring that students from lower-income backgrounds receive the support they need.

What information must be reported on NON-TAX FILER STATUS AND INCOME STATEMENT FOR PARENT(S)?

The information that must be reported includes the parent's name, Social Security number, income sources (such as wages, unemployment benefits, etc.), amounts received, the reason for non-filing, and any relevant documentation that supports the claims made in the statement.

Fill out your non-tax filer status and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Tax Filer Status And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.