NC Form 61 2006 free printable template

Show details

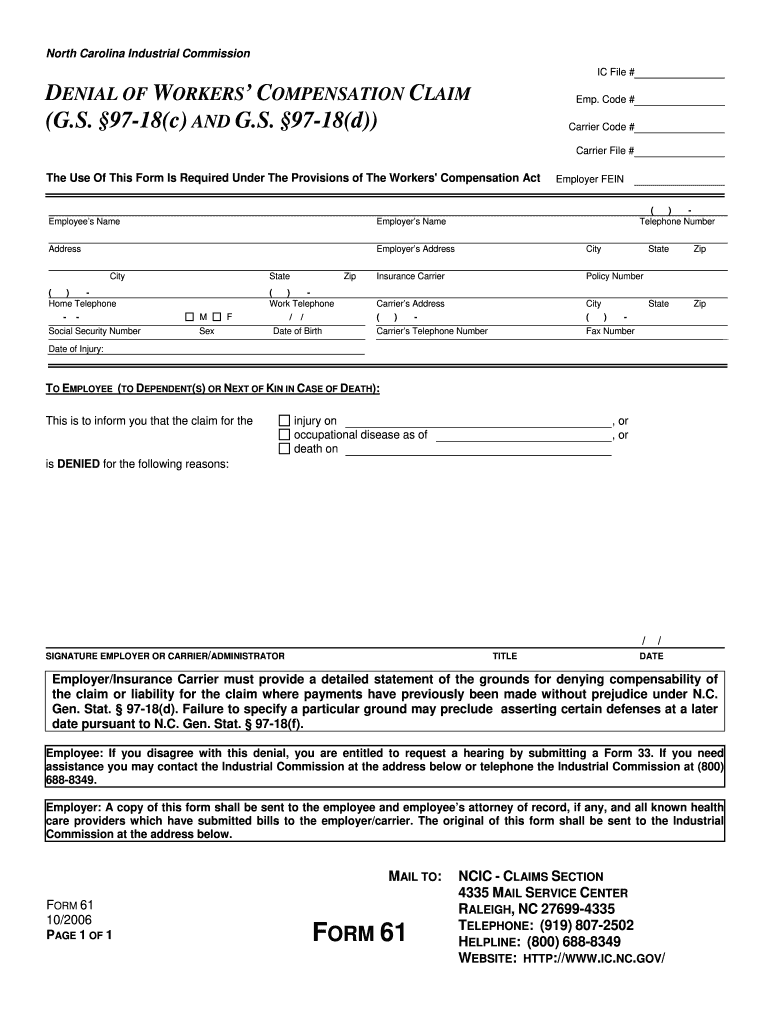

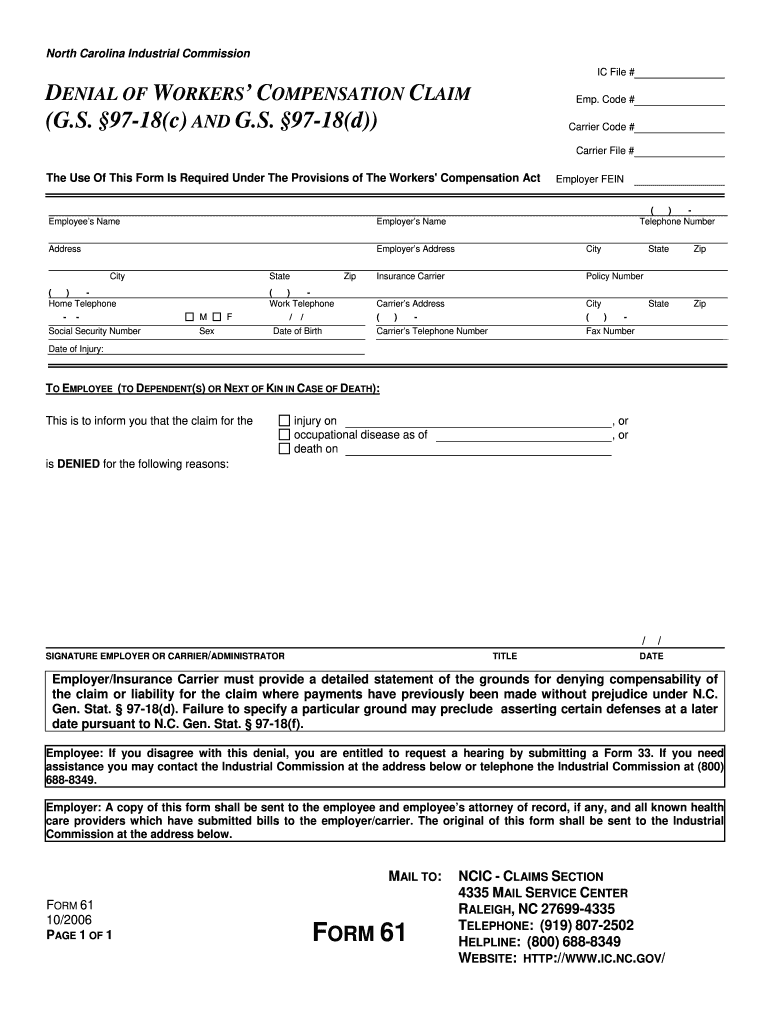

North Carolina Industrial Commission IC File # DENIAL OF WORKERS' COMPENSATION CLAIM (G.S. 97-18(c) AND G.S. 97-18(d)) The Use Of This Form Is Required Under The Provisions of The Workers' Compensation

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC Form 61

Edit your NC Form 61 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC Form 61 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC Form 61 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NC Form 61. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC Form 61 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC Form 61

How to fill out NC Form 61

01

Begin by downloading NC Form 61 from the official website or obtain a physical copy.

02

Fill out your personal information in the designated sections, including your name, address, and contact details.

03

Provide details of the property involved, including its location and description.

04

Specify the purpose of filing the form and any relevant background information.

05

Review the form for completeness and accuracy to ensure all required fields are filled.

06

Sign and date the form at the bottom as required before submission.

07

Submit the completed form to the appropriate agency or department as instructed.

Who needs NC Form 61?

01

Individuals or entities wishing to request or report information regarding property transactions.

02

Anyone involved in matters related to real estate or property management in North Carolina.

03

Legal representatives or attorneys handling property-related cases.

Fill

form

: Try Risk Free

People Also Ask about

What is report serial number in Form 61A?

What are the Statement Number and Statement ID in Form 61A? The statement number in form 61A is a validation field. Thus, it is crucial to fill this form, or the Income Tax department will reject your form. It is further mandatory to run a validation check to look for any possible correction in the form.

Who is responsible for filing SFT?

The Income-tax department requires companies to submit a statement of Specified Financial Transactions (SFT). SFT reporting is mandatory for certain reporting entities from Finance Act 2014 by introducing section 285BA followed by additions made in Finance Act 2020 through notification no. 16/2021, dated 12-03-2021.

How do I file a SFT return online?

SFT shall be submitted through following procedure: If already registered on e-filing portal, log in and go to My Account>Manage ITDREIN (Income Tax Department Reporting Entity Identification Number) Click on 'Generate New ITDREIN' Select form type and Reporting entity category and click on 'Generate ITDREIN'

How do I file SFT online?

SFT shall be submitted through following procedure: If already registered on e-filing portal, log in and go to My Account>Manage ITDREIN (Income Tax Department Reporting Entity Identification Number) Click on 'Generate New ITDREIN' Select form type and Reporting entity category and click on 'Generate ITDREIN'

How to file nil return form 61A?

61A is not mandatory under section 285BA read with rule 114E but to be on safer side Assessee may consider filing such return.Nil statement in form 61A of SFT- Optional or Compulsory? 1.Statement of Financial Transactions (SFT) and ITDREIN5.Statement of Financial transactions – Form 61A filing & Submitting “SFT Preliminary Response”5 more rows • 27 May 2019

How do I file a nil SFT report?

SFT shall be submitted through following procedure: If already registered on e-filing portal, log in and go to My Account>Manage ITDREIN (Income Tax Department Reporting Entity Identification Number) Click on 'Generate New ITDREIN' Select form type and Reporting entity category and click on 'Generate ITDREIN'

How to file SFT Form 61A online?

Step 1 – Visit designated e-filing portal. Step 2 – Login to the portal with the help of User ID, authorised PAN and Password. Step 3 – Navigate to e-file and upload Form 61A. Step 4 – Once uploaded, details like – reporting entity PAN, Form Name and reporting entity Category will be displayed on the screen.

What is the form 61?

Form 61 refers to the document that is duly filled by the individual who receives income from agriculture and who does not obtain income that is chargeable to income tax. Moreover, those individuals who do not possess PAN have to submit Form 61 when making any financial transactions.

How do I file Form 61A?

Step 1 – Visit designated e-filing portal. Step 2 – Login to the portal with the help of User ID, authorised PAN and Password. Step 3 – Navigate to e-file and upload Form 61A. Step 4 – Once uploaded, details like – reporting entity PAN, Form Name and reporting entity Category will be displayed on the screen.

What are SFT transactions?

[As amended by Finance Act, 2022] UNDERSTANDING STATEMENT OF FINANCIAL TRANSACTION (SFT) To keep a watch on high value transactions undertaken by the taxpayer, the Income-tax Law has framed the concept of statement of financial transaction or reportable account.

How do I file SFT?

SFT shall be submitted through following procedure: If already registered on e-filing portal, log in and go to My Account>Manage ITDREIN (Income Tax Department Reporting Entity Identification Number) Click on 'Generate New ITDREIN' Select form type and Reporting entity category and click on 'Generate ITDREIN'

Can we file nil 61A?

It is the not mandatory to file NIL statement of Financial Transaction (Form 61A). However, an assessee has to file preliminary response.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NC Form 61 online?

pdfFiller has made it simple to fill out and eSign NC Form 61. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit NC Form 61 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing NC Form 61, you can start right away.

How do I edit NC Form 61 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign NC Form 61 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is NC Form 61?

NC Form 61 is a tax form used in North Carolina for reporting information related to the expected tax liability of certain entities.

Who is required to file NC Form 61?

Entities that anticipate owing North Carolina income tax and have certain corporate structures or tax situations are required to file NC Form 61.

How to fill out NC Form 61?

To fill out NC Form 61, gather the necessary financial information, complete the required sections accurately, and ensure all calculations are correct before submitting it to the appropriate tax authority.

What is the purpose of NC Form 61?

The purpose of NC Form 61 is to provide the North Carolina Department of Revenue with necessary information to assess and manage tax obligations for corporations and other entities.

What information must be reported on NC Form 61?

Information reported on NC Form 61 typically includes entity identification details, gross income estimates, applicable deductions, and any credits or payments applied.

Fill out your NC Form 61 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC Form 61 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.